Register now, make more friends, enjoy more functions, and let you play in the community easily.

You need Sign in Can be downloaded or viewed without an account?Register Now

x

Global Exchange Market Summary——

Yesterday, the US dollar index fell0.22%, closing at103.38Point,

Euro appreciation0.17%Closing price1.0864Point;

Appreciation of the Japanese yen0.7%Closing price144.85Point;

GBP depreciation0.06%Closing price1.2725Point;

Swiss franc appreciation0.3%Closing price0.8779Point;

Overall, the US dollar index has entered a correction band, with most non US currencies appreciating except for the Japanese yen.

Macroeconomics, Monetary Policy, and Exchange Rate——

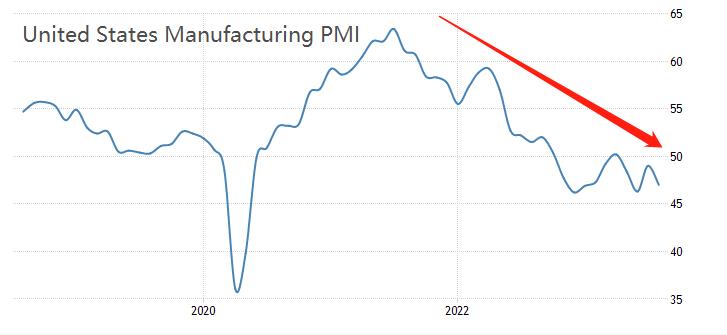

U.S.APMIPoor data performance.8monthMarkitmanufacturingPMIinitial value47, lower than the previous value49And expected values49.3;8monthMarkitService industryPMIinitial value51, lower than the previous value52.3, lower than expected52.2. Especially in the manufacturing industryPMI, from2021year7Month approaching65Afterwards, it has been in a downward trend, with the latest value below50The boom and bust line is in a state of contraction, exacerbating financial market concerns about the US macroeconomic situation. The Federal Reserve often putsCPIThe unemployment rate is seen as an important indicator for adjusting monetary policy, but equally important is overlookedPMIdata How to manufacturePMIThe data continues to hit new lows, and the probability of a recession in the US economy in the second half of the year will greatly increase.

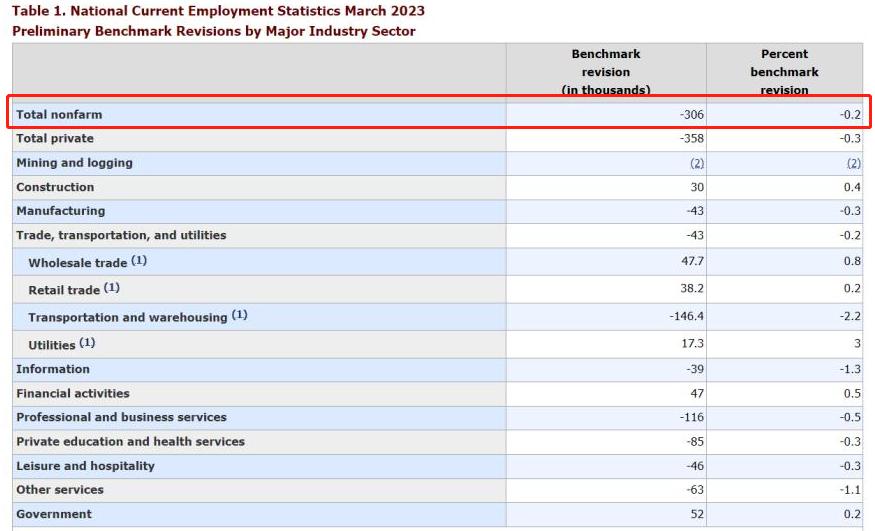

According to preliminary data released by the US Department of Labor, the annual benchmark adjustment for non farm data this year will decrease30.6Ten thousand people, the thriving state of the US labor market may have significant water reserves. Due to the fact that non agricultural data is released on the first Friday of each month, the time left for statistical work is very tight, so the accuracy is relatively compromised. Corrections to non agricultural data often result in slower release of quarterly employment data(QCEW)Based on the annual3Month is the termination month for data correction, when the non agricultural data in March is different fromQCEWAfter alignment, the changes will be proportionally distributed within the year ending in March. Affected by this news, the US dollar index first rose and then plummeted in the middle of the day yesterday, ending with a long upward trendKThe short line shows a turning trend.

US 10-year treasury bond bond yield4.2%The short-term decline and medium-term trend remain bullish; Yields of one-year treasury bond bonds5.39%,7The month has been in a fluctuating state ever since. The yield of short-term treasury bond bonds can better reflect the financial market's attitude towards the macroeconomic situation in the second half of this year and its judgment on the number of interest rate increases by the Federal Reserve. The upper limit of the Federal Reserve's benchmark interest rate is5.5%, basically equal to the yield of one-year treasury bond bonds, indicating that the bond market believes that the Federal Reserve will not9Increase interest rates on monthly and subsequent interest rate resolutions.

Federal Reserve Chairman Powell and ECB President Lagarde will deliver keynote speeches at tomorrow's Jackson Hole annual meeting. Considering Powell's long-standing hawkish attitude, it is expected that the US dollar index will be boosted by the speech. The overall performance of economic data in the Eurozone is not as good as that of the United States, and the benchmark interest rate of the European Central Bank4.25%Below the Federal Reserve's benchmark interest rate125Base point. Even if Lagarde's speech leans towards hawks, it will be difficult to change the trend of mid-term depreciation of the euro against the US dollar.

Risk reminder, disclaimer, special statement:

There are risks in the market, and investment needs to be cautious. The above content only represents the analyst's personal views and does not constitute any operational suggestions. Please do not consider this report as the sole reference. At different times, analysts' perspectives may change, and updates will not be notified separately.

2023-08-24

|

"Small gifts, come to Huiyi to support me"

No one has offered a reward yet. Give me some support

|