Register now, make more friends, enjoy more functions, and let you play in the community easily.

You need Sign in Can be downloaded or viewed without an account?Register Now

x

source:Solitary Wolf Meditation

With the understanding of Wolf King,optionThe cultivation path should be as follows: start with the parity formula, gradually transition to the pricing formula, combine the probability of stock price movement and statistical quantification, learn the quantification and qualitative judgment of risk return ratio, and finally speculate on various strategies. During the study process, it is advisable to first establish Understand physics in a "schematic" manner, and then seek precise understanding in a "mathematical" manner. Based on this approach, let's briefly discuss the scenario of option parity.

I4Seed order and profit and loss chart

(1)Basic concepts

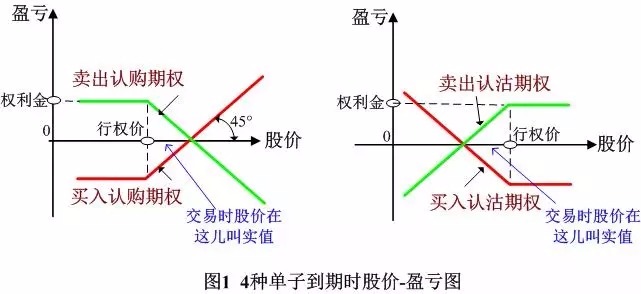

A. subscription/Put two types of options and buy/The combination of the seller and the seller is formed in pairs4Seed list, as everyone knows4The profit and loss on the maturity date of the seed order is shown in the figure1(Neglecting transaction fees), two points to clarify:1)The exercise price corresponds to the discount point, and the straight line after the discount is45Degree (of course, the change in stock price after the exercise price is the profit and loss value), and the profit and loss of both buyers and sellers are "zero sum";2)For call options, if the stock price is higher than the exercise price, it is called a real value option, otherwise it is called a virtual value option, and if put, it is opposite. During the holding period, as the stock price moves, real becomes virtual, and virtual becomes real.

BMany students are "building call option right position", "buying buyer's option", "buyingcall”After getting confused by various theories, let me elaborate a bit:

1)Buying options is called building a rights position (spending money to buy rights), and of course, it can also be used to close an obligation position; Put options, known as building obligation positions, are also known as equity positions;

2)Real value options, also known as in price optionsin the money optionVirtual options, also known as out of price optionsout of the money option;

3)Call option is also called call option, buy option, call option orcall option, put option is also called put option, put option, put option orput option;

4)Don't be fooled by things like "buying a buyer's option". The former "buy" refers to paying the premium and enjoying the right, while the latter "buyer" indicates that this right is "bought" under the agreed terms.

(2)Extension - "Symmetry" and "Asymmetry" of Risk Returns

AOptions are a "zero sum game" (considering transaction costs, then a "negative sum"), and the risk return should be logically balanced. The so-called option buyer "has limited risk and unlimited return", and the power position enjoys a one-way right of favorable execution and unfavorable abandonment, at the cost of paying interest, in this sense, the risk return is symmetrical; However, the uncertainty of the future price of the target determines that the symmetry of risk return expressed through a broken line profit and loss may be reasonable.

B. From an overall and long-term perspective, Lang Jun has not yet seen empirical data indicating that one party in the option trading has an advantage, and cannot falsify or confirm whether the risk return is strictly symmetrical. Fortunately, we only need to find and wait for a time when there is a significant asymmetry in risk and return to take action.

(3)Extension 2: Maturity Date "Simple" Line and Holding Period "Not Simple" Surface

AIt seems simple that when a position (obligation position or right position) expires, the trading profit or loss is only determined by the stock price (the premium and exercise price are determined during trading);

BThe complexity is that during the holding period, the option price is mainly influenced by three factors: "target price," "remaining time," and "target volatility market expectation" (called "implied volatility"), which is a multidimensional surface. In other words, guessing the "stock price" at a certain time cannot lock in the "option price", because the "option price" also contains "market volatility expectation" (which is somewhat absurd "implied volatility"), More pricing formulas will be discussed later.

CIf there are multiple expiration date options in the position, the combined profit and loss chart at the expiration of the recent options is a curve, and the curve cannot be accurately drawn based solely on the stock price.

2、 Parity Formula and Equivalence Strategy Landscape

(1)Parity formula

A. There is a parity constraint between call options, stock options, stock prices, and exercise prices, that is, the call option price(C)+ Exercise price(K) = Put Option Price(P) + Stock price(S)In the formula, the call and put options are the same amount (i.e., except for the call and put options, the exercise price and expiration date are the same), and the holding cost is ignored on the right side of the formula. If the difference between the two sides of the equation reaches a certain level, the parity arbitrage operation will quickly balance the two sides.

B. Open option marketTType quotation, based on each exercise price, add or subtract subscription and put prices to see if they meet the parity formula, in order to deepen the impression.

CVarious pricing formulas generally derive the call option price based on the assumption of stock price movement, and then use the parity formula to obtain the put option price.

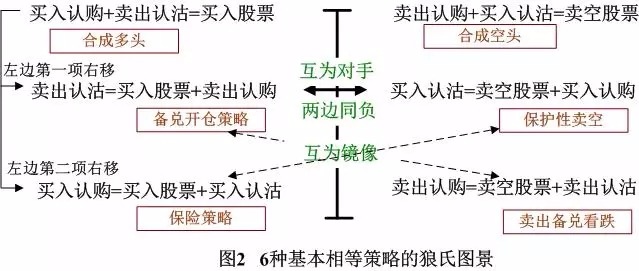

DMove the first item on the right side of the parity formula to the left to obtain a buy subscription+Sell put=Buying stocks can lead to an equal strategy.

(2)Equivalence Strategy Landscape

AThe subtlety of strategy construction comes from the flexible selection of equal strategies (with the same profit chart when there is no arbitrage)6Three basic equal strategies, namely buying or selling stocks, subscribing and placing6Any position in the species can be constructed from the other two positions, and it took Wolf King some time to create an equal strategy diagram as shown in the figure2Remember and speculate more.

B. More complex equality strategies are none other than the above6The addition and subtraction of individual equations, such as "buy low exercise subscription+The subscription type bull market spread of selling high exercise options is equal to the first term of "buying stocks"+Buy low exercise put ", the second item is equivalent to" sell stocks+Sell high exercise options and put them together to obtain Buy Low Exercise Put+Sell high exercise price put "is a bull market spread in the put type. When constructing strategies, the good habit is to 'think about the other side of the equation'.

CThe equal strategy is by no means completely equal. The return on funds, holding period monitoring, and warehouse transfer strategies are very different, and we will understand them later.

DThe strategy for constructing call options is basically to use put options. The general principle is to call for calls and put for puts, but not absolute.

EFinally, to put it simply and roughly without explanation, 'covering and opening positions' is usually not as good as' selling and putting', and 'insurance strategy' is usually not as good as' buying and subscribing '. |

"Small gifts, come to Huiyi to support me"

No one has offered a reward yet. Give me some support

|