Register now, make more friends, enjoy more functions, and let you play in the community easily.

You need Sign in Can be downloaded or viewed without an account?Register Now

x

Global Exchange Market Summary——

Yesterday, the US dollar index rose0.29%, closing at103.17Point,

Euro depreciation0.37%Closing price1.0907Point;

Depreciation of the Japanese yen0.41%Closing price145.55Point;

GBP depreciation0.06%Closing price1.2687Point;

Depreciation of Swiss franc0.21%Closing price0.8783Point;

Overall, the US dollar index has appreciated significantly, with mainstream non US currencies plummeting one after another.

Macroeconomics, Monetary Policy, and Exchange Rate——

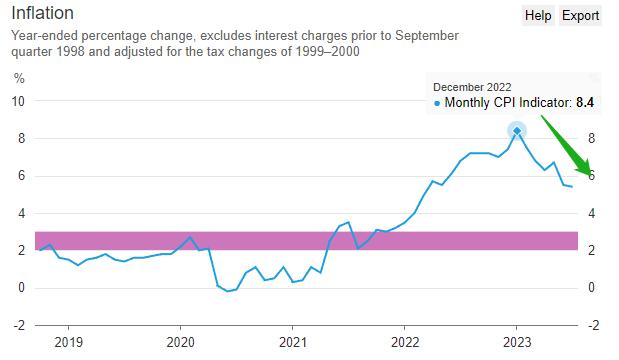

The minutes of the meeting released by the Federal Reserve of Australia stated that maintaining interest rates is more justified than raising them. Latest in AustraliaCPIthe annual rate5.4%The absolute value is relatively high but relative to the highest point in history8.4%Significant decrease. The Regulatory Objectives of the Reserve Bank of Australia2%The gap between the latest value and the target is still significant. The Reserve Bank of Australia maintains its benchmark interest rate unchanged, mainly to observe the lag of high interest rates on various economic data, onceCPIThere are signs of a rebound in the annual rate, and it is expected that the aggressive interest rate hike policy will restart.

The situation faced by the Federal Reserve and the Reserve of Australia is similar: inflation rates are rapidly decreasing, high interest rate policies have taken effect, and there is a strong expectation of stopping interest rate hikes.8The month is the Federal Reserve's decision window period,9The latest resolution will only be welcomed in the month.8The performance of the month's non farm employment report was poor, with insufficient new non farm employment added20Ten thousand people, the labor market demand is not as strong as before.9The probability of monthly interest rate hikes is not high, if9The non farm employment report at the beginning of the month was once again unexpectedly cold, and the possibility of stopping interest rate hikes will greatly increase.

The US economy has a comparative advantage, and there is still a huge demand for the US dollar before the end of the year. The problem of high inflation in the euro area is still serious. There is no sign of easing the Russia-Ukraine conflict. The logic of euro and sterling funds flowing into the United States is still firm. China's economic data in the first half of the year fell short of expectations, todayMLFReduction of reverse repurchase rate15Base point,USDCNHThe highest price has risen or fallen7.3000Gateway, it is expected that RMB assets also existWLIndications. Although the US dollar index has been suppressed by the expectation of the Federal Reserve stopping interest rate hikes, it is difficult to see a significant depreciation trend in the face of continuous inflows of peripheral funds.

UK Q2GDPGrowth rate0.4%, higher than the previous value0.2%However, the absolute value is still low. The UK is facing a dual disadvantage of low growth and high inflation. manufacturingPMILatest value45.3, in a contracting state; Service industryPMILatest value51.5It has been declining for four consecutive months. There is a potential macroeconomic recession in the UK, and unless the stock market can attract global funds or the financial, real estate, tourism, and high-tech industries enter a strong cycle, the depreciation trend of the pound is difficult to change.

Japan's inflation rate is rapidly rising, the latest value3.3%The likelihood of falling back into a deflationary phase is decreasing. Although the Bank of Japan is still verbally releasing expectations for loose monetary policy, it has been adjustingYCCFrom the perspective of policy actions, insiders already have a view of returning to positive interest rates. Tightening expectations benefits the appreciation of the Japanese yen but is not conducive to the rise of the Japanese stock market. If the Japanese stock market falls, the attractiveness of the yen will also decrease. Overall, if the Bank of Japan does indeed raise interest rates, it will create short-term gains and long-term losses for the Japanese yen.

Risk reminder, disclaimer, special statement:

There are risks in the market, and investment needs to be cautious. The above content only represents the analyst's personal views and does not constitute any operational suggestions. Please do not consider this report as the sole reference. At different times, analysts' perspectives may change, and updates will not be notified separately.

2023-08-15

|

"Small gifts, come to Huiyi to support me"

No one has offered a reward yet. Give me some support

|