Register now, make more friends, enjoy more functions, and let you play in the community easily.

You need Sign in Can be downloaded or viewed without an account?Register Now

x

The importance of this week's data and events, from high to low, is as follows: Jackson Hole Central Bank Annual Meeting, European and American CountriesPMIData, Philadelphia Federal Reserve Chairman Huck in an interview. Let's analyze and interpret one by one:

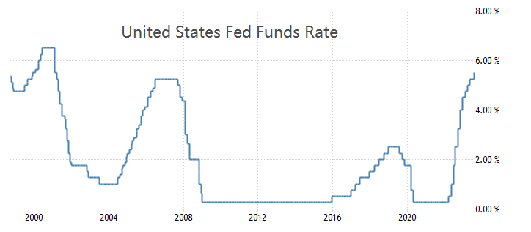

This Thursday to Saturday,2023The Jackson Hole Global Central Bank Annual Meeting was held in, with the theme of "Structural Changes in the World Economy". At that time, presidents, finance officials, renowned economists, and others from European and American countries will gather in Jackson Hole, Kansas City to engage in in-depth discussions on the global economy. Federal Reserve Chairman Powell will deliver a speech at the meeting this Friday, which is expected to reveal the development path of the Federal Reserve's monetary policy in the second half of the year, as well as key economic data on the United States, such asCPIReport on growth rate and non agricultural employment, expressing personal opinions.goldsilvercrude oilUS Index Euro Yen, US Big Threestock market indexInternational varieties will be influenced by Powell's speech. If his statement is biased towards hawkish, then the US index will rise and the US stock market will weaken; If its stance is biased towards doves, then the US index will weaken and the US stock market will rise. After more than a year of continuous interest rate hikes, the Federal Reserve's interest rate range has reached as high as5.25%~5.5%As a non interest bearing asset, gold loses its comparative advantage. If Powell demonstrates his determination to continue raising interest rates, the price of gold may suffer a heavy blow.

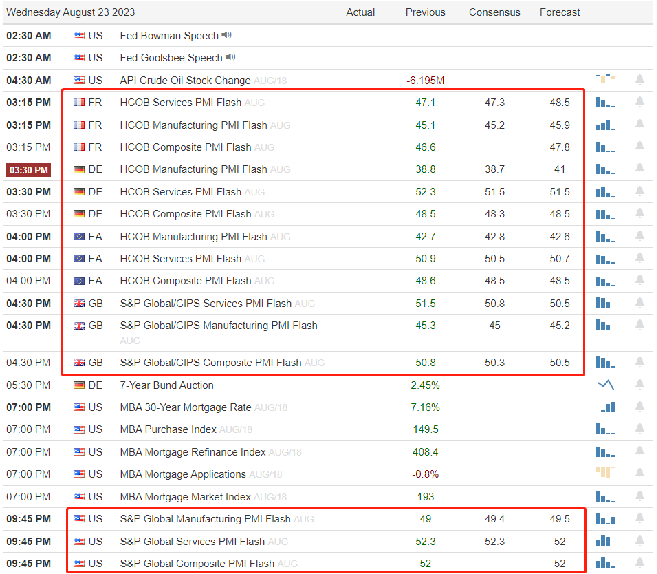

This Wednesday, manufacturing and service industries in France, Germany, the eurozone, the UK, and the United StatesPMIIt will be announced one after another, and the euro, pound sterling, and dollar will be impacted by the data market.PMIAlthough there is no data availableCPIData and unemployment rate data have received high attention, but their forward-looking effect on the macro economy is stronger than the latter two. The manufacturing industry produces physical goods, while the service industry provides virtual goods. When the economy is in an expansion cycle, the demand for physical and virtual goods increases, and the orders and prices of enterprises rise,PMIThe data will also be in the50Above the line of prosperity and withering. On the contrary, when the global economy enters a contraction period, consumer demand for goods decreases, and both orders and prices of enterprises decrease,PMIWill be below the boom and bust line. Manufacturing industryPMIFor example, France45.1Germany38.8,Eurozone42.7UK45.3, USA49, both in50Below the boom and bust line, it indicates that the global economy is in a significant stage of recession. If the recession lasts too long, it will trigger a collective shift in monetary policy from central banks in Europe and America towards easing, and the money market will be impacted.

In the early hours of this Friday, Philadelphia Fed Chairman Huck acceptedCNBCInterviews; On the same day21:00Huck will be interviewed by Bloomberg TV. Huck belongs to2023yearFOMCThe voting committee has the right to vote on Federal Reserve decisions, and the information he disclosed in the interview will have an impact on US dollar stocks. At the beginning of this month, Huck mentioned in his speech on the prospects for the US economy: "The Federal Reserve has made progress in combating inflation and boosting the economy, and may have reached a position to maintain interest rates unchanged, and it is unlikely that the Federal Reserve will cut interest rates in the short term; From now on9In mid month, without any worrying new data, I believe we may be at a time where we can maintain patience, interest rate stability, and easing. The above remarks indicate that Huck tends to maintain interest rates unchanged, which means9Suspend interest rate hikes on a monthly basis. It is expected that this Friday's speech will also lean towards a pause in interest rate hikes, and the US index may come under pressure and decline, benefiting US stocks.

Risk reminder, disclaimer, special statement:

There are risks in the market, and investment needs to be cautious. The above content only represents the analyst's personal views and does not constitute any operational suggestions. Please do not consider this report as the sole reference. At different times, analysts' perspectives may change, and updates will not be notified separately.

2023-08-21

|

"Small gifts, come to Huiyi to support me"

No one has offered a reward yet. Give me some support

|