Register now, make more friends, enjoy more functions, and let you play in the community easily.

You need Sign in Can be downloaded or viewed without an account?Register Now

x

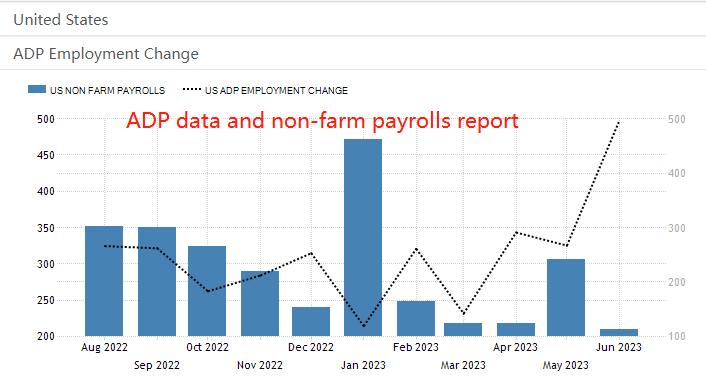

ADPAs a forward-looking indicator for non farm employment reports, it often plays a role in guiding market sentiment and expectations.7Published in the month6monthADPData, published values49.7Ten thousand people are significantly better than the previous value26.7Ten thousand people, driving the rapid growth of confidence in holding the US dollar. However,7Published in the month6The monthly non farm employment report was surprisingly cold, with confidence among US dollar holders plummeting to the bottom, driving the US dollar index below100Gateway.

From an empirical perspective,ADPData can be used as a reference for non farm employment reports, but it cannot be the only data for evaluating the quality of non farm employment reports. The monthly performance of the non farm employment report also relies on comprehensive consideration of factors such as US manufacturing, services, stock market, and federal government policies.

today20:15Automatic Data Processing CompanyADPTo be announced7monthADPEmployment data, previous value is increase49.7Ten thousand people, expected value only increases18.9Ten thousand people. The lower expected value may be due to6The impact of the cold month's non farm employment report data. If the announced value in the evening meets expectations, market pessimism will be stimulated, and the US index may suffer severe selling pressure.

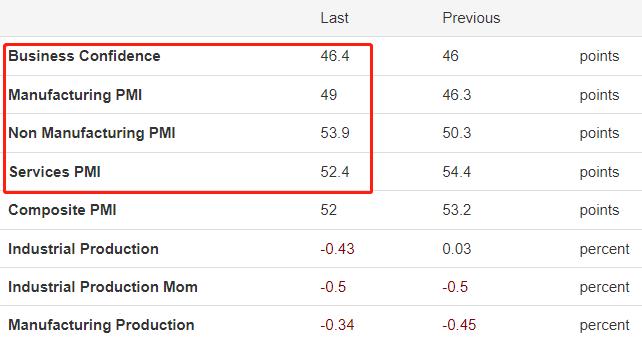

6Month, Manufacturing in the United StatesPMILatest value49, higher than the previous value46.3There are signs of recovery, but they are still in a state of contraction. Service industryPMILatest value52.4, lower than the previous value54.4There was a slight contraction, but still an expansion trend. Business Confidence Index46.4Compared to previous values46There has been a slight rebound, but it is still at a low level. Overall,6The confidence in the manufacturing, service, and industry sectors in the United States was mixed and there was no consistent trend in the month.6The monthly non farm employment report may be average, and the probability of new non farm employment is not much different from the previous value.

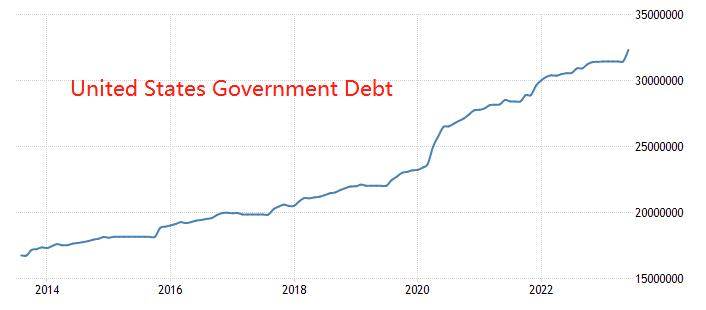

The US government debt is rapidly expanding, with the total scale of debt increasing from2023year5Of31.464457Trillion US dollars increased to6Of32.332274Trillion dollars, exceeding the debt ceiling that has already been abolished31.4Trillion US dollars. The continuous increase in total debt and the simultaneous increase in bond yields mean that the US federal government needs to repay interest, which undermines the potential for US economic growth.

Fitch downgrades the US long-term foreign currency debt rating toAA+Looking negative (later modified to stable). Doubts about the international credit of the US dollar have spread from peripheral countries such as Russia, Brazil, and Iran to the United States. The reason for Fitch's downgrade of the US Treasury credit rating is clearly due to the previous agreement between the White House and Congress to "suspend the debt ceiling", which led to disorderly expansion of federal government debt and a lack of constraints.

In the short term, breaking the debt ceiling and increasing fiscal budget can stimulate macroeconomic recovery, and there may be growth in non farm employment. In the long run, the high debt burden will damage the long-term credit of the US dollar. Once the international market questions the repayment ability of the US White House, the hegemonic position of the US dollar will be severely weakened, and the macroeconomic situation is highly likely to shift from a recovery state to a recession.

Risk reminder, disclaimer, special statement:

There are risks in the market, and investment needs to be cautious. The above content only represents the analyst's personal views and does not constitute any operational suggestions. Please do not consider this report as the sole reference. At different times, analysts' perspectives may change, and updates will not be notified separately.

2023-08-02

|

"Small gifts, come to Huiyi to support me"

No one has offered a reward yet. Give me some support

|