Register now, make more friends, enjoy more functions, and let you play in the community easily.

You need Sign in Can be downloaded or viewed without an account?Register Now

x

Market Review:

internationalgoldThursday(9month10The daily rise and fall maintain volatility, with the opening price1943.37dollar/Ounces, highest price1966.33dollar/Ounces, lowest price1942.24dollar/Ounces, closing price1958.99dollar/ounce.

Message surface:

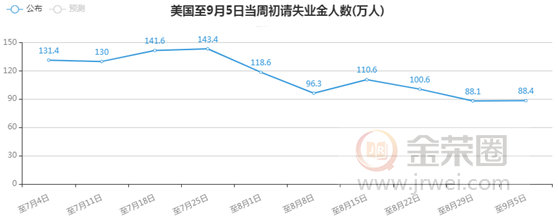

Thursday's announcement from the United States to9month5The number of initial claims for unemployment benefits in the current week is88.410000 people, higher than market expectations84.610000 people.

Commentary states that the United States9month5Record of initial claims for unemployment benefits for the current week88.4Ten thousand people, completely consistent with the last revised data, which is strange, while the data for continuing unemployment benefits is increasing. In fact,4Since the bottom of the month, the proportion of part-time employment among laid-off employees has rebounded significantly. The growth rate of full-time employment is high, but the proportion is low.4Within a period of months, the number of part-time employment has rebounded68.1%Full time rebounds47.9%. Overall, the degree of employment recovery is only54.8%。

Bank of Canada Governor McLehm stated that the economy will continue to require special support. The process of economic recovery will be slow and unstable. Reiterating that quantitative easing policy will continue until the smooth start of economic recovery. Due to the good operation of the credit market, the demand for short-term liquidity tools has decreased, and the implementation of provincial and corporate bond purchase plans has not been strong. The Federal Reserve shifts towards an average inflation target(AIT)This means a significant change in inflation targets. Canada has recovered300Out of 10000 unemployed positions200Ten thousand, it may take longer to recover the remaining100Ten thousand. There is still a long way to go before discussing exit stimulus measures. Ending quantitative easing before stopping interest rate adjustments is in logical order.

The Wall Street Journal survey shows that the overall economic recovery in the United States has exceeded economists' expectations. Economists predict the third quarter of the United StatesGDPThe annualized growth rate is23.9%,8Monthly survey is18.3%. Economists expect this yearGDPGrowth rate will shrink year-on-year4.2%. expect12The monthly unemployment rate is8.1%,8Monthly survey is9%。87.3%Economists predict that interest rate cuts will increase unemployment benefits and hit consumer spending.

According to the report, the head of Sinopharm Group's China Biotech Co., Ltd. urgently used COVID-19 inactivated vaccine overseasIIIAccording to the interview with the media about the phase I clinical research, the two COVID-19 inactivated vaccines developed by Sinopharm China Biotech have been used urgently, and hundreds of thousands of people have been vaccinated, without any obvious adverse reaction or infection; Tens of thousands of people who went to high-risk countries and regions overseas after receiving the vaccine have achieved zero infections so far.

Eurozone:

Eurozone to announced on Thursday9month10The main refinancing rate of the European Central Bank in Japan is0%Meets market expectations.

The policy statement released by the European Central Bank shows that uncertainty has increased, and the recovery efforts are still affected by uncertainty. Therefore, this year's adjustment will be adjusted upwardsGDPExpected growth rate, lowered expectations for the next two years; The overall inflation in the coming months will remain negative, and based on the bleak long-term inflation outlook in the market, inflation will continue to decline2021The year changes to a positive value; The European Central Bank has discussed the appreciation of the euro and will carefully evaluate its impact on inflation, which will have an impact onforeign exchangeMonitoring exchange rates Not targeting exchange rates; An ambitious and coordinated fiscal stance is crucial, measures should be targeted, and actions taken should be correct, timely, and effective; Adequate monetary stimulus is still necessary The central bank is preparing to adjust all tools as needed and has not yet discussed expanding the emergency anti epidemic bond purchase plan.

European Central Bank President Lagarde said the data shows a strong rebound. The level of activity is far lower than before the epidemic. Domestic demand has significantly recovered. The decrease in energy prices has suppressed inflation. Adequate monetary stimulus remains necessary. Uncertainty suppresses consumer spending and corporate investment. The strength of the recovery is still affected by uncertainty. The rebound situation is basically in line with previous expectations. Uncertainty has increased, and the economy is significantly idle. Data and surveys will indicate the third quarterGDPWill rebound strongly. The number of new cases of COVID-19 is not good for the short-term prospects. Further sustained recovery is highly dependent on the development of the COVID-19 pandemic. Overall inflation will remain negative in the coming months. In the medium term, the recovery of demand will bring upward pressure to inflation. Inflation will affect2021At the beginning of the year, it turned positive. The fiscal actions taken are correct, timely, and effective.

Goldman Sachs analysis predicts that the European Central Bank will continue to implement loose monetary policy for the foreseeable future. Given the uncertainty of the evolution of the epidemic, the European Central Bank continues to characterize the outlook risk as leaning towards a downward trend. Anyway, we expect that asset purchase plans and the use of loan instruments will still be the preferred policies of the European Central Bank, rather than implementing deeper negative interest rates.

Geopolitical situation:

According to reports, US Secretary of State Pompeo held a meeting with the Association of Southeast Asian Nations on Thursday(Abbreviated as ASEAN,ASEAN)In a remote speech, the Foreign Minister stated that Southeast Asian countries should have confidence in the United States and resist China's maritime bullying behavior. Pompeo also hopes that ASEAN countries will reassess their business dealings with Chinese state-owned enterprises, which has intensified the new confrontation between China and the United States in the competition for influence.

According to The Times of India, the Indian army has occupied a location overlooking Lake Bangong4Number finger(Finger 4)The highland of Chinese military positions. Sources said on Thursday that the operation to occupy the highlands is aimed at8At the end of the month, a preemptive action was taken to occupy the highlands near the south bank of Bangongcuo. Sources say that the Chinese military has occupied4The highlands near the number finger, but the Indian army has now occupied the highlands overlooking the Chinese positions, including the Green Top.

according toCMEFederal Reserve Observation: The Federal Reserve9Monthly interest rate maintained at0%-0.25%The probability of the interval is100%Interest rate hike25Bps to0.25%-0.50%The probability of the interval is0%;11Monthly interest rate maintained at0%-0.25%The probability of the interval is100%Interest rate hike25The probability of a basis point is0%。

Today's Focus

14:00 britain7Monthly industrial and manufacturing output rate

14:00 britain7Commodity Trade Account after Monthly Adjustment

14:00 britain7Three months in a monthGDPMonthly rate

14:00 Germany8monthCPIMonthly rate final value

20:30 U.S.A8After adjusting the roseCPIMonthly rate

Technical aspect:

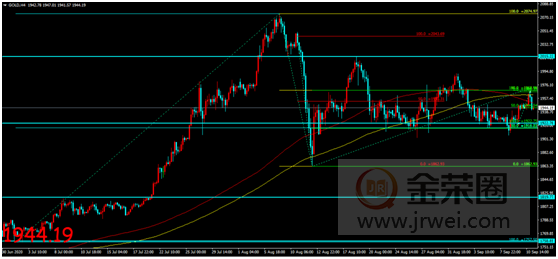

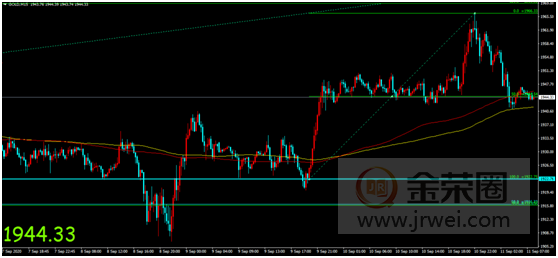

International gold rose and fell on Thursday, maintaining volatility, while gold prices remained short-term during Asian trading on Thursday1942-1950The consolidation of the high range maintains the continuation of short-term gains, and gold prices continue to hit the highest point in the short-term high range in the afternoon session1952First line. The opening of the US market saw the gold price expand in the short term, with the highest increase reaching its peak1966On the first line, gold prices in the US market have experienced short-term fluctuations and have fallen, forming a short-term trend so far1944First line retracement performance, short-term1941-1947The narrow range consolidation of the range continues to fluctuate downward. The daily chart records a longer and smaller shadow lineKThe current gold price has returned to the daily technical indicators to support the pressure level price range, and the overall daily moving average shows a sticky contraction pattern. The short-term volatility trend may still be difficult to change. The hourly chart shows that the gold price has risen and fallen again, returning to the form of short-term oscillation technical indicators. Short cycle technical indicators are arranged in a downward cross divergence pattern, and the short-term gold price has not shown a clear pattern of oscillation to break free. The intraday oscillation trend may be difficult to change. Be cautious and maintain a biased operating strategy within the day.

Daily operating range:

Multiple orders:

radical1928Frontline participation, stop loss3-5Point, profit target1933upper

steady1916Frontline participation, stop loss3-5Point, profit target1920upper

Empty order:

radical1957Frontline participation, stop loss3-5Point, profit target1952Below

steady1969Frontline participation, stop loss3-5Point, profit target1963Below

The European Central Bank maintains its interest rate policy unchanged, while gold prices continue to fluctuate as they rise and fall. It is cautious to maintain a biased range of operating strategies during the day |

"Small gifts, come to Huiyi to support me"

No one has offered a reward yet. Give me some support

|