Register now, make more friends, enjoy more functions, and let you play in the community easily.

You need Sign in Can be downloaded or viewed without an account?Register Now

x

7month19Benefiting from expectations of loose monetary policy, the Nasdaq Index surged to14446.55Point. Since then, the Nasdaq has fallen into a mid-term correction trend, reaching yesterday's closing price13463.97Point, cumulative decline exceeding6%Market sentiment has bottomed out. after27Has the correction of the NASDAQ index been in place for the first trading day?

1From a technical perspective, the decline is nearing its end

The attached indicators areMACDAccording toAThe bar chart of the district shows signs of a rebound in the trend, and the bar line will soon cross the zero axis. In the main image,BThe formation of a bottom fractal supporting structure in the district, as long as the market price does not fall belowBDistrict lowest point(13161)The rebound may persist.

2The Nasdaq represents technology stocks, and the technology industry has attractive prospects for artificial intelligence, with long-term holding value still present.

At the end of last yearopenAIPublished Text Q&A RobotchatGPTOnce introduced, it became popular worldwide. Microsoft's official announcement states that all its products will be fully integratedChatGPTIncluding search engine BingOfficeOffice software, cloud computing platformAzureWait a minute. According to the second quarter financial report, Microsoft achieved revenue561.9100 million yuan, year-on-year growth8.34%; Net profit200.8100 million yuan, year-on-year growth19.96%. Behind the high growth of performance is thechatGPTRepresenting the great development of the artificial intelligence industry. NASDAQ100Microsoft's proportion in the weight distribution of the index9.12%, second only to the proportion12.637%Apple Company. As Microsoft's stock price continues to rise due to the development of artificial intelligence, the Nasdaq will also receive a positive boost.

3The unfavorable factor lies in the Federal Reserve raising interest rates, but the turning point of high interest rates is approaching

The stock market rejects high interest rates because they can increase financing costs for listed companies and lower their future cash flow expectations. Yesterday, former St. Louis Fed President James Brad stated that further interest rate hikes may be needed in the coming months to continue fighting inflation, and the economic recession was exaggerated by Wall Street predictions. The hawkish style is strong,9The probability of the Federal Reserve's interest rate decision to raise interest rates in January has greatly increased.

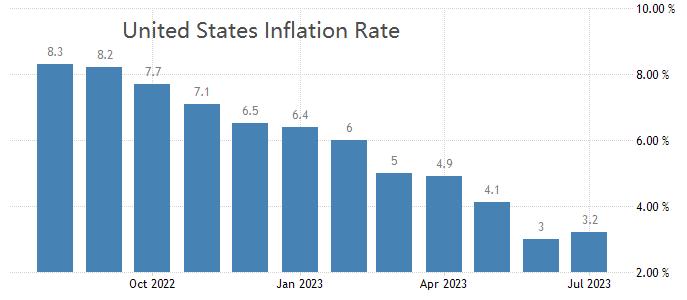

7Month, in the United StatesCPIThe annual growth rate has decreased to3.2%Approaching a reasonable inflation range2%~3%It can be considered that there is no longer a problem of high inflation in the United States. The main purpose of the Federal Reserve's interest rate hike is to curb high inflation, and once the problem of high inflation is resolved, the reason for further interest rate hikes no longer exists. We believe that even if9The Federal Reserve continues to raise interest rates in the month25The base point will also stop the pace of interest rate hikes by the end of this year, and the turning point of high interest rate policies will also emerge. At that time, the Nasdaq index will be boosted.

4The NASDAQ index has been bullish for decades, and at this stage, the probability of success is higher for bullish than bearish.

The rise and fall mechanism of the US stock market is already very clear: when there is a risk of a decline in the stock market, the Federal Reserve will implement loose monetary policy without a bottom line, and the US government even dares to directly issue huge cash subsidies to the public to boost the economy. Under the support of the government and central bank, any decline in the US stock market is a false fall, and ultimately it will go against the macroeconomic trend due to abundant liquidity.

Risk reminder, disclaimer, special statement:

There are risks in the market, and investment needs to be cautious. The above content only represents the analyst's personal views and does not constitute any operational suggestions. Please do not consider this report as the sole reference. At different times, analysts' perspectives may change, and updates will not be notified separately.

2023-08-25

|

"Small gifts, come to Huiyi to support me"

No one has offered a reward yet. Give me some support

|