Register now, make more friends, enjoy more functions, and let you play in the community easily.

You need Sign in Can be downloaded or viewed without an account?Register Now

x

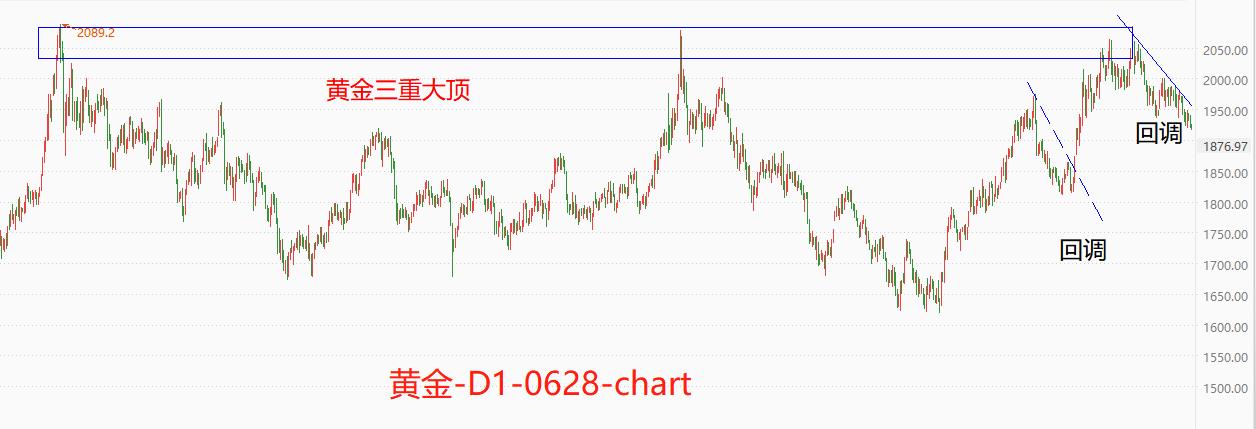

Located in the historical high rangegoldThe price ultimately failed to withstand the continuous selling pressure and questioning.5month4Day, goldfuturesPrice touched2085.4The US dollar has reached a temporary high. Subsequently, there were many doubts in the market, believing that2000Gold prices above the US dollar are clearly overvalued, and entering the market at this time is likely to become a "buyer". As expected, as of today15:00The price of gold futures1920USD (partially)CFDThe price has fallen below1910US dollars), in5Calculate the highest point of the month, with a cumulative decline of nearly8%The market price also varies from2000Up, down1900Around the US dollar.

Along with the decline in gold prices, the US dollar index is also falling. Normally, we believe that the gold price and the US dollar index have a reverse fluctuation relationship because gold is priced in US dollars. However, the premise of this reverse change relationship is that there have been no major risk events internationally. For example, when the Russia-Ukraine conflict just broke out in the first quarter of last year, the dollar index and gold rose at the same time.5month30Up to now, the cumulative decline of the US Composite Index1.4%Once again, it fluctuated in the same direction as gold, but this time in a downward direction. The decline in the US dollar index has led to a significant appreciation of non US currencies, represented by the euro,EURUSDExpected to soon break through1.1000Pass. The main reason why gold failed to appreciate in the same direction as other non US currencies may be due to the decline in international safe haven sentiment.

2022Although the Russia-Ukraine conflict lasted to2023Years, but the impact has greatly diminished. The Wagner incident that occurred last Saturday may indicate a weakening of Russia's control over the situation. Funds that had previously bet on the escalation of the situation have withdrawn from the gold market, causing the international gold price to be unable to return for a long time2000Above the US dollar.

At the monetary policy level, although the Federal Reserve announced the cessation of interest rate hikes, it did not recognize a long-term halt, but guided market expectations with a "temporary halt" attitude; The European Central Bank announced a rate hike in its latest interest rate decision25Base point; The Bank of England even chose to raise interest rates50Base point to combat high inflation. Various signs indicate that the critical point for international monetary policy to shift from a tight state to a loose state has not yet arrived, and although the decline of the US dollar index has begun to emerge, it is not as significant as previously expected by the market.

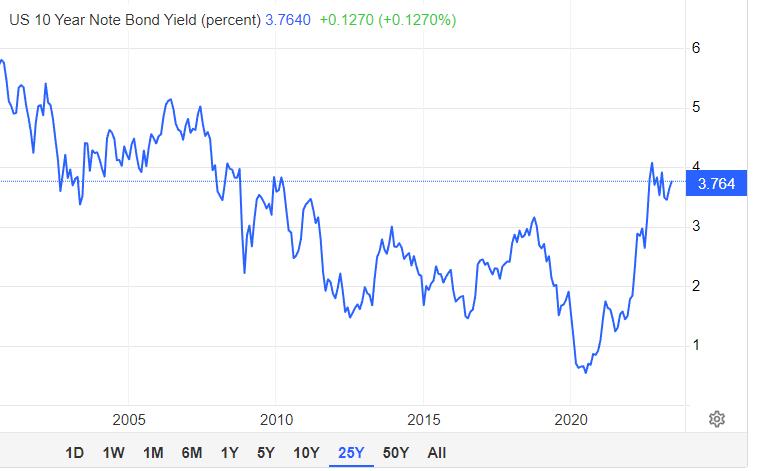

Gold, like US bonds, both have safe haven properties, and their prices resonate. The above chart shows the trend curve of the 10-year US Treasury yield. It can be seen that last year10Since the beginning of the month, although the yield has decreased, the decline is very limited. this year4Since the beginning of the month, there has been a significant rebound in yields, and the market price has reached3.764%Approaching the previous high point4.077%Bond yields remain strong, indicating that market funds are still optimistic about future economic recovery. Under the trend of economic recovery, the price of gold will naturally fall endlessly.

Despite the many negative factors mentioned above, the long-term price of gold still tends to rise. Because the situation of high interest rates, high inflation, and low growth in European and American countries will ultimately lead to economic recession, when the unemployment rate data issues a warning, the central banks of European and American countries will have to adopt loose monetary policies. At that time, the negative factors for gold mentioned above are likely to turn into positive factors for gold.

Risk reminder, disclaimer, special statement:

There are risks in the market, and investment needs to be cautious. The above content only represents the analyst's personal views and does not constitute any operational suggestions. Please do not consider this report as the sole reference. At different times, analysts' perspectives may change, and updates will not be notified separately.

2023-06-28

|

"Small gifts, come to Huiyi to support me"

No one has offered a reward yet. Give me some support

|