Register now, make more friends, enjoy more functions, and let you play in the community easily.

You need Sign in Can be downloaded or viewed without an account?Register Now

x

The data and event importance for this week, from high to low, are as follows: US Nonfarm Employment Report7Monthly CorePCEPrice index annual rate, Eurozone8monthCPIAnnual rate initial value. Let's analyze and interpret one by one:

This Friday20:30The US Department of Labor's Bureau of Labor Statistics will announce8The monthly non-agricultural employment report shows that the highest attention is paid to the non-agricultural employment population and unemployment rate after the quarterly adjustment.8After the adjustment of the rose season, the non-agricultural employment population, with a previous value of18.710000 people, expected16.8Ten thousand people, weak expectations.8Monthly unemployment rate, previous value was3.5%The expected value remains unchanged from the previous value. Natural unemployment rate standard4%Under this standard, even if the unemployment rate slightly rises, it will not have a serious negative impact on the US macroeconomy. This Wednesday20:15Having the title of "small non farm"8monthADPThe latest employment figures will be announced, with the previous values being32.410000 people, expected20Ten thousand people, the expectations are very pessimistic. From historical experience,ADPThe forward-looking effect of data on non-agricultural employment reports is weakening, with a bullish outlookADPData does not imply a bullish non farm employment report, and vice versa. Suggestions forADPMaintain a calm attitude towards data. If the overall performance of the non farm payroll report is excellent, the US index will benefit and the US stock market will suffer, as strong labor demand will stimulate the Federal Reserve to9The decision to raise interest rates in the month has strengthened the attractiveness of the US dollar, but it will lower the valuation of the stock market.

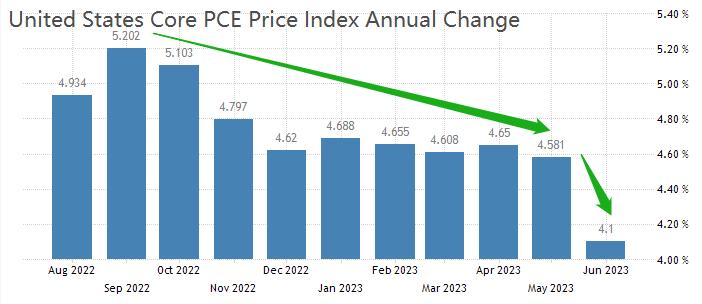

This Thursday20:30The US Department of Commerce will announce7Monthly CorePCEAnnual rate of price index, previous value is4.1%, expected4.2%Expected to slightly rise.PCEData is an important reference indicator for the Federal Reserve's decision-making, and it is related toCPIThe data is similar and is used to measure the price fluctuations in the US consumer goods market.2023Since the beginning of the year, the core of the United States hasPCEThe overall price index is in a downward trend, especially6The core of the monthPCEAnnual rate, from4.5%Sudden drop to4.1%, far exceeding market expectations. Although for7monthPCEThe annual rate is expected to slightly increase in the market, but there is still a possibility of further decline in this data.7Monthly CoreCPIAnnual rate from4.8%Lower to4.7%, added ThursdayPCEThe possibility of a decrease in published data values. If there are signs of weakening high inflation in the United States, the motivation for the Federal Reserve to raise interest rates will decrease accordingly. It should be noted that during the annual meeting of the Jackson Hole Central Bank, Federal Reserve Chairman Powell said:"Although inflation has fallen from its peak, which is a welcome progress, it is still too high. We are prepared to further raise interest rates in appropriate circumstances and intend to maintain policies at restrictive levels until we are confident that inflation is continuing to decline towards our goals."This speech indicates that even ifPCEThe data has decreased, as long as it does not decrease2%Within this range, the Federal Reserve will not stop raising interest rates.

This Thursday17:00Eurostat to announce the Eurozone8monthCPIAnnual rate initial value, previous value is5.3%The expected value remains unchanged. Eurozone7The monthly unemployment rate data will also be released at the same time, with a previous value of6.4%The expected value remains unchanged. Inflation rate data and unemployment rate data are the two most important economic indicators for a country. When both indicators perform well, it indicates that the country's economy is on the path of recovery. However,5.3%Compared to the European Central Bank, the inflation rate2%The regulatory goals are too high;6.4%Compared to the unemployment rate4%The natural unemployment rate is also relatively high. Based on this judgment, the macroeconomic situation in the eurozone still has a long way to go before it recovers. ECB President Lagarde said at the annual meeting of the Jackson Hole Central Bank that the ECB still needs to maintain policy stability, and monetary policy itself should not be a source of uncertainty. The meaning is that the European Central Bank will continue to maintain its aggressive interest rate hike policy until the inflation rate falls back to the target range. For the euro, high interest rates are beneficial in curbing domestic capital outflows. However, for US dollar assets with higher returns, the asset yield of the Euro is not high enough, and there is still a risk of depreciation of the Euro against the US dollar.

Risk reminder, disclaimer, special statement:

There are risks in the market, and investment needs to be cautious. The above content only represents the analyst's personal views and does not constitute any operational suggestions. Please do not consider this report as the sole reference. At different times, analysts' perspectives may change, and updates will not be notified separately.

2023-08-28

|

"Small gifts, come to Huiyi to support me"

No one has offered a reward yet. Give me some support

|