Register now, make more friends, enjoy more functions, and let you play in the community easily.

You need Sign in Can be downloaded or viewed without an account?Register Now

x

12The moon arrived as expected, mixed with the howling north wind and the cold of winter.G20It should have been the focus of everyone's attention over the past weekend. When the Xi Jinping special session ended with enthusiastic applause, did you see our article from last week?

As aoptionPractitioners, today's market situation can also be considered one of the long-lived series. Soybean meal1901Option Near Maturity OverlayG20Driven by events, amidst various expectations, the implied volatility of soybean meal has collapsed like the cliff we foresaw last week, with a spectacular scale. If you were interested in buying cross style products last week and saw our article come to an end, please do not express gratitude to us. We have only done what we need to do. If you buy straddle and...Please believe that life is still beautiful.

This week, soybean meal1901The series of options will expire on Friday, and further negotiations are needed in the future regarding trade issues between China and the United States. Therefore, soybean meal1901The series of options is likely to bid farewell to us in a calm week.

reviewM1901The life of the series of options is short but full of excitement. They have witnessed the repeated trade between China and the United States, while also realizing their self-worth in serving the real economy in the financial market.

To put it bluntly, it is in this uncertain context that soybean meal1901The series of options provide us with many trading opportunities for volatility. Today, let's take a look at theGamma ScalpingStrategic performance.

Magical implied volatility

last weekM1901The implied volatility of the series of options is already at historical highs, despiteG20It may have a significant impact on the market situation, but as uncertainty runs out,M1901The implied volatility of the series of options will also experience a significant decline, therefore, buying cross or wide cross strategies actually face extremely high strategic costs.

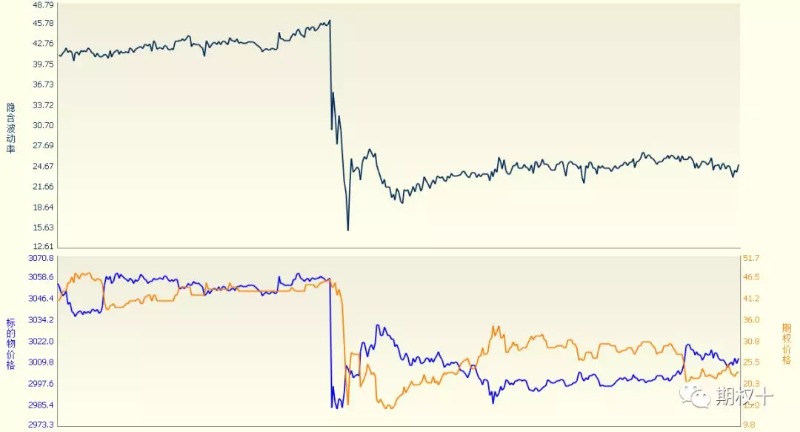

After today's opening, the market has gradually evolved with our expectations. althoughM1901futuresThe contract opened low, but the implied volatility of the options market plummeted even more spectacularly. We useM1901-P-3000For example, at the close of last Friday's night trading, the price of the option contract was43Near the yuan, the implied volatility is within45%Left and right. As of today's close, the price of the option has dropped to23Yuan, implied volatility at25%Left and right. Implied volatility is close to20%The decline is indeed rare in the options market, so there has also been a strange phenomenon of futures falling and put options also falling.

The cliff like decline in implied volatility is not limited to just one of the options mentioned above,M1901The series of options are basically the same. Faced with significant adjustments in implied volatility, buying cross style stocks does require significant investmentDeltaOnly with value can we turn losses into profits, but the postponement of the Sino US trade issue has basically closed the time window for turning losses into profits.

So, if you checked our report last week and stopped buying straddles, please don't thank us. If you miss our report and let go of your longing for freedom, then please believe that tomorrow is still beautiful and pay attention to our article in a timely manner.

Under trade frictionGamma Scalpingstrategy

reviewM1901The life of the series of options is short but full of excitement. They have witnessed the repeated trade between China and the United States, while also realizing their self-worth in serving the real economy in the financial market. It is in this uncertain context that soybean meal1901The series of options provide us with many trading opportunities for volatility. Today, let's take a look at theGamma ScalpingStrategic performance.

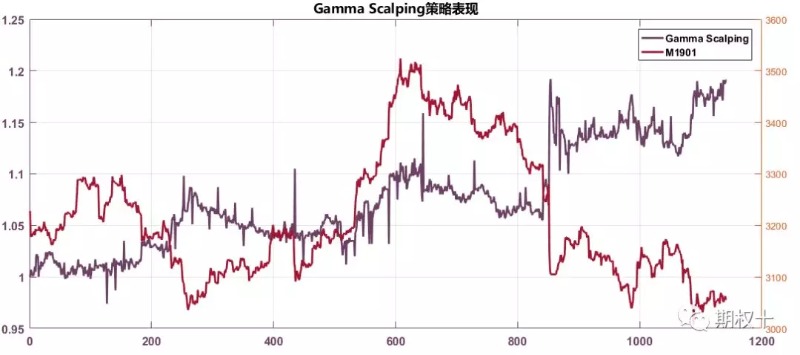

so-calledgamma scalpingStrategy is a common strategy in volatility trading. The basic trading idea is to buy options and maintain them when significant fluctuations are expected in future soybean meal futures contractsdeltaNeutral. Going longgammaWhen investors pay option fees, they have the opportunity to buy low and sell high on the underlying asset. When the underlying assets fluctuate as scheduled, timely lock in profits and re establish options and futures positions in new positions.

Due to the holding portfolio being maintainedDeltaNeutral, therefore, when the price of the underlying asset changes, the return on the position mainly comes fromGammaChanges in.

However, we should be aware that the price of option contracts is also influenced by their own factors, such as time and the implied volatility of options. The advancement of time will cause a decline in time value, and a decrease in implied volatility will also cause a decline in option prices. Therefore, in constructingGamma ScalpingWhen it comes to strategy, it is also necessary to weigh this.

Following this strategy, we aim toM1901A series of options were tested back and selected8Month to11Of30Minute data, in40Point to point profit condition,20Points are stop loss conditions, select2Hand value option pairs1Conduct testing on hand futures contracts.

We can see that the overall operation of this strategy is relatively stable, as of11month30Daily existence20%Left and right profitability. If the timing condition of volatility is added to the strategy in the future, it will further improve the strategy.(Yide Futures and Options Department) |

"Small gifts, come to Huiyi to support me"

No one has offered a reward yet. Give me some support

|