Register now, make more friends, enjoy more functions, and let you play in the community easily.

You need Sign in Can be downloaded or viewed without an account?Register Now

x

[paragraph]

投资虽然只是由简单的建仓和平仓构成,但从中却蕴含了很深技巧,想成为一名成功地投资者,就一定要养成一系列的好习惯,就像要有一个好身体就要养成早睡早起、合理饮食等等好习惯一样。习惯--尤其是好习惯--虽然不容易养成,但为了我们投资的最终目的--盈利,我们必须要这么做。下面的这6种投资的制胜习惯是很多的投资大师不约而同形成并坚持保持的,也正是这些投资习惯指引着他们一步一步的走到了福布斯的富翁排行榜上。【文末见联系方式】

1、保住现有财富

制胜习惯:保住资本永远是第一位的

投资大师:相信最重要的事情永远是保住资本,这是他投资策略的基石。

失败的投资者:为一的投资目标就是赚大钱.结果,他常常连本钱都保不住。

2、投资大师们不冒险么?

制胜习惯:努力回避风险

投资大师:作为习惯一的结果,他是风险厌恶者。

失败的投资者:认为只有冒大险才能赚大钱。

3、市场总是错的

制胜习惯:发展你自己的投资哲学

投资大师:他有他自己的投资哲学,这种哲学是他的个性、能力、知识、品位和目标的表达。因此,任何两个极成功的投资者都不可能有一样的投资哲学。

失败的投资者:没有投资哲学,或相信别人的投资哲学。

4、衡量什么取决于你

制胜习惯:开发你自己的个性化选择、购买和抛售投资系统

投资大师:已经开发并检验了他自己的个性化选择、购买和抛售投资系统。

失败的投资者:没有系统,或者不加检验和个性化调整地采纳了其他人的系统。(如果这个系统对他来说不管用,他会采纳另一个还是对他不管用的系统。)

5、集中于少数投资对象

制胜习惯:分散化是荒唐可笑的

投资大师:认为分散化是荒唐可笑的。

失败的投资者:没信心持有任何一个投资对象的大头寸。

6、省一分钱等于赚一块钱

制胜习惯:注重税后收益

投资大师:憎恨缴纳税款和其他交易成本,巧妙的安排他的行动以合法实现税额最低化。

失败的投资者:忽视或不重视税收和其他交易成本对长期投资的影响。

Understanding of Shan Chenjin Trading-frygold亏损原因

Personally, I believe that gold investment is a good investment product. Firstly, it has flexibility in trading, secondly, the stability of gold, and thirdly, the factors that affect gold are easier to analyze. Gold has been the main carrier of investment and wealth management since ancient times, but currently, domestic gold investors still suffer more losses and less profits. Why? Some people blame the platform, others blame the market, and say some personal opinions

1Lack of understanding of relevant knowledge. I heard that there is a great profit opportunity in this market, and if the broker deceives me again, I rashly enter the market without learning relevant knowledge, and even the trading rules and software usage are not clear. If you want to do a good job, you must first sharpen your tools. Even if you don't understand the resources in your hands, it's difficult to think of losing.

2I have learned relevant knowledge, especially technical analysis, and have a mixed understanding of various indicators and graphics. However, I am not proficient in them, and I am not familiar with them. When making orders, I have a confused mindset.

3Do not have their own trading strategy. The entry position is not suitable, which is not conducive to hanging a stop loss or not hanging a stop loss. A sharp rise and fall in the market is like chasing orders, and the result is always chasing the end of the market. There is no accurate positioning of profit margin before placing an order, and unexpected market conditions can be caught off guard.

4Blindly superstitious about brokers. The relationship between brokers and investors depends on trading volume, so some brokers encourage investors to place more orders, while some brokers have lower levels of proficiency.

5Attitude. Learning to hold coins and wait, being nervous when losing and also nervous when making profits, striving to find favorable factors for oneself through one's own analysis and the opinions of others, and so on.

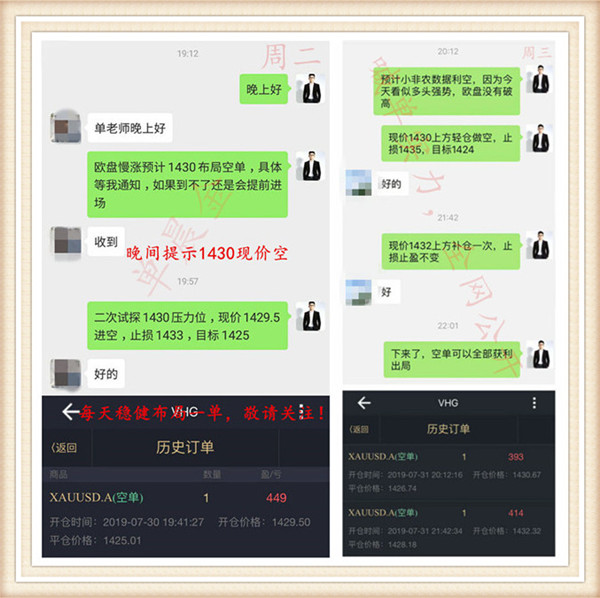

投资第一想的是赚钱,而不是在做完单亏损了以后才去翻阅博客找老师,单晨金从来不会说什么很花哨吹嘘自己的话,甚至更甚的马后炮,我是一个简单的人,愿意化繁为简抽取事物本质的人,我不愿意在河岸边跑上跑下用忙碌来麻痹自己。到这个市场的目的就是为了赚钱,不是为了表现比别人聪明做虚假的神让别人崇拜满足自己的虚荣心。所以我所分析和所做的一切都是为了赚钱。从业八年,在市场上见过许多所谓的“砖家”,保障收益,胡乱喊单,不考虑投资朋友的承受能力,做单后对投资朋友完全不管不顾,把投资朋友当提款机,方向错了,让投资朋友撤止损,抗单爆仓的频频皆是,在此,我送所有的同行一段话.“不要忽悠你的客户,更不要坑你的客户!!因为曾经无数人和他联系过,而他却选择相信了你!”一旦成为客户,便永远是朋友!

If you are a beginner, I can teach you techniques, cultivate good order making habits, and take you on a long-term stable and profitable path. If you are an old hand, I can correct your bad habit of doing singles and provide psychological counseling to help you make back the losses. If you are a undefeated general, then we can also spar together and explore becoming like-minded good friends. In addition to investing, you also have poetry, distant lands, and myself in your life. The market is risky, and entering the market requires caution. Strategies have a certain timeliness, and timely strategies are the main focus.

Author of this article: Shan Chenjin

作者赠言:交易之真谛,乃于淡雅间、无味之中

σ-σ:330-5379-776

V-Letter:scj366 WeChat official account: Shan Chenjin

The above content is for reference only. Investment carries risks and caution is required when entering the market. |

"Small gifts, come to Huiyi to support me"

No one has offered a reward yet. Give me some support

|