Register now, make more friends, enjoy more functions, and let you play in the community easily.

You need Sign in Can be downloaded or viewed without an account?Register Now

x

Analysis of GBP and key points of conversation- Don't be influenced by the UKGDPConfused by growth rate!

- The low growth environment has a negative impact on the pound.

- pound/Short positions in the US dollar are focused on breaking through the bear flag.

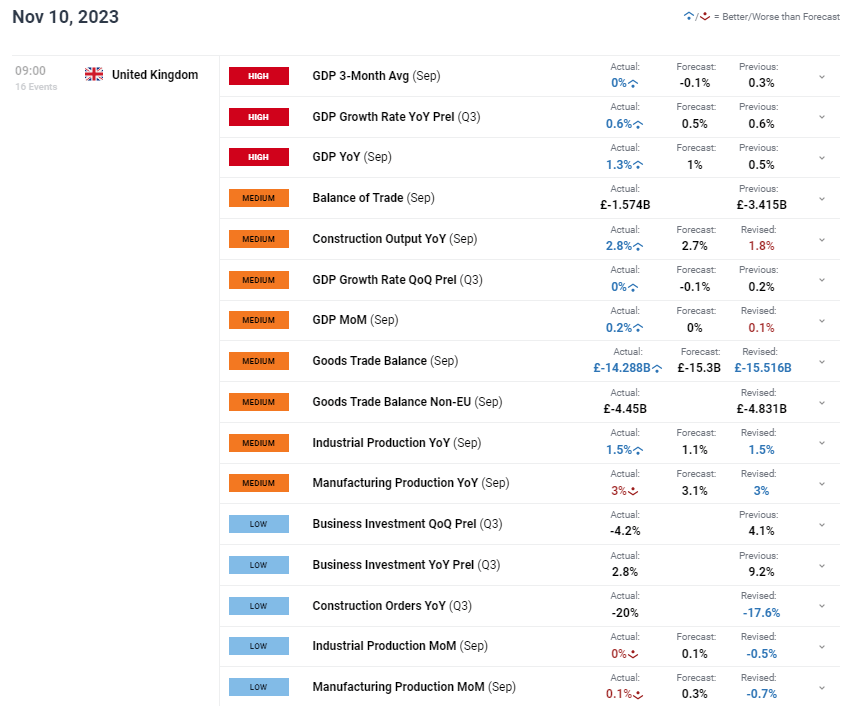

Background of GBP/USD FundamentalsAfter the UK GDP report (see Economic Calendar below) exceeded most indicators' forecasts, the pound remained relatively unchanged. Nevertheless, the overall situation shows that the economy is still in trouble, with the three-month average reaching an annual low and hovering around negative growth. Commercial investment is the biggest downside surprise, reflecting the severe economic situation faced by enterprises due to tight monetary policy. pound/USD Economic Calendar(GMT +02:00)

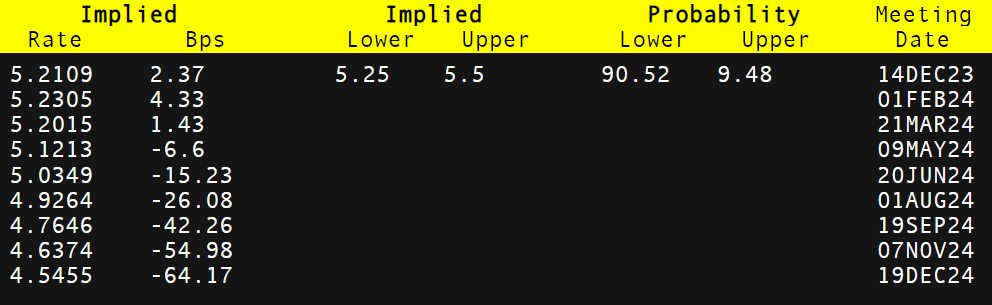

Source:DailyFX Economic Calendar Bank of England (BoE) of Interest rate expectations (see table below) still support in 12 Suspend interest rate hikes at the monthly meeting, but if the market subsequently sees weak economic data, despite Bank of England Governor Andrew Bailey (Andrew Bailey) Expressing opposition, but we may see a stronger dovish bias.

Probability of Bank of England interest rates

Source: Lu Fute

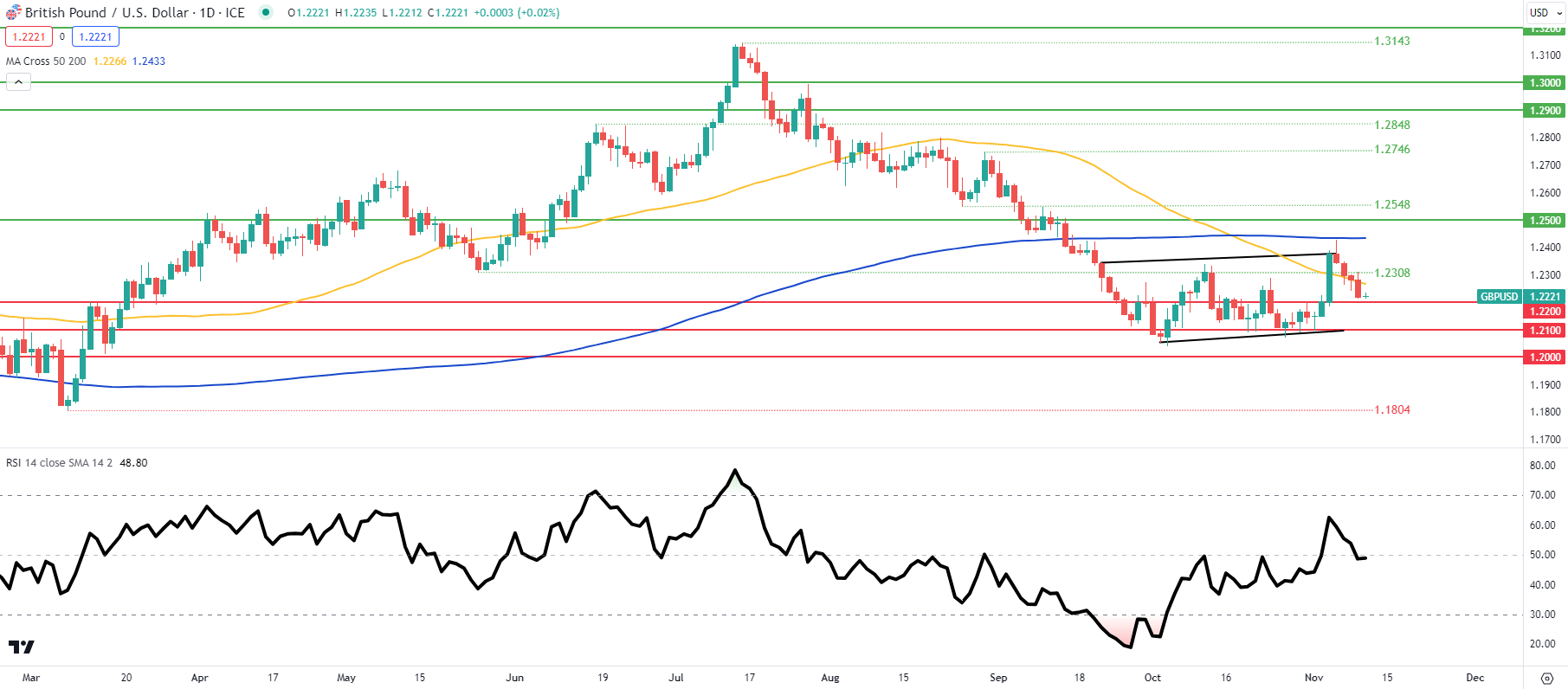

technical analysispound/USD daily chart

Chart byWarren Venketas , IGmake pound/The price trend of the US dollar has continued GDP The recent downward trend is expected to be tested again1.2200 Psychological barriers. The shape of the bear flag (black) is still under consideration, but additional downward space supported by the flag shape needs to be seen. Key resistance level: - 200 Daily moving average (blue)

- Flag shaped resistor

- 1.2308

- 50 Daily moving average (yellow)

Key support positions: - 1.2200

- 1.2100/Logo support

- 1.2000year

- 1.1804

IG Customer emotions vary (GBP/USDIG Customer sentiment data (IGCS) Display retail traders currently trading against GBP/Net holdings in US dollarsLong position, of which70%Traders hold long positions (as of the time of writing this article). |