Register now, make more friends, enjoy more functions, and let you play in the community easily.

You need Sign in Can be downloaded or viewed without an account?Register Now

x

optionClassification and Use of

For enterprises, avoiding the risk of price fluctuations in raw materials or finished products has become a market consensus. At present, the financial instruments used in the domestic market to avoid risks mainly include forward tradingfuturesOptions, swaps, etc. Enterprises mainly use futures, and the scope of options is expanding.

As a hedging tool, options are rapidly expanding in scope, mainly determined by their own characteristics. Options essentially involve paying a certain amount of funds to obtain a forward option. From the perspective of standardization or not, options can be divided into over-the-counter options and over-the-counter options.

On exchange options(traded options )Also known as "exchange traded options" or "exchange listed options", standardized financial option contracts are traded in centralized financial futures markets or financial option markets.

Off exchange options(Over the Counter OptionsGenerally abbreviated asOTC options(also translated as "store market options" or "counter options") refers to the trading of non-standard financial option contracts in non centralized trading venues.

The main difference between over-the-counter and over-the-counter options is whether the option contract is standardized. The nature of over-the-counter options is basically the same as that of option trading on the exchange. The main difference between the two is that the terms of over-the-counter option contracts do not have any restrictions or regulations. For example, the exercise price and expiration date can be freely determined by both trading parties, while option contracts on the exchange are traded on standardized terms. Participants in the over-the-counter option market can customize an option contract and set a price according to their unique needs, and then search for transactions through over-the-counter option brokers. The on exchange options under the jurisdiction of the exchange are traded and cleared through the exchange, and there are strict regulations and standards, so data such as transaction price, trading volume, and number of open positions are relatively transparent. Due to the diverse demands of hedging companies, there is a relatively broad demand space for over-the-counter options.

Option hedging analysis

Hedging is to ensure that when the prices of raw materials or finished products fluctuate significantly, the company's production costs or product profit margins have been locked in, and production and operation are not affected. According to this logic, futures hedging can fully achieve this goal. However, using futures hedging, prices move in a favorable direction for futures, resulting in profits for futures and relative losses for spot goods, resulting in a happy outcome for both parties; If prices develop in a disadvantageous direction towards futures, resulting in losses for futures and relative profits for spot goods, the results may not be as optimistic as expected.

From the analysis of hedging results, companies have completely different expectations for using futures hedging and option hedging. When using futures hedging, companies expect prices to move in a direction that is favorable for futures prices. Although the result is that the profits and losses of futures and spot goods offset each other, futures are profitable and companies are willing to accept them. When using option hedging, companies expect prices to move in the unfavorable direction of the option, and the larger the range of operation, the better. The result is that the option loses a certain amount of premium, and the spot gains greater profit space. The profit of the spot is much more than the premium of the option, and the result of hedging is an increase in profit space.

In short, using futures for hedging, whether done right or wrong, the results will not change, but the results of doing right are more easily accepted by the enterprise. By using options for hedging, companies prefer that hedging is done wrong, which can gain more profit margins, especially when prices change in the opposite direction of hedging, and the greater the magnitude, the better the results.

Analysis of Strategies for Enterprises to Use Over-the-counter Options

Whether it is purely speculative trading, hedging operations, or arbitrage trading, options have many combination strategies. Due to different purposes of trading, the emphasis on selecting trading strategies also varies. Speculative trading or arbitrage trading, investors' trading purpose is to obtain price differences and profits. When choosing trading strategies, they focus on cost returns and the probability of profits. Many strategies have stop loss settings or limited risk of the strategy itself. Hedgers, the majority of whom are physical enterprises related to hedging products, are trading to avoid price fluctuation risks. Therefore, when choosing a strategy, more attention should be paid to the investment cost of the strategy. This is also the main reason why zero cost option portfolios are popular among hedgers.

When choosing an option hedging portfolio strategy, the cost of the option portfolio strategy is a key factor for corporate hedgers, provided that it can effectively lock in costs or profits. For some low-profit enterprises, profits are very low. If the initial investment premium of options or option combinations is too high, the hedging result is correct and the predetermined hedging effect cannot be achieved, which means that the hedging operation has failed. Therefore, the choice of strategy is the key to the success or failure of hedging.

1.On exchange option portfolio

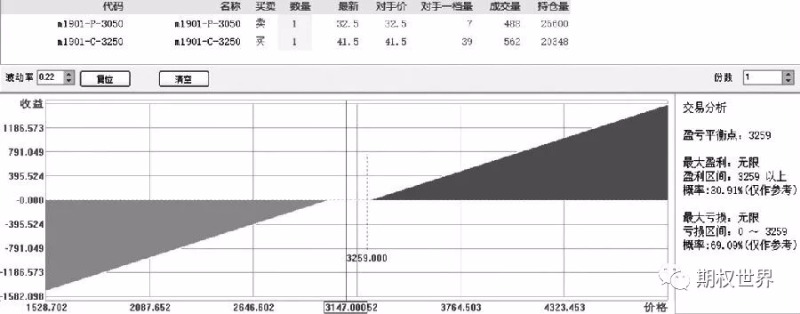

The figure shows the profit and loss balance of the hedging portfolio of on exchange options

For example, a certain aquaculture company believes that the trade friction between China and the United States will not be properly resolved in the short term, and the price of soybean meal may further increase due to the impact of this event. To lock2019year1The hedging decision-making group of the enterprise believes that it is necessary to hedge the procurement cost of soybean meal in the month. Comparing the hedging results of options and futures: If futures hedging is used, currentlyM1901Contract Price3150Left and right, locked without elastic space. If locked in options, there is still some profit margin for the later decline in soybean meal prices. If there is an increase, even if there is a certain loss, the risk is limited. So the company chose an option portfolio hedging and adopted a put option to sell+The strategy of buying call options involves paying the premium for buying call options with the premium for selling put options, effectively reducing hedging costs. The specific operation is to buy100The execution price is3250element/The ton standard isM1901The call option for the contract has a premium of41.5RMB, total payment of royalty4.15Ten thousand yuan, sold simultaneously100The execution price is3050element/The ton standard isM1901Put options on contracts, with premium charged32.5element/Tons, collected in total3.25Ten thousand yuan, initial investment is0.9Ten thousand yuan.

From a purely strategic perspective, this option combination has infinite risk and infinite returns. However, based on the analysis of the need for enterprises to purchase spot goods, the highest cost for enterprises to purchase soybean meal is3259element/Tons, with a minimum cost of3059element/Tons. When the option portfolio expires,M1901The contract price is3050element/At ton, the comprehensive procurement cost of the enterprise is the lowest (all options are waived, and the net expenditure cost is9element/Tons, spot purchase price3050element/ton). Compared to futures hedging, the underlying contract of an option portfolio expires(M1901)Price lower than3141element/Tons, the hedging yield of option portfolio is better than that of futures; Option portfolio expiration target contract(M1901)Price higher than3141element/The hedging results of ton futures are good.

2.Off exchange option portfolio

Compared to market demand, on exchange option contracts are not flexible enough to meet the unique needs of enterprises. If the price of soybean meal rises to3350element/Over tons or falling2980element/Under tons, the option portfolio becomes invalid, and on exchange trading cannot be satisfied, which requires off exchange options to supplement. Financial institutions design personalized over-the-counter option portfolio products based on the needs of spot enterprises to help them avoid price fluctuation risks.

For example, a cable company needs to purchase a large number of aluminum poles to produce wires. At present, aluminum prices are at a low level, with limited room for decline and no obvious signs of an increase. After analysis, the cable company believes that2019Before the year, the price of aluminum was13800—14200element/There will be no significant fluctuations between tons, so there is a demand for futures companies to obtain14000—14200element/The increase in yield between tons, but unwilling to pay royalties, if the price drops13800element/Under tons, a certain amount of spot goods can be purchased. Based on the needs of the enterprise, the futures company has developed the following strategies for selection:

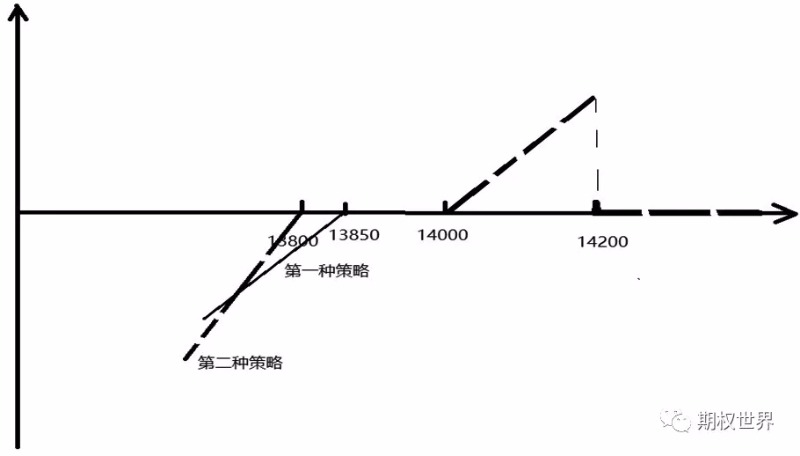

The first strategy: buy1The execution price for bullish shares is14000element/Tons of aluminum call options, sold simultaneously1The execution price is13850element/Tons of put options, holding time1For months, the premium for selling put options is equal to the premium for buying call options, with an initial investment of0The subject matter is the same asAL902Contract, the current price of the contract13900element/Tons. If the price rises to14200element/Above tons, futures companies only compensate enterprises14000—14200element/The part between tons. If the price drops to13850element/Under tons, companies compensate futures companies with double the price difference. Price in13850—14000element/Between tons, neither party needs to pay compensation.

The second strategy: buying1The execution price for bullish shares is14000element/Tons of aluminum call options, sold simultaneously1.6The execution price is13800element/Tons of put options, holding time1For months, the premium for selling put options is equal to the premium for buying call options, with an initial investment of0The subject matter is the same asAL902Contract, the current price of the contract13900element/Tons. If the price rises to14200element/Above tons, futures companies only compensate enterprises14000—14200element/The part between tons. If the price drops to13800element/Under tons, the enterprise pays compensation to the futures company1.8A price difference of times. Price in13850—14000element/Between tons, neither party needs to pay compensation.

The figure shows the profit and loss balance of the over-the-counter option hedging portfolio

Of course, corporate hedging can first use futures for hedging, and then use options to hedge futures positions. The first step is precise hedging (with the same proportion of rise and fall), and the second step is corrective hedging (if the direction of futures hedging is wrong, options can hedge losses generated by futures positions). In addition, there are cover up strategies, double limit strategies, protective bullish (bearish) strategies, and cover up strategies. No matter which strategy you choose or develop, you must start from your own needs. There is no best strategy, only the most suitable one. (Source: Futures Daily) |

"Small gifts, come to Huiyi to support me"

No one has offered a reward yet. Give me some support

|