Register now, make more friends, enjoy more functions, and let you play in the community easily.

You need Sign in Can be downloaded or viewed without an account?Register Now

x

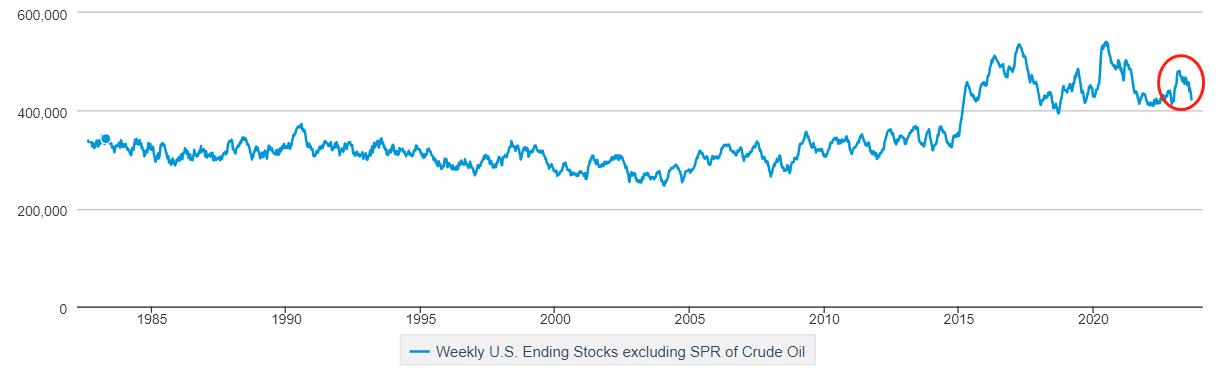

today23:00United States Energy Information AdministrationEIAA series of announcements will be releasedcrude oilInventory data, including: to9month1Day and WeekEIACrude oil inventory, previous value decreased1058.4Ten thousand barrels, expected decrease142.9Ten thousand barrels; to9month1Day and WeekEIAStrategic petroleum reserve inventory, with a previous value of59.4Ten thousand barrels; to9month1Day and WeekEIACrude oil inventory in Cushing, Oklahoma, decreased in previous value150.4Ten thousand barrels. Among the three data items, the one that has the greatest impact on crude oil prices isEIAThe inventory curve of crude oil commercial inventory is shown in the following figure.

2014Since the beginning of the year,EIACommercial inventory presents a typical fluctuating development pattern: inventory ceiling5.38Billion barrels, lower limit3.94Billion barrels, the total inventory at other times is between the upper and lower limits. cut-off8month25Day,EIATotal commercial inventory4.22Billion barrels, near the lower limit, have growth potential in the future. this year3Month is a watershed, with the inventory curve sharply rising in the previous few months and continuing to decline due to inventory limitations in the following months. expectEIACommercial inventory will hit again3.94Prior to the lower limit of one billion barrels, crude oil prices will be boosted by a decrease in inventory.

From a technical perspective, since8month30Recently,NYMEXThe price of crude oil has been consistently atMA30Above, the bullish forces dominate. Last FiveKThe line has three yang, one yin, and one cross star, and has not yet formed a top structure. The short-term trend is still relatively strong.MACDThe column lines have been continuously red for five consecutive years, and the absolute value of the column lines is relatively high, with a tendency towards more short-term and medium-term trends. It should be noted that when multiple indicators collectively indicate a bullish trend, sometimes the market may actually experience a reversal. Tonight'sEIAThere is also a possibility of an increase in data, so bulls cannot ignore the small probability of a decline risk.

Risk reminder, disclaimer, special statement:

There are risks in the market, and investment needs to be cautious. The above content only represents the analyst's personal views and does not constitute any operational suggestions. Please do not consider this report as the sole reference. At different times, analysts' perspectives may change, and updates will not be notified separately.

2023-09-07

|

"Small gifts, come to Huiyi to support me"

No one has offered a reward yet. Give me some support

|