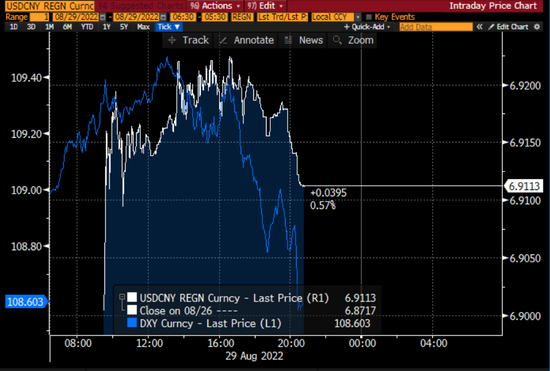

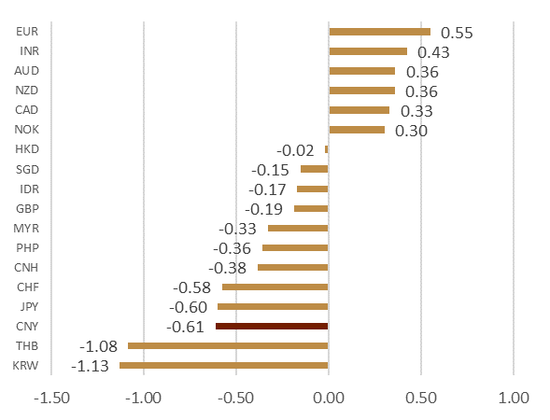

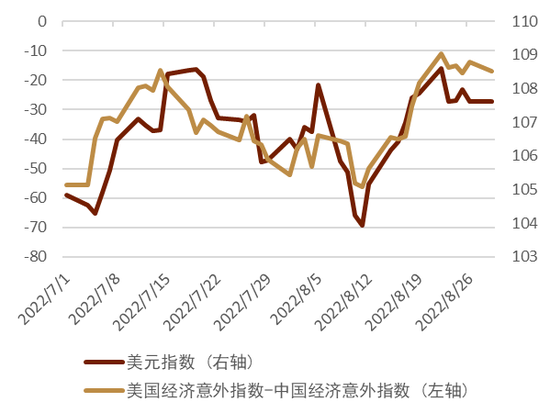

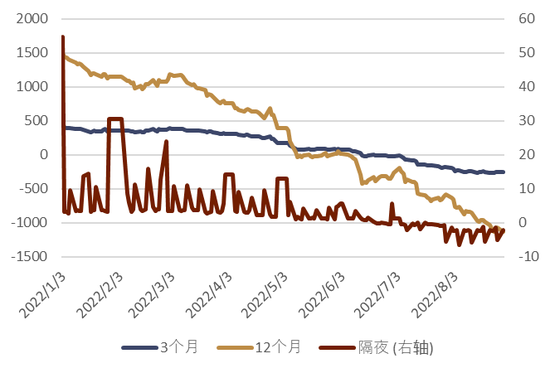

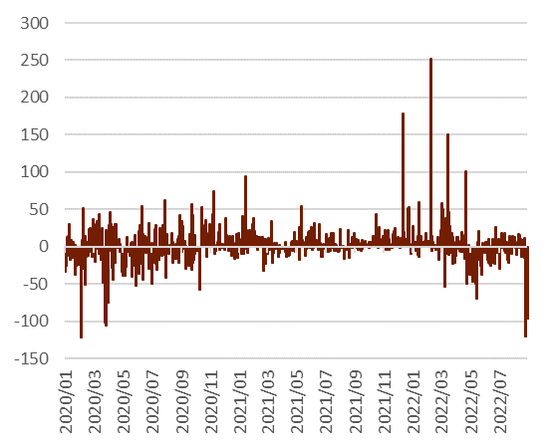

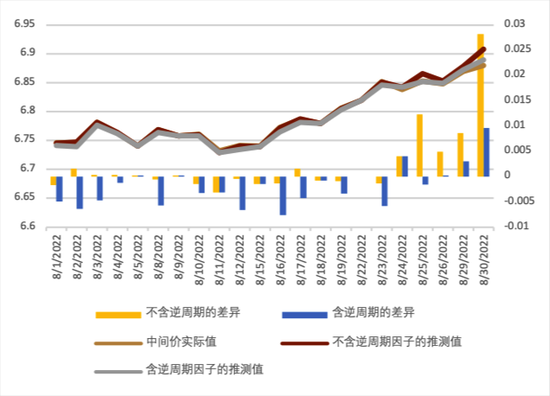

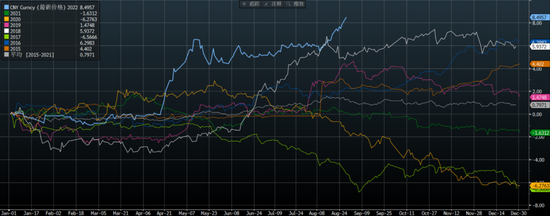

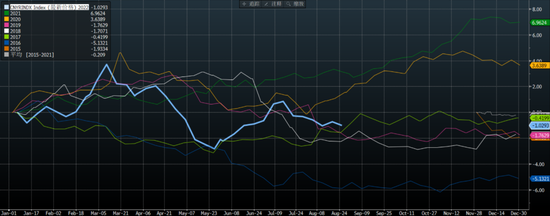

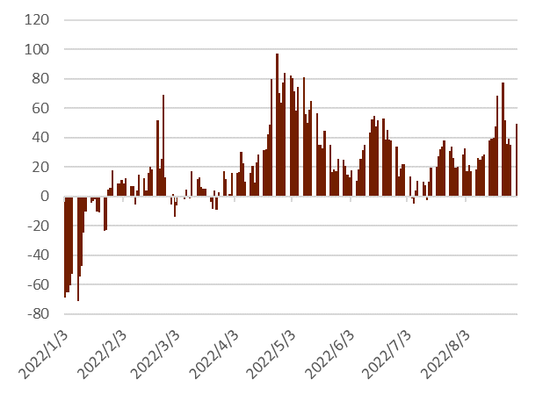

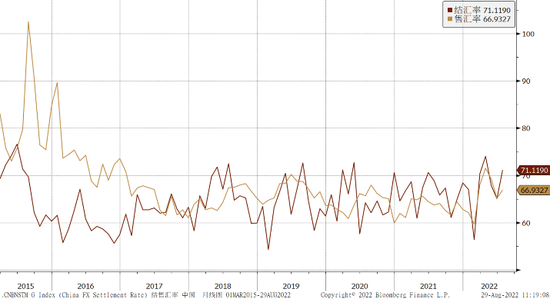

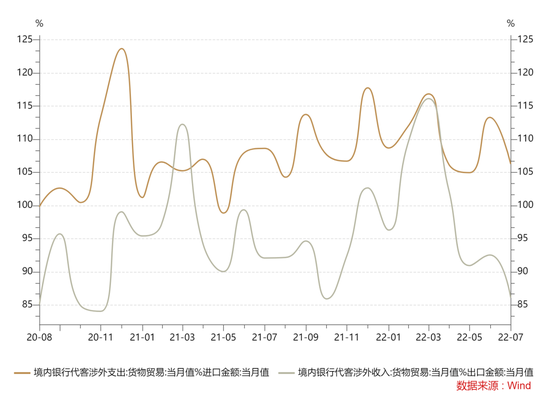

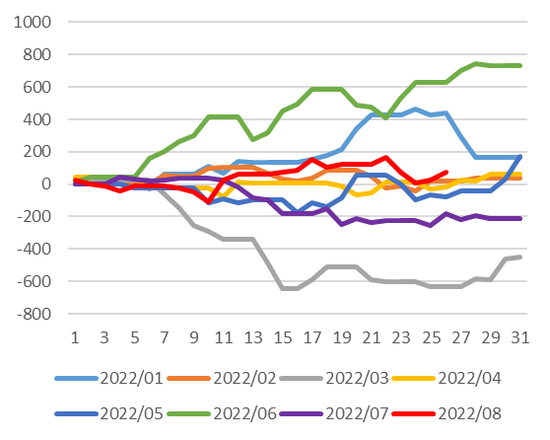

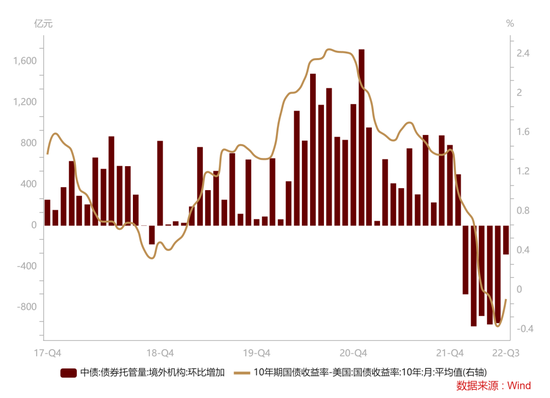

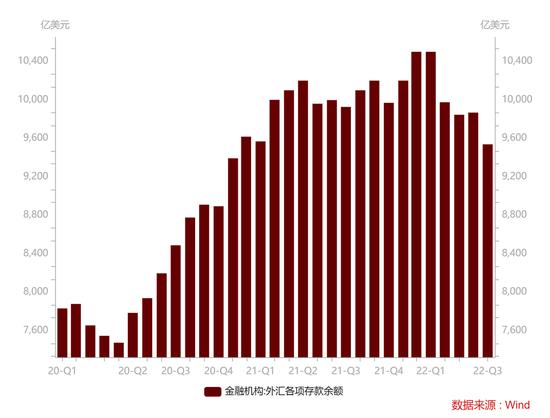

The onshore RMB exchange rate has fallen below6.90 8month29Daytime, onshore USD/The RMB exchange rate broke through the opening after jumping short and opening low6.90At the checkpoint, the exchange rate between the US dollar and the Chinese yuan stabilized thereafter6.90And in the6.90-6.9250Running within the interval of (Chart1)This is the onshore RMB exchange rate from2020year8Touched for the first time since the beginning of the month6.90。 As of Beijing time8month30day16:00Since the close of last Friday, the Chinese yuan has depreciated by approximately0.61%Ranked lower in the middle and weaker than all Asian currenciesG10Currency (Chart2)。 Chart1:8month29The Trend of Japanese RMB Exchange Rate and US Dollar Index  Source: Bloomberg News, Research Department of CICC Chart2Since the beginning of this weekG10And the rate of change of Asian currencies compared to the US dollar(%)  Note: As of Beijing time8month30day16:00 Source: Bloomberg News, Research Department of CICC Reasons for short-term fluctuations in the RMB exchange rate The driving force of the US dollar index and the inertia after the market starts From a graphical perspective,8The weakening of the RMB exchange rate since mid month is in line with the upward trend of the US dollar index. from8month15Solstice26The US dollar index rose by about2.6%The bilateral exchange rate between the Chinese yuan and the US dollar has depreciated by about1.8%The fit of intraday trading is relatively high. However, as the depreciation market entered its third week, although the US dollar index did not show a clear upward trend, the bilateral exchange rate of the Chinese yuan against the US dollar became prone to decline but difficult to rise. We believe that this may be related to the expected changes of major domestic market participants such as traders after the market starts. After the inertia fluctuation of the market, the correlation between the domestic RMB exchange rate and the US dollar index declined, showing a certain pro cyclical fluctuation characteristics. (Chart4)。 The impact of expected changes in China's economic recovery Although the changes in the US dollar index are an important factor driving the fluctuation of the RMB exchange rate, compared to the past, the current fluctuations in the US dollar index are not entirely determined by exogenous factors, but are more closely related to the expected recovery of the Chinese economy. We found that the Citi Economic Surprise Index in the United States and China(Citi Economic Surprise Index)The difference since this year7There is a high correlation between the trend since the beginning of the month and the US dollar index (chart3)。 This indicates that the relative performance of the Chinese economy is having a significant impact on the current global exchange rate environment. At a time when Europe is facing the energy crisis and the US economy is increasingly affected by the rapid rise of interest rates, the stronger expectation of China's economic recovery means that the downward slope of the global business cycle can be eased, which can slow the upward rate of the US dollar to a certain extent, while the time when China's economy is weak,foreign exchangeThe market will reflect the resonance and downward trend of the global business cycle, and the dollar will benefit from its risk aversion and become stronger. Therefore, we believe that the RMB exchange rate and even the US dollar index8Fluctuations since mid month and7There is a certain correlation between the slower than expected recovery rate of the Chinese economy in the month of June. Interest rate cuts are not the main cause of depreciation although8In mid month, China lowered the priceMLFAndLPRHowever, we believe that interest rate cuts are not the main factor contributing to the depreciation of the RMB. From the perspective of foreign exchange market trading, carry trades are mainly reflected in swaps. We found that the overnight and three-month onshore RMB swap points before and after the interest rate cut were relatively stable and did not show significant fluctuations (see chart)5)。 Therefore, the interest rate reduction did not significantly change the arbitrage returns in the domestic foreign exchange market/Cost. And what trade customers are more concerned about1Although the annual swap is still expanding the discount, we have not seen a clear relationship between the amount of net forward foreign exchange purchase and the increase in discount based on the data of forward foreign exchange settlement and sales in the past few months. We believe that exchange rate expectations may have a greater impact on customer settlement and foreign exchange sales behavior compared to interest rate spreads. Chart3The difference between the US China Economic Surprise Index and the trend of the US dollar index  Source: Bloomberg News, Research Department of CICC Chart4Technical analysis of the US dollar index  Source: Bloomberg News, Research Department of CICC Chart5The trend of onshore RMB swap points  Source: Bloomberg News, Research Department of CICC Market procyclical behavior or triggering core banks to adjust the middle price quotation model Quote line or reactivate anti cycle factor lately4On trading days, the central parity rate of the Chinese yuan was stronger than the market forecast by approximately120、56、96、249Points (Chart6)。 After our calculations, the actual midpoint of these trading days is closer to the predicted level of the model after opening the countercyclical factor (as shown in the chart)7)。 Based on this, we conclude that in the context of recent pro cyclical behavior in the RMB market, some quoting banks may have actively adjusted their pricing models based on their judgment of market conditions. In history, there have been two instances in which the central parity rate of the Chinese yuan (RMB) has been quoted by banks, with the first time introducing a countercyclical factor2017year5In the month of June, against the backdrop of the US dollar already peaking and falling, the RMB exchange rate was still operating at a weaker middle price. The second time2018year8In January, due to factors such as the strengthening of the US dollar index and trade frictions between China and the United States, the foreign exchange market experienced some pro cyclical behavior (Chart8)。 Against the backdrop of rapid fluctuations in the bilateral exchange rate of the RMB against the US dollar and against a basket of currencies in the short term, the resumption of countercyclical factors will have a positive impact on stabilizing the exchange rate. From the fluctuation of bilateral exchange rates, since the beginning of the year, the Chinese yuan has depreciated by about8.5%(Chart9), over811The annual fluctuation boundary since the exchange rate reform. andCFETSRMB basket index from7There has also been a significant downward trend since mid month (chart10)Compared to the beginning of the year, the level has already declined. Therefore, we believe that if the bilateral exchange rate of the Chinese yuan against the US dollar continues to show unilateral fluctuations, there are expected to be more stable exchange rate expectations and policies for cross-border payments in the future. Chart6The degree of deviation between the central parity rate of the Chinese yuan and market forecasts (Point)  Source: Bloomberg News, Research Department of CICC Chart7The antiperiodic factor may have restarted  Source: Bloomberg News, Research Department of CICC Chart8Statistics of past antiperiodic factors  Source: Bloomberg News, Research Department of CICC Chart9Since the beginning of the year in US dollars/The rate of change in the RMB exchange rate (%)  Source: Bloomberg News, Research Department of CICC Chart10Since the beginning of the yearCFETSThe ratio of changes in the RMB basket index (%)  Source: Bloomberg News, Research Department of CICC Changes in exchange rate expectations Although the RMB exchange rate in the current spot market is prone to decline but difficult to riseoptionFrom the perspective of the implied level of derivatives, the market is6.90The high level did not anticipate any further significant depreciation of the RMB. Risk premium (implied volatility) for each term of USD and RMB-Historical Volatility (Chart)11)Risk Reversal Options (Chart12)The degree of increase is limited, significantly lower than this year4-5The level of the month. In addition, the forward price difference between offshore RMB and registered RMB has not significantly increased in the near future (see chart)13)On the contrary, the spot exchange rate has converged, indicating that trading funds have not made significant bets on the depreciation of the RMB exchange rate. In terms of actual demand, the exchange settlement rate and sales rate are7The monthly performance is still quite stable (chart14)However, the export receipt rate is at a relatively low level (chart15)。 This may indicate that the expected weakening of the RMB exchange rate may to some extent affect exporters' willingness to receive payments. We believe that such funds may need to wait for the expected exchange rate to stabilize before choosing to enter and settle the exchange again. Chart11The risk premium of USD and RMB is not significantly upward  Note: Risk premium=Implied volatility -Historical volatility Source: Bloomberg News, Research Department of CICC Chart12USD RMB risk reversal options are also relatively stable  Source: Bloomberg News, Research Department of CICC Chart13Onshore and offshore RMB exchange rate forward1Monthly price difference  Source: Bloomberg News, Research Department of CICC Chart14The trend of the settlement exchange rate  Source: Bloomberg News, Research Department of CICC Chart15The export collection rate is at a relatively low level  Source:WindResearch Department of CICC Cross border payments will support exchange rates in the medium term Although the RMB exchange rate has experienced significant fluctuations in the short term, we believe that in the medium term, cross-border payments will still determine the RMB exchange rate. In terms of current income and expenditure, China's trade surplus is still at a historical high. Although the downward trend of the European and American economies may put some pressure on exports, China's trade share can still remain stable at a high level despite the incomplete restoration of energy supply such as natural gas, helping to maintain a high trade surplus. In terms of securities project revenue and expenditure, although Northbound funds have undergone some twists and turns, they have still shown an overall net buying trend since the beginning of this year (see chart)16)I believe that as China's economic recovery becomes more and more explicit, the net inflow of stock revenue and expenditure will be maintained. In terms of cross-border bonds, the long-term interest rate difference between China and the United States is closely related to cross-border bond investment. Against the backdrop of the intensification of the inverted interest rate difference between China and the United States this year2Foreign investors have sold Chinese bonds net since June, but against the background of the recent stabilization of the interest rate gap between China and the United States,7Net sales of Chinese bonds by foreign investors decreased significantly during the month of17)。 In addition, the relevant person in charge of the State Administration of Foreign Exchange stated last week[1] 8Since the beginning of the month, China's foreign exchange market has been operating steadily, 8Since the beginning of the month, foreign investors have been net buyers of Chinese securities overall. Based on this information, we believe that foreign funds may exist8The possibility of net buying of Chinese bonds during the month. In addition, the foreign exchange deposit balances of financial institutions in China are approximately9500About 100 million US dollars (chart18)Such domestic private foreign exchange reserves will also provide sufficient US dollar liquidity when necessary, thereby providing support for the RMB exchange rate. Overall, in terms of cross-border income and expenditure, China has maintained a net inflow of funds, which will bring stabilizing forces to the RMB exchange rate in the medium term. Although short-term exchange rates have experienced periodic fluctuations due to repeated economic expectations and changes in the external environment, this is also the norm in the exchange rate market. With the gradual manifestation of the effectiveness of China's economic stabilization policies, we believe that the RMB exchange rate may reverse its decline. Chart16Accumulated net purchases of northbound funds since the beginning of the month (100 million yuan)  Source: Tonghuashun Information, Research Department of CICC Chart17: China US interest margin and the month on month change of foreign investors on China's bonds  Source:WindResearch Department of CICC Chart18Domestic foreign exchange deposits remain abundant  |