AUD/US dollar analysis and key points of conversation

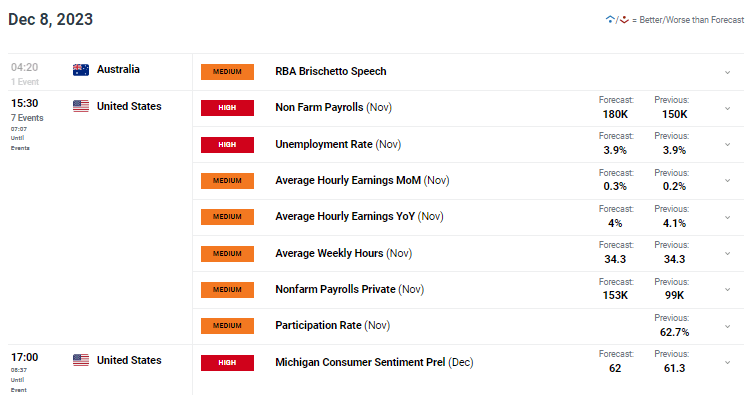

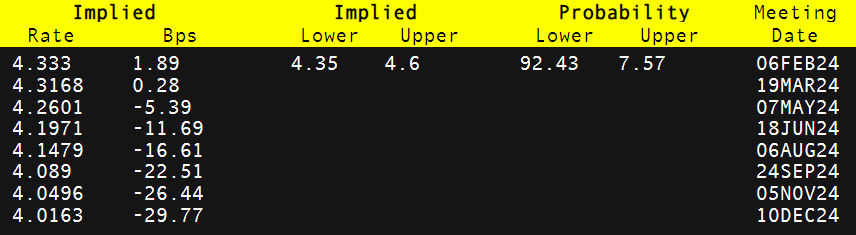

Background of Australian dollar fundamentalsDue to the market eliminating concerns about the upcoming release of non-agricultural employmentreportNFP)Concerns (see economic calendar below),Risk sentiment has improved this Friday,AUDThen it rises.miss ADP Employment changes and the number of people applying for unemployment benefits may be contributing factors, but due to recent developments ADP and NFP Disjointed between them,NFP There is still room for unexpected upward movement.The weak US consumer credit has supplemented the Australian dollar, but as mentioned above, non farm employment data will be a key driving force for short-term guidance.As the US trading session shifts towards Michigan consumer confidenceThe data is over, will the recent downward trend continue, and the average return will be closely monitored。 AUD/dollarEconomic calendar(GMT +02:00)  Source:DailyFX Economic Calendar From an Australian perspective,Reserve Bank of Australia(RBA)OfAndrea Blancheto(Andrea Brischetto)Currently highinterest rateThe rising environment and unemployment rate have raised an alarm about the risk of financial pressure facing Australians.Although still in its early stages, families have planted seeds for adopting more cautious decision-making habits to fulfill their financial obligations.Overall, the good family response highlights the resilience of the Australian economy - which is a net benefit for the Australian dollar. Pricing in the money market below this level may be a positive signal for Australian households, and it is expected thatThis week, we willRe pricing approximately12 Basis points(2024 year 12 Month), and furtherraise interest ratesThere is not much hope for it.With the tightening of monetary policyThe lag effect of the implementationWe have seen this trend inThe central bank'sA chain reaction occurs in the prediction. Reserve Bank of Australia interest rateprobability  Source: Lu Fute AUD/Today's USDoptionThe expiration date is shown below, with priority given to an increase relative to the current level.

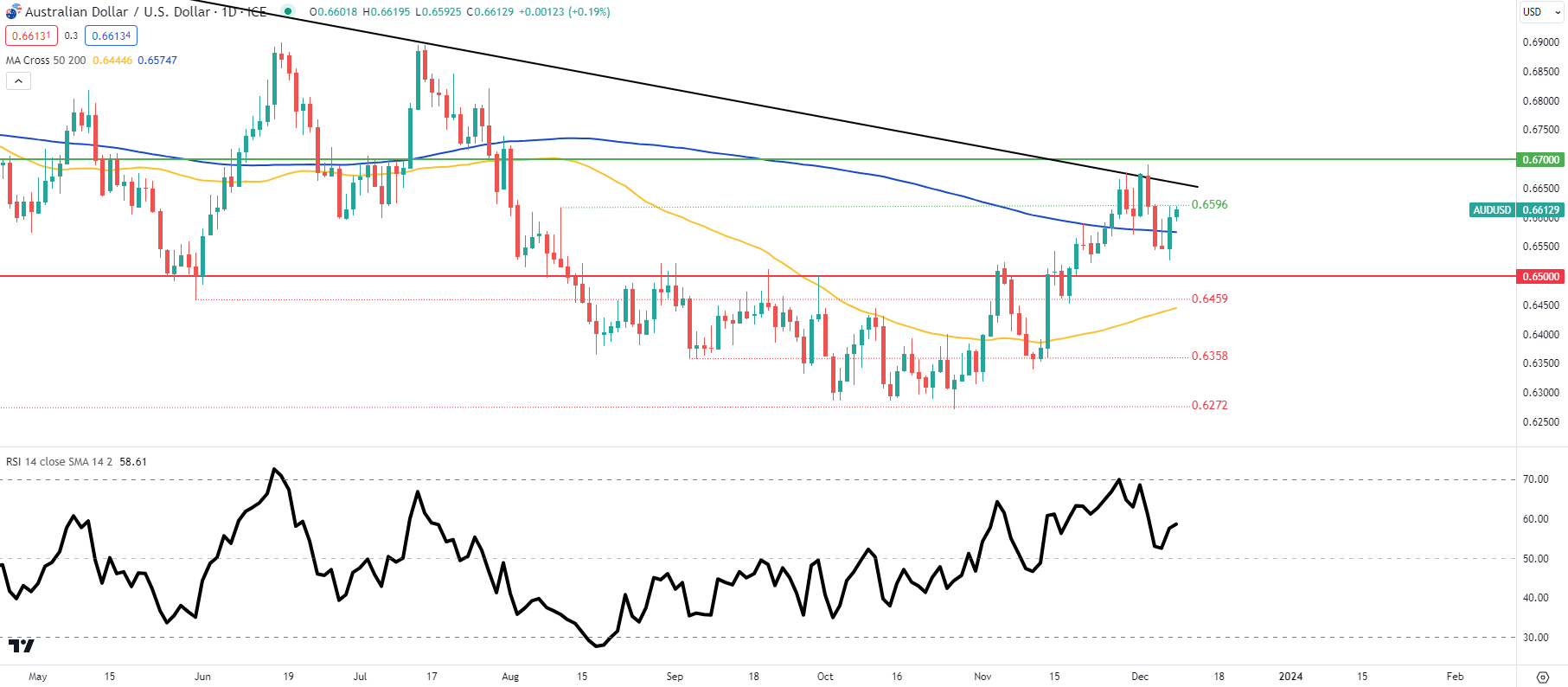

technical analysisAUD/USD daily chart  Chart by TradingView Warren Venketas prepare The above-mentioned AUD/USD per dayPrice trendIndicating that as non farm employment data approaches, traders are hesitant about whether they tend to have directional bias at this time.The wise approach is to remain cautious and seek opportunities after the release of non farm employment data.If the Australian dollar/Long positions in the US dollar break through the resistance level of the long-term trend line (black) and are expected to test 7 The high point of monthly fluctuations.On the contrary, if missed, the Australian dollar mayFalling below again200Daily moving average (blue) and retest0.6500 psychologyGateway.

Key support positions:

|