Register now, make more friends, enjoy more functions, and let you play in the community easily.

You need Sign in Can be downloaded or viewed without an account?Register Now

x

Previously, with some bullish players off the courtoptionThis business has not been started yet, and during the process of communicating with agents working on other projects, I found some misunderstandings about laws and regulations. So, I also want to explain how the recent regulatory and policy market for over-the-counter options is, hoping to be seen by more people who are optimistic about the over-the-counter options market and to clear their minds of the dark clouds about laws and regulations.

Firstly, at the beginning of this year, over-the-counter options were very popular, and everyone rushed in to do this business. The regulatory authorities also saw some chaos.(For details, please consult:17816852114)

Time has arrived4In June, private equity was suspended. Previously, we were also using equity based private equity. After this suspension, we also changed our identity and participated in over-the-counter options as an ordinary asset management legal entity.

The next three months can be said to be the darkest period for over-the-counter options. Many companies have switched projects during this period and feel that policy risks and uncertainties are too high. And although we know that over-the-counter options will indeed be released, there are also some news coming out,8month1There will be a new policy release on May 1st, but three months of waiting, to be honest, is difficult.

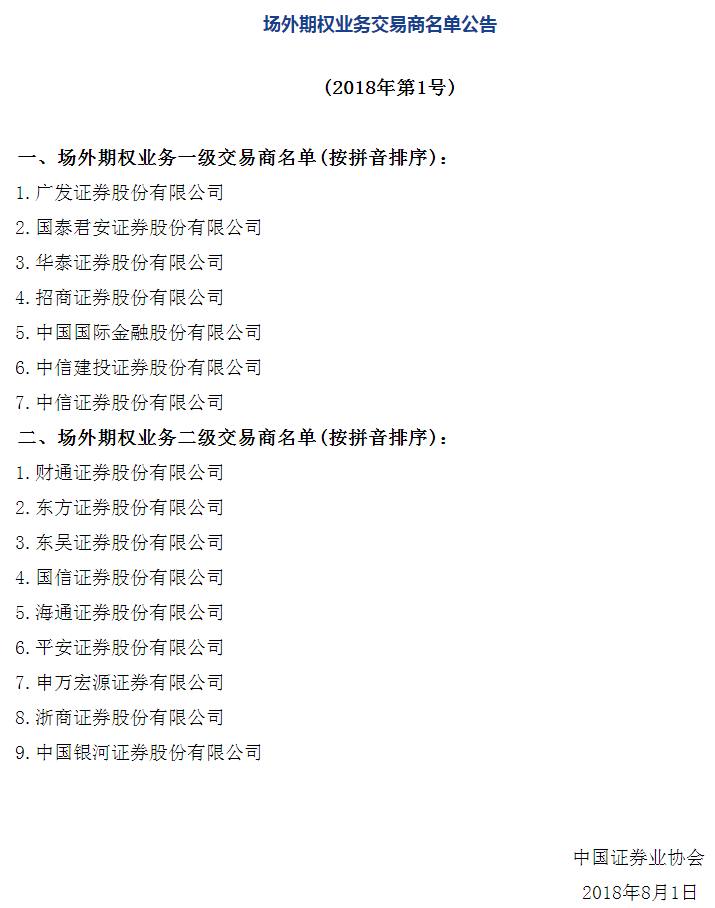

8month1On the afternoon of the th6Point, here comes the news. A list of securities firms that can participate in over-the-counter options has been released, including7Primary dealers and9Secondary dealers. The news has set the tone. However, at the same time, regulatory authorities have also put forward some requirements that participating legal entities must possess“532”Qualification. Explain532The net assets of the company at the end of the past year shall not be less than5000wFinancial assets not less than2000wHaving no less than experience in securities and other investments3In addition, the previous qualification review by securities firms has now been changed to one by one review by the China Securities Regulatory Commission, which greatly increases the difficulty of passing. The difficulty of this threshold is no less than applying for a securities private placement license.(For details, please consult:17816852114)

8month2Number, under the guidance of the local mid-term cooperation window, the period has started self inspection, and the orders that go through the period channel cannot be cancelled. Some platforms in the market are searching for new platforms to do orders due to channel issues. reach8month8Day, the self inspection is over.

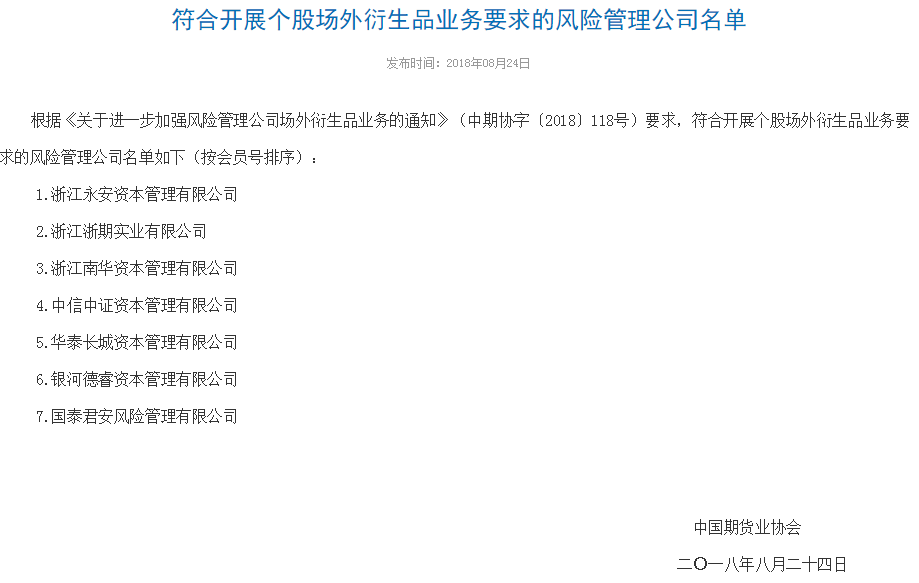

Time has arrived8month24On the same day, the Mid Term Association released the list of risk management companies that can participate in the over-the-counter derivative business of individual stocks. common7Home, including: Yong'an, Zheqi, Nanhua, Zhongzheng, Huatai Great Wall, Yinhe, and Guotai. stay8At the end of the month, it was learned through communication with colleagues working on derivatives at Founder Securities that,9At the end of the month or10At the beginning of the month, another batch of securities firms will be released, and Founder is likely to be included in the secondary list.

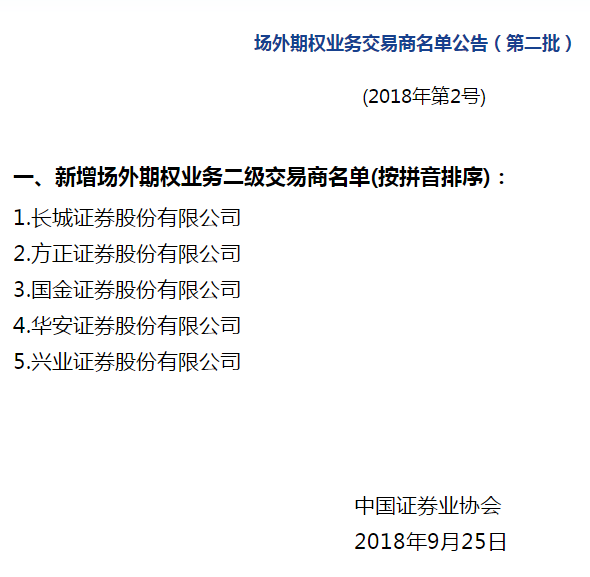

9month24Today, this batch of lists arrived as scheduled. They are: Great Wall, Fangzheng, Guojin, Hua'an, and Xingye. common5In short, a secondary trader can only operate as a channel and cannot hedge on their own.(For details, please consult:17816852114)

Since then, so far, some important laws and regulations on over-the-counter options have been completed. During my communication with the people in the derivatives department of South China, I learned that everyone is actually very optimistic about this business. They have also made some orders before, but due to some things, they stopped doing them later.2018In, there were some clear regulations regarding options, making the overall situation clearer. Although the market has been very popular on the market recently, the market outside the market will definitely be much larger than on the market. The scale may not be inferior to the size of a commodity market. So sometimes choice is more important than effort. These notices can be found in the "Notice Announcement" column on the official website of the China Securities Association or the China Securities Association.

8month1The first batch of lists announced by the China Securities Association

8month24The first batch of list released by the Japan Mid term Association

9month25The second batch of list released by the Japan China Securities Association

|