Register now, make more friends, enjoy more functions, and let you play in the community easily.

You need Sign in Can be downloaded or viewed without an account?Register Now

x

This post was finally written by Ultima_Markets to 2026-2-5 10:58 edit

Are you interested in the shimmering golden light goldThe market is full of curiosity, but it is always plagued byXAU/USDIs this mysterious code causing confusion and disorientation? Don't worry, this article will start from the beginning and uncover the gold for youusdThe mysterious veil provides practical quotation tools and analysis techniques, and deeply compares the advantages and disadvantages of the three mainstream investment channels in the market, allowing you to understand the core logic of gold investment in one go.

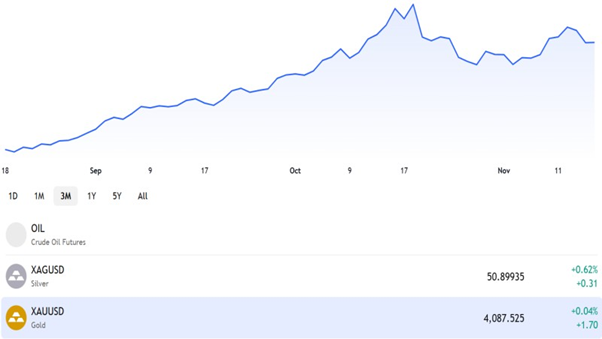

goldUSDPrice Trend Chart - ultima markets

What is the Golden Dollar(XAU/USD)Why is gold priced in US dollars?

XAU/USD The basic definition is the trading pair between gold and the US dollarThis set of codes is actually a currency pair, similar to the common Euro/dollar(EUR/USD)Or GBP/dollar(GBP/USD)。 XAU:This is the International Organization for Standardization of Gold(ISO 4217)Currency code. among which, 「XARepresents assets that are not issued by any specific country, 「UIt comes from the Latin word for goldAurum」。 USD:This represents the US dollar(United States Dollar)。

Therefore,XAU/USD The quote directly displays' how much does it cost to purchase one ounce of gold '. When you see XAU/USD The quotation is 2,350This means that the current price of one ounce of gold in the international market is 2,350 USD.

The historical origin of gold being priced in US dollarsThe reason why gold is commonly priced in US dollars is mainly due to the Bretton Woods system established after World War II. At that time, currencies of various countries were pegged to the US dollar, while the US dollar was pegged to gold at a fixed price(35The exchange rate of the US dollar to one ounce of gold established the position of the US dollar as the global central currency.

Although the system is1970The collapse of the era and the fluctuation of gold prices have not shaken the position of the US dollar as the world's most important reserve currency, payment currency, and valuation currency. Therefore, global commodities, including gold, oil, etc., are still accustomed to being priced and traded in US dollars, which has become a convention in the international financial market.

How to interpret XAU/USD offerInterpreting the quotation is very intuitive. Assuming you see the following quote on the trading platform:

XAU/USD = 2350.50 / 2350.80 the left side 2350.50 It's the 'selling price'(Bid)The price at which a trader is willing to buy one ounce of gold. the right side 2350.80 It's the 'buying price'(Ask)The price at which a trader is willing to sell one ounce of gold. The difference between the two (in this example0.3The US dollar is referred to as the "spread"(Spread)It is one of the transaction costs.

goldUSDRelationship with the US Dollar Index - ultima markets

Gold dollar(XAU/USD)price analysis

Recommended instant quote query toolTo obtain the most real-time and accurate gold quotes, you need professional market tools. Widely used globally MT5 (MetaTrader 5) The platform not only provides real-time XAU/USD The quotation also includes dozens of built-in technical indicators and drawing tools to help you conduct in-depth analysis. Investors can proceed firstUltima Markets MT5 downloadFamiliar with chart operations in a real market environment.

How to understand goldKA line chart? Introduction to Basic Technical AnalysisKA candlestick chart, also known as a line chart, is the basis for interpreting market sentiment. each and everyKThe stick contains four key price information: opening price, closing price, highest price, and lowest price.

bullish candlestick (Green or red stick, depending on the setting)The closing price is higher than the opening price, indicating strong buying power and a strong bullish sentiment in the market. Yin line (Red or black stick)The closing price is lower than the opening price, indicating that the selling power is dominant and the market bearish atmosphere is dominant. Shadow line:KThe thin lines above and below the stick represent the highest price (upper shadow) and lowest price (lower shadow) of the day, respectively. The length of the shadow reflects the intensity of price fluctuations and the tug of war between long and short positions.

Through observationKThe combination of lines, such as "swallowing pattern", "cross star", etc., combined with the judgment of "support level" and "pressure level", can help traders find potential entry and exit points.

Key factors affecting the volatility of gold pricesThe price of gold is not only influenced by technical factors, but also highly sensitive to macroeconomic data. Here are several core factors that traders must closely monitor:

Interest rate policy:Especially the Federal Reserve of the United States(Fed)The interest rate resolution. When interest rates rise, the opportunity cost of holding non interest bearing gold increases, and funds may flow into assets such as fixed deposits in US dollars, putting pressure on gold prices. On the contrary, interest rate cuts are beneficial for gold prices. inflation:When inflation is high, the purchasing power of currency decreases. Due to its rarity and value preservation function, gold is often regarded as a "hedge against inflation" tool, which increases demand and pushes up prices. Geopolitical risk:Any regional conflict, war, or instability can trigger market risk aversion. At this point, funds will flow out of high-risk markets such as the stock market and seek protection from safe haven assets such as gold. Reserve demand of the central bank:Central banks around the world have continued to increase their holdings of gold in recent years foreign exchangeA portion of reserves to diversify dependence on the US dollar. The massive purchasing behavior of the central bank will provide long-term structural support for the price of gold.

USD Index(DXY)The seesaw relationship with gold prices

What is the US Dollar Index(DXY)?USD Index (US Dollar Index, DXY) It is an indicator that measures the value of the US dollar relative to a basket of foreign currencies. This basket consists of six major currencies, each with different weights:

euro (EUR): 57.6% Japanese yen (JPY): 13.6% pound (GBP): 11.9% Canadian dollar (CAD): 9.1% Swedish krona (SEK): 4.2% Swiss Franc (CHF): 3.6%

When DXY Rising, representing the US dollar becoming stronger relative to these major currencies; On the contraryDXY A decline indicates a weakening of the US dollar.

Why does the strength of the US dollar usually lead to a decline in gold prices?

This negative correlation is mainly based on two core logics: Pricing effect:Due to gold being priced in US dollars, when the US dollar appreciates(DXY When the price rises, the cost of buying gold increases for buyers holding other currencies such as euros and Japanese yen. For example, a European investor needs to use more euros to exchange for the same amount of dollars to buy gold. This will suppress global demand for gold, thereby putting pressure on the price of gold. Substitution effect:Gold and the US dollar both play the role of "safe haven assets" in certain situations. When the US economy performs strongly and interest rates rise, the attractiveness of the US dollar increases because investors can earn higher returns from US dollar assets. Funds will flow from non interest bearing gold to the US dollar, leading to a decline in gold prices.

However, this negative correlation is not absolute. In extreme global crisis periods (such as large-scale financial storms or wars), market panic can cause investors to flock to both gold and the US dollar for safe haven, and the two may experience a brief period of simultaneous rise.

How to use the US dollar index to determine the possible trend of goldTraders can XAU/USD The chart and DXY Compare and observe the charts together. If you discover DXY We are testing an important pressure level and it may fall back, which could indicate that there is room for gold prices to rise. On the contrary, if DXY If we break through the support level strongly and continue to rise, then we need to be more cautious when going long on gold. Translate into English DXY As an auxiliary 'filter', it can effectively improve your accuracy in judging the trend of gold.

goldUSDComparison of investment tools - ultima markets

Three popular gold coins/Comparison of investment channels in US dollarsWe will compare the three most mainstream gold investment channels on the market through a table: gold funds, bank gold passbooks, and gold price difference contracts(CFD)。

Investment pipeline | gold fund/ETF | Bank Gold passbook | Gold Contract for Difference(CFD) | Core Features | Funds that buy and sell on the stock exchange and track gold prices | Open a bank account and record the amount of gold bought and sold with a passbook | Not actually holding gold, trading derivative products whose prices fluctuate | advantage | High liquidity, convenient trading, and relatively low management fees | Low threshold, simple operation, suitable for long-term savings | Can be traded in both directions(Go long/Short selling)High leverage24Hourly trading | shortcoming | There are management fees and tracking errors, and physical gold cannot be exchanged | The bid ask spread is large, and the trading time is limited by the bank's business hours | High risk and high return, requiring overnight interest payment, and traders requiring high professionalism | suitable for | Investors accustomed to stock trading and seeking asset allocation | Novice investors, risk averse individuals, and those who want to save in fixed amounts on a regular basis | Active short-term traders and professional investors who can withstand high risks |

For traders who want to operate flexibly and capture short-term fluctuations, gold price difference contracts(CFD)Provides advantages that traditional tools cannot match. Through the image Ultima Markets Such a professional platform allows investors to leverage their funds to maximize their returns, providing profit opportunities regardless of whether the gold price rises or falls.

Of course, high returns come with high risks. Therefore, before investing real funds, it is strongly recommended that beginners first practice thoroughly through a simulated account and ensure that the chosen broker has a comprehensive understanding of itUltima Markets securityGuarantee mechanism. Ready investors can consider opening an account immediately to explore the infinite possibilities of the gold market.

summaryUnderstanding the dynamic relationship between gold and the US dollar is the first step towards successfully trading gold. For different investors, their choices should also vary:

Conservative investors: can access their bank's gold passbook or goldETFStart with long-term and stable asset allocation. Active trader: GoldCFDProvides higher flexibility and potential returns, but it is important to manage risks and set stop loss points.

Regardless of which method you choose, continuously monitoring the monetary policy trends, inflation data, and global geopolitical situation of the Federal Reserve in the United States will be an important compass for you to judge the future trend of gold prices.

goldUSDfrequently asked questions - ultima markets

FAQ

What is the unit of gold 'ounce' equal to in grams?The commonly used unit in precious metal trading is the "troy ounce"(Troy Ounce)。1 A troy ounce is approximately equal to 31.1035 Gong Ke. This is consistent with the "constant ounce" used in our daily lives to measure the weight of food(Avoirdupois OunceAbout28.35Gongke (grams) are different, so it is important to distinguish them clearly when investing.

Is now a good time to buy gold?There is no standard answer to this question, it entirely depends on an individual's investment goals, risk tolerance, and market judgment. Instead of seeking an 'absolute' good time, it's better to establish a strategic viewpoint: Long term configuration: If you are optimistic about the long-term anti inflation value of gold, you can buy it in batches on a regular basis to smooth costs. Short term trading: If you want to earn a spread, you need to closely monitor key factors such as interest rates and the US dollar index mentioned earlier, and combine technical analysis to find entry points. Before making a decision, it is necessary to evaluate whether the current price is at a relatively high or low point.

What is the most important factor affecting the price of gold?The 'real interest rate' in the United States is usually considered the most core driving factor. The real interest rate is equal to the nominal interest rate minus the expected inflation rate. When the real interest rate is negative or low (for example, when the interest rate is lower than the inflation rate), the return on holding cash or bonds cannot outperform inflation, and funds tend to flow into gold to seek preservation, which is extremely beneficial for the gold price.

Investing in goldUSDWhat transaction fees should be noted?

gold fund/ETFThe main costs are management fees (deducted from net asset value) and securities transaction fees incurred during trading. Bank gold passbook: The main cost is the bid ask spread quoted by the bank, which is usually significant. goldCFDThe main costs include spread (bid ask spread) and overnight interest on open positions(Swap)。

|