Register now, make more friends, enjoy more functions, and let you play in the community easily.

You need Sign in Can be downloaded or viewed without an account?Register Now

x

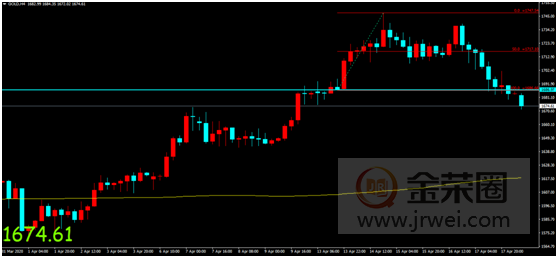

Market Review:

internationalgoldFriday(4month17Japan's volatility closed lower, opening price1722.44dollar/Ounces, highest price1724.48dollar/Ounces, lowest price1683.56dollar/Ounces, closing price1690.42dollar/ounce.

Message surface:

On Monday morning Beijing time, US President Trump said he is close to reaching an agreement on additional stimulus plans. Maybe there will be an answer on Monday. Tomorrow's negotiations with the Democratic Party may reach a "good" result. Re opening and stimulus measures will boost the U.S. economy. There are constant signs that the epidemic has passed its peak. The United States has greatly increased the detection of COVID-19 virus. Schools will resume soon.

(U.S. Senators Cassidy and Mendez develop a plan outline to support states and propose the establishment of5000A billion dollar state and local government bailout fund. )

US Treasury Secretary Mnuchin said that economic recovery takes months rather than years. Some states are ready for a quick restart, while others still need some time. I hope the relief plan will return to normal on Wednesday. Approaching an agreement on emergency relief measures. I hope the Senate can pass the bailout plan on Monday.

Governor Cuomo of New York stated that the hospitalization rate in the state has further decreased. The trend in New York State suggests that the virus infection rate is decreasing. We once again call for federal funding to be provided to state and local governments. The US Food and Drug Administration(FDA)The antibody testing in New York State has been approved and will begin this week.

The Federal Reserve stated that in4month20-24During the period, it will be arranged on a daily basis150Buy treasury bond bonds at the speed of US $100 million. The Federal Reserve's current round of treasury bond bond purchase plan began3month13On the day, and in3month19day-4month1Peak reached between dates750USD100mn/Day. After several adjustments, the Fed's purchases of treasury bond bonds this week were daily300Approximately one billion US dollars, which will further decrease to daily next week150USD100mn

Federal Reserve official Brad stated that there is reason to believe that the United States can basically overcome the crisis in the second quarter and the economy will perform well in the second half of the year. Many market liquidity indicators have improved compared to a few weeks ago. The Federal Reserve may emphasize in its next statement that the current data is' meaningless'. The goal of the Federal Reserve is that if a company1The monthly performance is good, and it can also operate normally in the second half of the year. It is not expected that there will be many forward-looking guidelines in the upcoming meeting, and the current focus is on the pandemic rather than interest rates. The Federal Reserve has pledged to maintain current interest rates for the foreseeable future. It is expected that Congress will increase assistance for small business loans in the United States. The downside risks for the US and global economy are significant. The impact of the epidemic is expected to be concentrated in the second quarter.

Federal Reserve official Meister stated that the economy may partially restart in the third quarter. The economic recovery will take some time, and the Federal Reserve is trying to reduce economic losses. The Federal Reserve is working hard to help the market operate and support business activities in order to prepare for the reopening of the economy. The data is ugly, but not surprising.

Federal Reserve official Williams said that the Fed is using big data for foresight and is prepared to support economic development no matter how the situation evolves. It is expected that the economy will not fully recover its strength by the end of the year. The operation of financial markets has significantly improved. Industries such as construction may rebound faster. We expect to see poor data in the second quarter. I have hope for the ultimate recovery of the US economy.

According to analysis by Wells Fargo, the main focus of the global economy has shifted from manufacturing to services. Given the severity of the impact of the pandemic on the economy, it is expected that the global economy will enter a recession in the first half of this year and stabilize later this year, with a full year economic contraction2.9%。

Analysis suggests that the US economy will not fully recover until people's fear of the pandemic subsides. If the United States wants to restart its economy, it must help those unemployed workers find new jobs. However, the good news is that at least half of the unemployed have indicated that their situation has improved.

Eurozone:

French Prime Minister Philippe said that the COVID-19 epidemic in France has improved "slowly but surely", but the public health crisis is still not over. A plan to lift the blockade will be proposed within the next two weeks. France2020The annual economy will shrink10%about.

Italian Prime Minister Conte stated that,5month4Starting from today, we will gradually relax control and formulate a national unified plan for resuming work and production. We will work together with local government representatives and various sectors of society to develop a national unified plan for resuming work and production, taking into account health protection and production needs. But he refused the request to resume work early next week, stating that he would further discuss the details of the resumption plan with the resumption special working group, experts from the Science and Technology Committee, and cabinet members.

Brexit:

The report shows that the negotiations between the UK and the EU have officially restarted a few days ago after the "Brexit" postponed due to the COVID-19 epidemic. Both sides have agreed to hold multiple rounds of video bilateral negotiations in the coming weeks, striving to6A future relationship agreement was reached a month ago. According to relevant regulations, if the UK and Europe fail to reach a trade agreement during the Brexit transition period and the transition period is no longer extended, both sides will return to the World Trade Organization framework to conduct trade. Extending the transition period for Brexit is an option to ensure that both parties have sufficient time to reach an agreement. Analysts point out that the pandemic has caused delays in negotiations and made it difficult for subsequent negotiations to take place face-to-face for a considerable period of time. From the current progress and complexity of the negotiations, if the transition period is not extended, the possibility of both parties reaching a free trade agreement as scheduled will be greatly reduced.

according toCMEFederal Reserve Watch: The Federal Reserve maintains current interest rates at0%-0.25%The probability of the interval until next year3Monthly average100%。

This week's focus is on:

Monday:09:30 China4Monthly one-year loan market quoted interest rate;14:00 Germany3monthPPIMonthly rate;16:00 eurozone2Monthly adjusted current account;17:00eurozone2Monthly trade account;20:30 Canada2Monthly wholesale sales rate;

Tuesday:14:00 britain3Monthly unemployment rate, number of unemployment benefit applicants2Three months in a monthILOUnemployment rate, Switzerland3Monthly trade account;17:00 Germany, Eurozone4monthZEWEconomic Sentiment Index20:30 Canada2Monthly retail sales rate;22:00 U.S.A3Annualized total monthly home sales;

Wednesday: 14:00 britain3monthCPIMonthly rate, retail price index monthly rate;20:30 Canada3monthCPIMonthly rate;21:00 U.S.A2monthFHFAMonthly rate of housing price index;

Thursday:14:00 Germany5monthGfkConsumer confidence index;15:00~16:30 France, Germany, Eurozone, and UK have successively announced4Monthly manufacturing industryPMIInitial value, UK4Monthly service industryPMI;18:00 britain4monthCBIIndustrial order difference;20:30 The number of initial jobless claims for the week in the United States;21:45 U.S.A4monthMarkitManufacturing and service industriesPMIInitial value;22:00 U.S.A3Annualized total monthly sales of new homes;

Friday:07:01 britain4monthGfkConsumer confidence index;07:30 Japan3Monthly National CoreCPIAnnual rate;14:00 britain3Monthly retail sales rate after seasonal adjustment;16:00 Germany4monthIFOBusiness Prosperity Index;20:30 U.S.A3Monthly rate of durable goods orders;22:00 U.S.A4The final value of the University of Michigan Consumer Confidence Index for the month;

Technical aspect:

International gold prices fluctuated and closed lower on Friday, with gold prices starting from1718First line accelerated downward with the lowest touch1703After hitting the bottom and rebounding on the first line, gold prices rebounded again during Asian trading hours1718After the first line, the price fluctuated and fell in the short term, entering the afternoon session, and the gold price gradually stabilized at the low support level1703On the front line, forming a pair1703On the eve of the opening of the European market, the gold price hit its lowest point due to the accelerated breakdown performance on the front line1687After hitting the bottom and rebounding on the front line, it forms a pair1706Frontline stepping performance. Gold prices fall again during European trading hours, hitting their lowest point1684Maintain a low sideways trend after the first line. During the US trading session, the price of gold expanded, with a low point rebounding and a high retracement1700After reaching the first line, it fell again and fluctuated, closing lower1684frontline. On Monday morning, the gold price continued its short-term decline and hit its lowest point1672Maintain a short-term low after the first line. The short-term downward movement of gold prices in a continuous range still maintains a relatively positive support level performance, forming a low range at the end of Friday to maintain performance. The short-term bearish momentum gradually strengthens, gradually narrowing the support level result range, and further compressing the stop loss space for long positions in the future. The daily chart recorded a strong bearish candlestick, and the short-term gold price fell to the daily moving average10Below the pressure level of the daily moving average, the short-term low point range maintains or further consolidates the current bearish momentum of oscillation. As the range falls again, it will further bring about the adhesive performance of daily level technical indicators. The four hour line shows that the short-term gold price continues to decline, forming a negative impact on the four hour period60The daily moving average has broken through, and the four hour technical indicators are arranged in a downward cross pattern of adhesion. Attention should be paid to the maintenance of short-term intervals, and the maintenance of longer period low point intervals will further consolidate short-term bearish momentum. Cautiously reduce the expectation of multiple orders entering the market within the day and maintain a conservative range of operations.

Daily operating range:

Multiple orders:

radical1665Frontline participation, stop loss3-5Point, profit target1669upper

steady1645Frontline participation, stop loss3-5Point, profit target1650upper

Empty order:

radical1681Frontline participation, stop loss3-5Point, profit target1677Below

steady1695Frontline participation, stop loss3-5Point, profit target1690Below

The plan to restart the US economy has boosted market confidence, and gold prices have fluctuated and continued to decline in the short term. Cautiously reducing the expected price of new orders within the day to maintain a biased operating strategy |

"Small gifts, come to Huiyi to support me"

No one has offered a reward yet. Give me some support

|