Register now, make more friends, enjoy more functions, and let you play in the community easily.

You need Sign in Can be downloaded or viewed without an account?Register Now

x

Traders may have encountered a mentality collapse issue when entering the market for the first time. Watching the market continue to rise, the results after entering the market continue to fluctuate and fluctuate... The fluctuation is so intense that there is no patience, so the market is guaranteed to exit. As a result, the market just started to rise. Previous articles:Wave theory--Driving waves

If the market goes up in one breath, then it will go down in one breath. But unfortunately, this exists in dreams. We are all aware of a trend market, no matter how small the time period is1The minutes are still large enough1Every month, the market will adjust and correct for a period of time before continuing the previous trend or turning around.

At the end of the day, the market situation is an emotional game among the traders behind it. The price may be hit by brainless traders who rush into short positions, and the price may also be adjusted by short-term traders who make a profit and then run. In any case, it will lead to an upward trend in the marketKThe line graph shows a downward structure with a callback. This downward structure may be either a reversal or a oscillation.

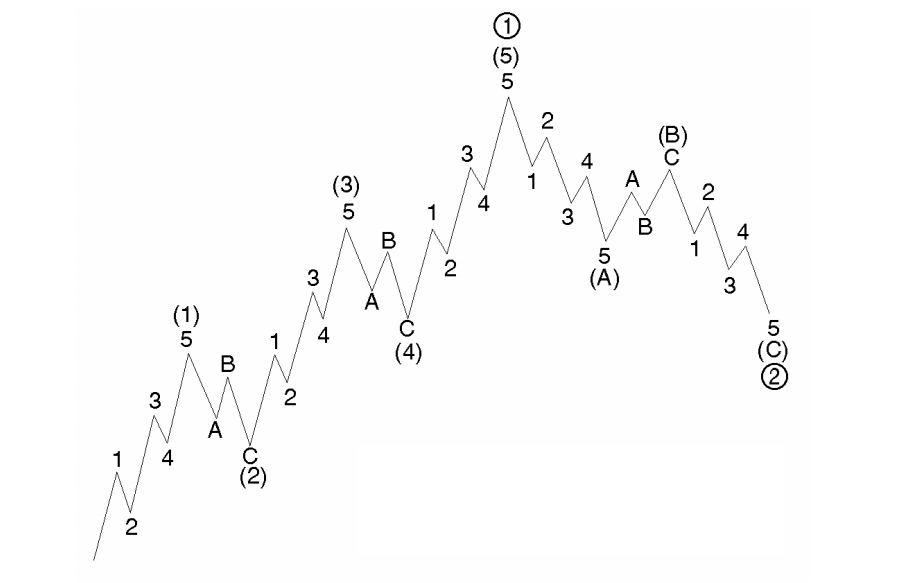

In Elliott's wave theory, this type of oscillatory consolidation structure is called an adjustment wave.

Adjusting the specific structure of waves can be subdivided into as many as13There are various types of adjustment waves, including serrated, platform, triangular, and combination types. When the adjustment wave is completed, the market will continue the trend direction of the previous driving wave.

However, for traders who are new to wave theory, it is difficult to accurately capture the structure of adjusted waves in actual market analysis. Therefore, for beginners, simply remember to adjust the structure of the wave to easily find trading opportunities in the market.

The common feature of sawtooth and platform type adjustment waves is the internal structure of the three waves. Specifically, we only need to2A simple step can be taken to find a simple way to adjust the wave structure.

1、 Confirm whether the previous market is in a driving wave

If the market shows a unilateral trend and continues to rise, there is usually a structural adjustment and correction. Therefore, after finding the driving wave, we can determine whether the current market is an adjustment structure that corrects the previous trend. If it is confirmed that the current market trend is an adjustment wave, it will return to the previous trend direction and reach a new high after the adjustment is completed.

For specific information on how to distinguish whether the previous market trend is a driving wave, you can refer to the previous article "Elliott Wave Theory: What is a driving wave". It should be noted that after confirming that the previous trend was driven by a wave, the current price trend is not allowed to break through the starting point of the previous trend. If it breaks through, it indicates that the previous trend has been incorrectly adjusted.

II Searching for band overlap

In Elliott's complete wave cycle chart, we can observe a clear pattern: when the market trend direction appears, the premise is that adjusting the structure will not enter below the previous high again after breaking through it. for example3Wave Breakthrough1After the wave reaches its peak, it will not enter again1The price range of waves(4Waves are not allowed to enter1Wave price area).

(Wave Cycle Diagram)

(Wave Cycle Diagram) The most typical feature of adjusting waves is band overlap. When the market returns to the previous price range again after being low or high before breaking through. This proves that the previous market trend is clearly not a new driving wave trend, but a fluctuating adjustment wave structure.

When prices fall back to their previous highs or lows, we can temporarily assume that the previous three wave structure isABCAdjust the waves. For beginners in Elliott waves, we don't need to worry about whether the waves are sawtooth or platform shaped. What we need to do now is to confirm that after the adjustment is completed, we will enter the market and build positions in the direction of the previous trend.

To summarizeABCGuidelines for adjusting the shape of waves:

ICWaves should break throughAThe endpoint of the waves;

2、 If the market retreats toAWithin the wave price range, the most basic conditions for adjusting the form are met;

3、 ExceedingBThe breakthrough at the end of the wave may be a signal of the end of the adjustment.

In a noisy trading market, what we can do is to block the noise and search for the simplest, most basic, and most accurate structure to help us trade with the flow and improve trading returns. |

"Small gifts, come to Huiyi to support me"

No one has offered a reward yet. Give me some support

|