Register now, make more friends, enjoy more functions, and let you play in the community easily.

You need Sign in Can be downloaded or viewed without an account?Register Now

x

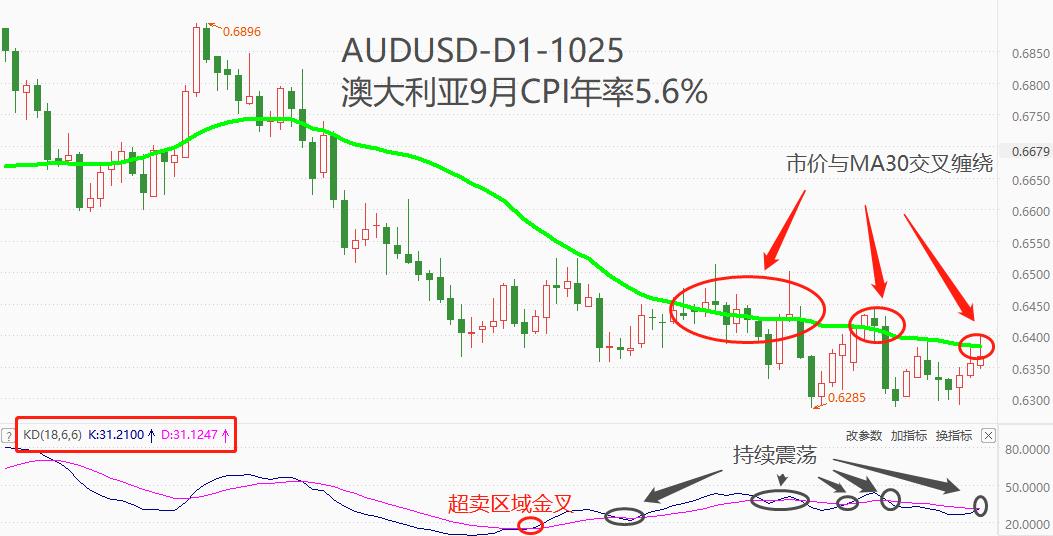

According to the Australian Bureau of Statistics today08:30Published data:9Monthly and quarterly adjustmentsCPIthe annual rate5.6%, higher than the previous value5.2%, higher than expected5.4%For two consecutive months, there have been signs of expansion in the increase. However, the third quarter announced at the same timeCPIAnnual rate display, latest value5.4%Compared to previous values6%decline0.6One percentage point. Based on this, it can be inferred that Australia's inflation level is in a state of medium-term stable decline and short-term slight rebound. For the value of the Australian dollar, financial institutions pay more attention to monthly data as it displays the latest inflation trends. Due to9monthCPIThe annual rate has increased, increasing the possibility of the Reserve Bank of Australia raising interest rates and boosting the value of the Australian dollar. Within five minutes of data release,AUDUSDfrom0.6363Up to0.6390Increase27Base point. Due to multiple factors affecting the monetary policy of the Federal Reserve of Australia,CPIData is just one of the influencing factors, so for a longer period of time after the data is released,AUDUSDThere is a trend of giving back previous gains.

From a technical perspective,AUDUSDMarket price in9month14Japan and JapanMA30After crossing, multiple consecutive upward breakthroughs failed, and theMA30Repeatedly intertwining (highlighted in red in the figure), forming a significant oscillation trend. At the same time, oscillation indicatorsKDstay8month28After crossing the oversold range with a golden cross, meaningless intersections were formed multiple times in the central region (highlighted in black in the figure), confirming the conclusion of market price fluctuations. Affected by data today,AUDUSDFirst rise and then fall, and then align again withMA30Crossing. It is expected that this breakthrough will return to volatility as before, suitable for short-term trading but not suitable for long-term holding.

From a fundamental perspective, Australia'sGDPGrowth rate2.1%In developed countries, it is at a medium to high level. benchmark interest rate4.1%, higher thanGDPThe growth rate has a negative effect on suppressing economic expansion. The benchmark interest rate is lower than9monthCPIThe annual rate means that monetary returns cannot offset the depreciation effect of rising prices, and there is still a possibility of further tightening of monetary policy. The manufacturing and service industriesPMIAll below50There is a risk of contraction in the real economy due to the boom and bust line. unemployment rate3.6%Below the natural unemployment rate5%The labor market demand is relatively strong. Overall, most economic indicators in Australia have performed well, and in the long term, there is a foundation for sustained appreciation of the Australian dollar. However, the Federal Reserve continues to guide the market's expectation of interest rate hikes, with the US dollar index remaining high and the opportunity for the Australian dollar to appreciate has not yet arrived.

Risk reminder, disclaimer, special statement:

There are risks in the market, and investment needs to be cautious. The above content only represents the analyst's personal views and does not constitute any operational suggestions. Please do not consider this report as the sole reference. At different times, analysts' perspectives may change, and updates will not be notified separately.

2023-10-25

|

"Small gifts, come to Huiyi to support me"

No one has offered a reward yet. Give me some support

|