Register now, make more friends, enjoy more functions, and let you play in the community easily.

You need Sign in Can be downloaded or viewed without an account?Register Now

x

Market Review:

internationalgoldMonday(8month10Japan's volatility closed lower, opening price2033.52dollar/Ounces, highest price2049.68dollar/Ounces, lowest price2019.15dollar/Ounces, closing price2034.76dollar/ounce.

Message surface:

US President Trump has stated that new job opportunities are increasing and the unemployment rate is falling faster than expected. In the past3Within months, we created900Ten thousand job positions. Collaborate with Europe on the opportunity to lift travel restrictions. A statement will be issued soon regarding the existing situation. The probability of COVID-19 infection in children is low and the condition is mild. The number of confirmed cases of COVID-19 in children is not large enough to prevent the reopening of schools. Considering a reduction in capital gains tax and a reduction in salary tax for middle-income families. There is no reason why the economic growth rate in the third quarter cannot reach20%。

US Treasury Secretary Nuqin said that if we can reach a fair agreement with the Democratic Party on COVID-19 assistance, we will achieve it this week. There is room for compromise in the negotiations on epidemic assistance. On the issue of COVID-19 assistance, we are no longer in a state of "emergency" as before. President Trump will sign a separate education bill. We cannot just compromise with the Democratic Party on the cost of the epidemic relief plan, but must negotiate one by one. Unemployment relief will not require states to bear any costs. Legislation on COVID-19 assistance needs to be passed. States in the United States have enough funds to deal with the shortage.

White House Press Secretary McNuny, Trump still hopes to see direct payment. The White House is still actively pushing for the next economic stimulus bill. Trump still hopes to pass the COVID-19 Relief Act, which includes direct funding and funding to schools. The Democratic Party should return to the negotiating table on the stimulus plan. Orders are entirely within the executive authority of the President. States could consider funding unemployment assistance through the COVID-19 Economic Stimulation Act. I hope to provide additional unemployment assistance immediately.

The Governor of Kentucky in the United States stated that Trump's current executive order is "not feasible". States in the United States cannot withstand the pressure of unemployment for the long term.

New York Governor Komo has stated that Trump's executive order will increase state spending. I hope Trump's executive order is just a 'strategy'.

Federal Reserve official Evans said that not all businesses will survive after the virus subsides, and many workers will have to return to work. People affected by the crisis will need new policies to help them weather the economic downturn. The current situation has no modern precedent, and the speed, severity, and scope of the recession are all unique.

Moody's analysis shows that due to the longer recovery of employment and consumption, US municipal revenue will be lower than pre pandemic levels for several years. After the recession ends, the economic downturn caused by government shutdowns will have a lingering negative financial impact on the market sectors of various cities. The tax revenue of US state and local governments will take several years to recover from the economic downturn. In recent years, the high sensitivity of the United States to social issues has increased political barriers to reducing budget gaps through spending cuts. In two to three years, the US municipal authorities will still face the sequelae of the COVID-19 epidemic, mainly the decline in income.

Goldman Sachs analysis predicts that "at least one" vaccine will be available in2020Approved at the end of the year and2021Launch in the second quarter of this year to achieve widespread distribution. This progress will drive consumer spending and generate stronger revenue next yearGDPData and job opportunities.

According to reports, a large influx of funds into the world's largest gold exchange traded fund(ETF)SPDR GoldLater, some investors "closed down", so that theETFRecorded last Friday3.82$100 million outflow of funds, although relative to this size820Billion dollarETFIt's just a small amount, but the lost funds are still3The most since the month.

Eurozone:

Starting from the Euro announced on Monday8monthSentixThe investor confidence index is-13.4Higher than market expectations-15.1, previous value is-18.2.

Commentary states that the Eurozone investor confidence index has risen for the fourth consecutive month and reached its highest level since the lockdown in February, but is still at a lower level than normal. In an absolute sense, there is still no encouraging news, and it has been proven that the process of economic recovery is very slow.

according toCMEFederal Reserve Observation: The Federal Reserve9Monthly interest rate maintained at0%-0.25%The probability of the interval is100%Interest rate hike25Bps to0.25%-0.50%The probability of the interval is0%;11Monthly interest rate maintained at0%-0.25%The probability of the interval is100%Interest rate hike25The probability of a basis point is0%。

Today's Focus

14:00 britain6Three months in a monthILOunemployment rate

14:00 britain7Monthly unemployment rate and number of applicants for unemployment benefits

17:00 Germany and the Eurozone8monthZEWEconomic Sentiment Index

18:00 U.S.A7monthNFIBSmall Business Confidence Index

20:30 U.S.A7monthPPIMonthly rate

Technical aspect:

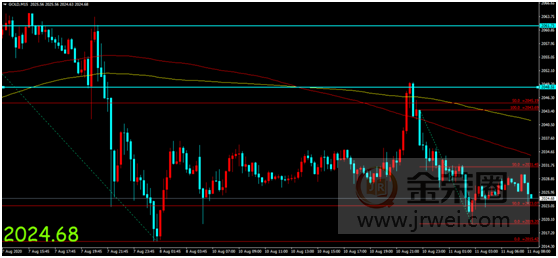

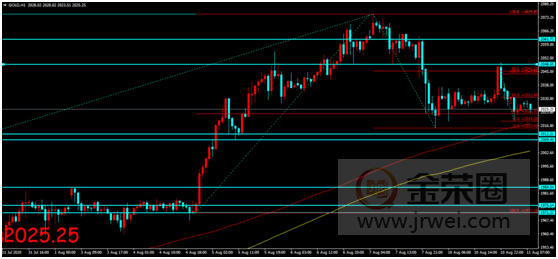

International gold rose and fell on Monday, maintaining a volatile trend, with a slight upward trend in the opening of gold prices on Monday morning2036Accelerate the descent after the first line and reach the lowest point2019Form a short line after a single lineVType reversal, gold prices rebounded in the early stages of the Asian session and remained stable2027-2035Horizontal price range. At the beginning of the European and American market opening, gold prices did not form a short-term range and continued to change2027-2035Organize intervals. The trading time of the US market has reached its highest point as gold prices have expanded due to repeated short-term pressure levels2049After the first line, it fell again. Gold prices hit their lowest point early Tuesday morning2019Maintain stability in the short term after the first line2030Below, short line from2046The maintenance of the first line decline did not show a significant impact on the low support level, and the continuation of the short-term decline was relatively good. The daily line recorded a small negative line, and the consolidation of intraday intervals did not result in a change in the form of daily technical indicators. As the short-term low range is maintained, the probability of short-term gold prices expanding and falling further and stepping back on the support level of daily technical indicators further increases. Hour line display, short-term gold price stepping back2049The first-line formation has shown a positive impact on the pressure level of hourly technical indicators, with short-term technical indicators having a positive impact. Currently, gold prices have once again fallen below the pressure level of short-term technical indicators, and the short-term decline is maintained(2045-2019)There was no significant effect of effective support position. Prudently reduce the expected new orders for the day and maintain a biased operating approach.

Daily operating range:

Multiple orders:

radical2009Frontline participation, stop loss3-5Point, profit target2014upper

steady1997Frontline participation, stop loss3-5Point, profit target2001upper

Empty order:

radical2032Frontline participation, stop loss3-5Point, profit target2028Below

steady2042Frontline participation, stop loss3-5Point, profit target2038Below

The US coronavirus rescue bill continues to ferment, and gold prices continue to rise and fall, maintaining a volatile trend. We are cautious in expanding the new single price range within the day and maintaining a biased operating approach |

"Small gifts, come to Huiyi to support me"

No one has offered a reward yet. Give me some support

|