Register now, make more friends, enjoy more functions, and let you play in the community easily.

You need Sign in Can be downloaded or viewed without an account?Register Now

x

7Monthly Exchange Market Review——

7The U.S. Dollar Index fell in July1.01%, closing at101.88Point,

Euro appreciation0.76%Closing price1.0997Point;

Appreciation of the Japanese yen1.41%Closing price142.27Point;

GBP appreciation1.08%Closing price1.2835Point;

Swiss franc appreciation2.61%Closing price0.8718;

Overall, the US dollar index7The month saw a sharp depreciation, but the appreciation of the euro, which dominates the US index, was not significant, with the Swiss franc ranking first in terms of appreciation.

7Monthly macroeconomic and monetary policy analysis——

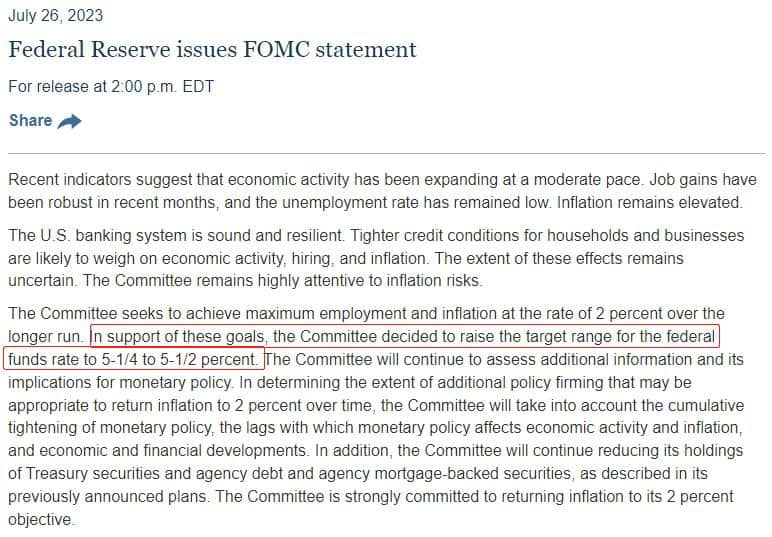

7Offoreign exchangeThe logic of the market is basically the same as that of the previous two quarters. Since the United StatesCPIAfter the annual growth rate showed a downward trend, market expectations shifted from "aggressive interest rate hikes" to "stop interest rate hikes".7month27On the same day, the Federal Reserve raised interest rates25The expectation of "stopping interest rate hikes" has not yet been fulfilled. Federal Reserve Chairman Powell stated that it is possible to9The (federal) funds rate was raised again at the meeting in September. The funds betting on the Federal Reserve's monetary policy shift have encountered serious resistance.

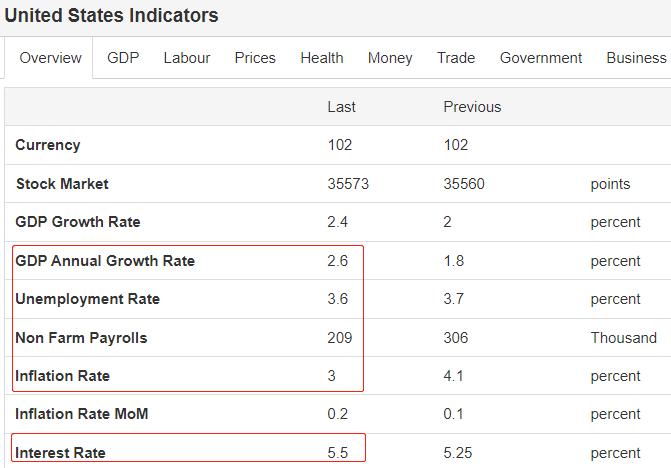

From the already released economic data, there is no possibility of a recession or a "hard landing" in the US economy. Firstly,GDPThe annual rate of quarterly growth is positive, and the growth rate in the second quarter is higher than that in the first quarter, indicating a significant recovery trend. Secondly, the core indicator of the labor market - unemployment rate, the latest value3.6%Below the natural unemployment rate4%The labor force is still in short supply. Thirdly, the problem of high inflation is no longer present, and the latestCPIThe annual growth rate has decreased to3%Below, approaching the Federal Reserve's regulatory targets2%。

The only economic data that worries the market may be the high federal benchmark interest rate range5.25%~5.5%. High interest rates will inhibit the expansion of corporate capital and residents' consumption, which logically has a high probability of leading to macroeconomic recession. However, this logical decline has not yet been reflected in real economic data, only as a pessimistic expectation and bearish argument.

7month6Solstice13On the day, the US dollar index suddenly plummeted3.46%, lowest touch99.73The reason is that the United States6The monthly non farm employment report was extremely cold. Market participants are keeping a close eye on the new non farm payrolls in the United States, and if there are signs of weakness in the data, it will trigger a massive sell-off.7month14In the future, although the US Index struggled to rebound102The above, but the main driving force is the hawkish speeches by Federal Reserve officials. If8The monthly non farm employment report data is no longer ideal, and the rebound in the US index may be easily erased.

8Monthly macroeconomic and monetary policy outlook——

8In January, the Federal Reserve and the European Central Bank did not make interest rate decisions and had lower monthly weights. The Bank of England will announce the results of its interest rate resolution this Thursday, raising interest rates25The probability of base points is extremely high. The UK is facing the highest inflation rate among major developed economies, and the urgency and certainty of the Bank of England raising interest rates rank first among countries.

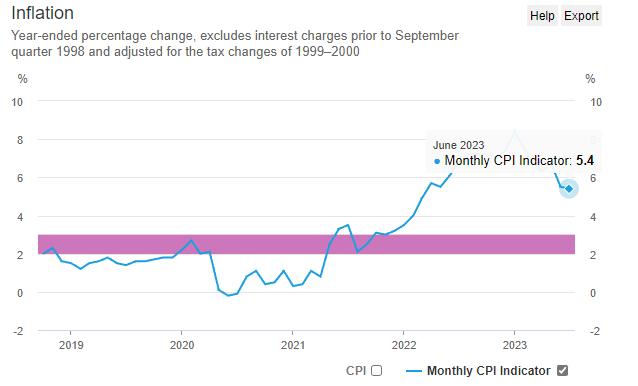

Both the Australian and New Zealand Federal Reserve8The results of the interest rate resolution will be announced in the month, with the former announcing the maintenance of the benchmark interest rate4.1%Constant, exceeding market expectations. New Zealand and the Federal Reserve of Australia have close economic and trade relations and similar economic structures, and it is expected that the Federal Reserve of New Zealand will also choose to maintain its benchmark interest rate unchanged.

The Federal Reserve of Australia has kept its benchmark interest rate unchanged for two consecutive periods due to cooling inflationary pressure and weak household spending. Monthly AustraliaCPIAnnual growth rate5.4%Far below2022year12Of the month8.4%There are significant signs of inflation falling back. In the first quarter of this year, AustraliaGDPGrowth rate2.3%, lower than the previous value2.7%The macroeconomic situation is currently weak.

Australia's choice may be a common choice for major economies such as the United States, Europe, and the UK in the second half of the year. From historical experience, the United States5.5%Eurozone4.25%UK5%The benchmark interest rates are too high, and the cost of debt for the entire society has increased, making investment and consumption more cautious. As of7month27The US federal government's debt reached32.659Trillion dollars, an increase from last month3927.5USD100mn With the increase in bond yields, the federal government in the United States pays more than $1 trillion in interest per quarter, resulting in a decrease in the efficiency of fund utilization.

The Russia Ukraine issue has been ongoing for over a year, and the situation is in a state of anxiety. Although new news comes out from time to time, it cannot have an impact on the macro situation. We believe that the characteristics of the "tug of war", "public opinion war", and "local war" between Russia and Ukraine will still exist8The month continues.goldWeakly boosted by geopolitical risk aversion.

Due to the tightening of oil production and exports by countries such as Russia and Saudi Arabia, internationalcrude oilThe market presents a brief situation of inventory decline and supply exceeding demand.WTIThe price has stabilized and stands at80Above the US dollar. This phenomenon is not in line with the weak global macroeconomic growth rate,WTIThe price may vary8There is a turning point in the month.

Risk reminder, disclaimer, special statement:

There are risks in the market, and investment needs to be cautious. The above content only represents the analyst's personal views and does not constitute any operational suggestions. Please do not consider this report as the sole reference. At different times, analysts' perspectives may change, and updates will not be notified separately.

2023-08-01

|

"Small gifts, come to Huiyi to support me"

No one has offered a reward yet. Give me some support

|