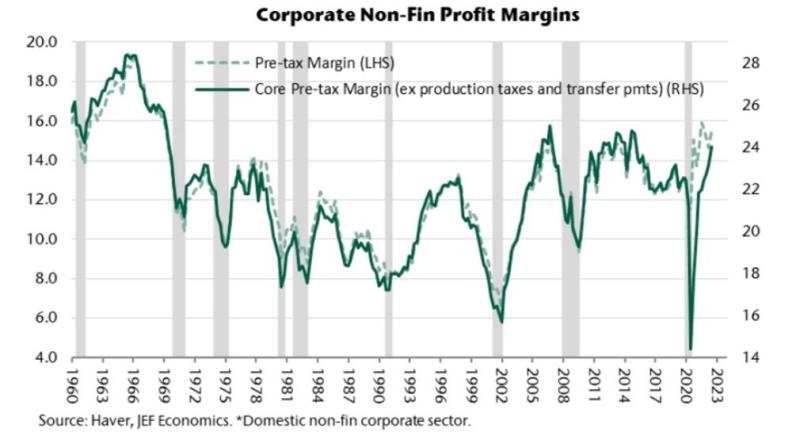

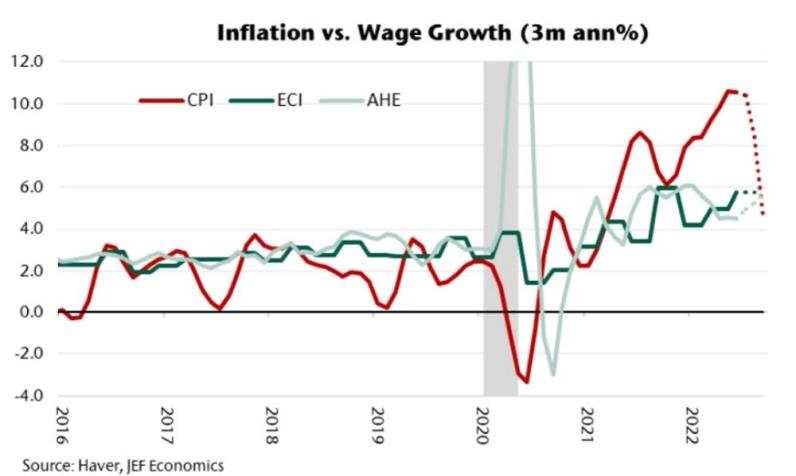

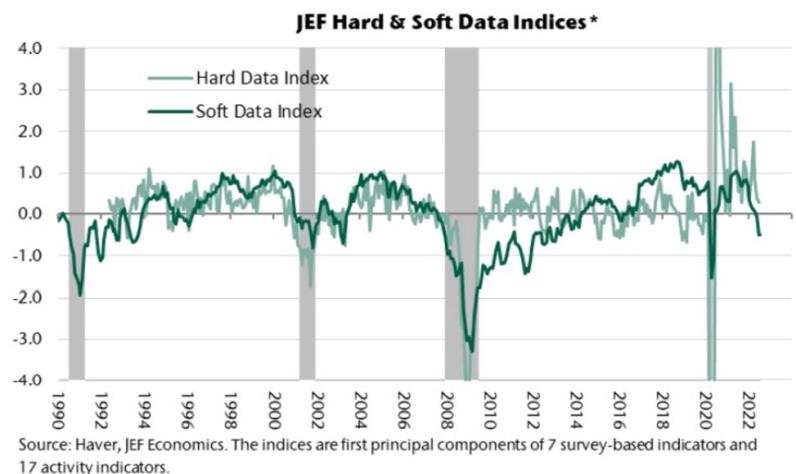

After Powell's speech at Jackson Hole, the US stock market has been down for two consecutive trading days. The US economy has not yet felt the pain of raising interest rates, and US stocks have already felt it in advance. The most concerned question in the market now is, where is the endpoint of the Federal Reserve's interest rate hike? The Federal Reserve's tolerance for potential economic downturns has increased, and Wall Street's predictions for interest rate hikes and economic downturns have also changed.JefferiesEconomists predict that even if the Federal Reserve pushes interest rates up to4%And throughout the entire2023Keeping interest rates unchanged, the US economy will remain strong. Jefferieschief economist Aneta MarkowskaAnd the bank's money market economistThomas SimonsIn a report, it was written:We believe that the Federal Reserve will continue to raise interest rates and believe they will push them up to4%And in the23The year remains unchanged. We believe that interest rates will continue to rise, as economic strength will continue for a longer period of time Aneta MarkowskaandThomas SimonsContinuing to explain, 'In our view, the future6-9The risk of a US economic recession last month is much lower than expected. Obviously, we do not believe in the soft landing scenario. We do believe that the Federal Reserve will eventually be forced to trigger a recession in order to reduce wage growth and push inflation back2%。 However, making the economic downturn more difficult will take longer than expected JefferiesRefuted concerns in the market that the economy would decline. Firstly, profit expansion and good cash flow in the second quarter will not trigger layoffs。 Many investors are concerned that companies will cope with high inflation and weak productivity in the first quarter by reducing their workforce, butJefferiesEconomists say that so far, companies have been able to pass on these costs to consumers, leading to a significant increase in profit margins in the second quarter JefferiesThe report states that non-financial pre tax profits driving future recruitment and capital expenditure decisions have increased month on month9.4%。 Employee compensation accounts for approximately two-thirds of the company's cost structure, with a month on month increase2%But the growth in net income is even greater3.3%。 This leads to an expansion of profit margins and positive cash flow  secondly,8The actual salary for the month will increase. US Q3GDPGrowth exceeds3%。 JefferiesEconomists say that the statement that negative real wages will squeeze consumer demand is' very outdated 'and ignores7The actual monthly salary has increased compared to a month ago0.5%。Aneta Markowska and Thomas Simons Say, 'ConsideringCPIMonth on month decrease0.1%The actual salary will almost certainly be8The month has risen again. As consumers' spending on gasoline decreases, their discretionary spending and actual spending will accelerate Meanwhile, these two economists also predict that in the third quarter of the United StatesGDPWill grow3%The above is because net exports may have a significant promoting effect on growth.7The trade balance of goods narrowed in the month95Billion dollars, now completely reversed11Month to3The expanding trend of the month. They estimate that the actual imports decreased month on month last month2.1%And actual export growth3%。 If both numbers remain at their current levels9Month, third quarterGDPincrease3%The above is practical.  Thirdly, the investigation has become a misleading indicator, andGDPThe correlation is poor. Investors use soft data to construct recession forecasts for the fourth quarter and the first quarter of next year. But this is another key premise, which is that the survey is a good leading indicator, butJefferiesEconomists say that due to the impact of economic activity andGDPThe correlation is poor, and these data can be misleading. Aneta Markowska and Thomas Simons In the report, it was stated that 'our soft and hard data indices indicate that these differences are systematic It has existed for a period of time. Soft data and hard data used to move together, but in the past decade they have become very irrelevant  |