Register now, make more friends, enjoy more functions, and let you play in the community easily.

You need Sign in Can be downloaded or viewed without an account?Register Now

x

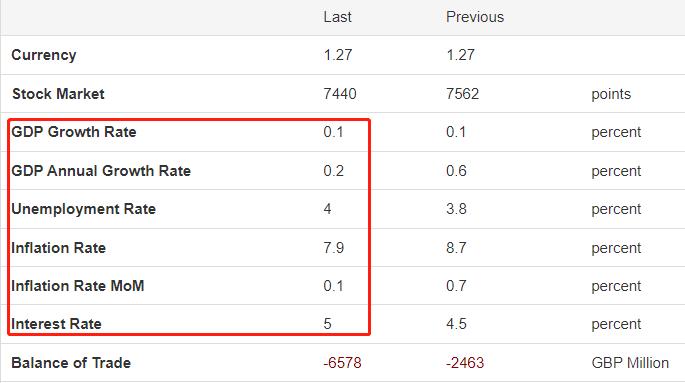

today19:00The Bank of England releases interest rate resolutions, meeting minutes, and monetary policy reports,; Half an hour later, Bank of England Governor Bailey held a monetary policy press conference. Current Bank of England benchmark interest rate5%The market is expected to raise interest rates25Base point to5.25%If it meets expectations, create2009The highest interest rate since the beginning of the year.

There are two reasons why the market is so confident that the Bank of England will raise interest rates. Firstly, the UK inflation rate7.9%Ranking first among major developed economies, the issue of high inflation is exceptionally significant, and previous tightening monetary policies have not played their due role. Secondly, Bank of England officials continue to release hawkish interest rate hikes to the market, such as7In mid month, Bank of England Governor Bailey stated, "The latest consumer price increase is8.7%Inflation is unacceptably high, and we must push it down to2%The goal of We believe that the Bank of England will not only8Monthly interest rate hike, three interest rate resolutions in the second half of this year(09month21Day11month02day 、12month14Japan has increased the probability of raising interest rates.

Both sterling and UK treasury bond bond yields will be boosted. GBP exchange rate current price1.2692,7Touched in the month1.3143The main reason for the high and declining exchange rate is the unexpected rise in the US dollar index. Although the main purpose of the Bank of England's interest rate hike is to curb high inflation, its secondary purpose is also to prevent excessive interest rate differentials between the UK and the US, leading to the outflow of funds. From a technical perspective, the long-term trend of the pound exchange rate is still short, and the basic logic of the US dollar appreciation still exists. The Federal Reserve9There is still a possibility of interest rate hikes in the month. In the short to medium term, the pound exchange rate has entered a rebound band and the highest point of the rebound has broken through key resistance levels1.3000Although the market price has fallen below this level, the high expectations of bulls still exist.

britain1Yields of one-year treasury bond bonds5.11%, 10-year treasury bond bond yield4.449%The yield of long-term treasury bond is lower than that of short-term treasury bond, and the interest rate is upside down, which means that the Bank of England will start to cut interest rates at some point in the future. At this stage, with the aggressive interest rate increase of the Bank of England, the yield of short-term treasury bond bonds will jump up.

The above picture shows1Yields on one-year UK treasury bond bonds,2022Since the beginning of the year, the yield has steadily increased, and there has been no significant correction during this period. The core reason is that the Bank of England has not changed the pace of aggressive interest rate hikes. The yield of ten-year treasury bond also showed an upward trend, but there was an obvious correction during the period, indicating that the Bank of England's interest rate increase process still has twists and turns in the long term. The main carrier of international capital flow is the bond market, and when the yield of long-term and short-term bonds of the pound does not have an advantage, funds will flow out of the UK. It is reported that the United States1Yields of one-year treasury bond bonds5.41%, 10-year treasury bond bond yield4.1527%Short term treasury bond is higher than that of the UK, and long-term treasury bond is lower than that of the UK. There is currently no possibility of a significant outflow of domestic funds from the UK.

britainGDPQuarterly growth rate annual rate0.2%At an extremely low level. unemployment rate4%It is consistent with the natural unemployment rate and performs well. combine7.9%From the perspective of inflation rate, the UK's macro economy is facing low growth+High inflation+The triple negative factors of high interest rates. If the resilience of investment and consumption in the UK is insufficient, a continuously rising benchmark interest rate may lead to further decline in economic growth, or even fall into a negative range, leading to an economic recession. Focus on tracking unemployment rate data in the futureGDPGrowth rate data.

Risk reminder, disclaimer, special statement:

There are risks in the market, and investment needs to be cautious. The above content only represents the analyst's personal views and does not constitute any operational suggestions. Please do not consider this report as the sole reference. At different times, analysts' perspectives may change, and updates will not be notified separately.

2023-08-03

|

"Small gifts, come to Huiyi to support me"

No one has offered a reward yet. Give me some support

|