Register now, make more friends, enjoy more functions, and let you play in the community easily.

You need Sign in Can be downloaded or viewed without an account?Register Now

x

Beijing Time20:30The US Department of Labor's Bureau of Labor Statistics will announce4Month US nominalCPIAnnual growth rate and coreCPIAnnual growth rate.4Month nameCPIThe value before the annual rate is5%, expected5%The expected inflation rate will remain unchanged. coreCPIThe growth rate excludes the impact of fluctuations in energy and food prices, which better reflects the trend of long-term inflation rates.4Monthly CoreCPIThe pre growth value of is5.6%The expected growth rate is5.5%Expected to decrease slightly0.1Percentage points. If the data released in the evening is consistent with market expectations, the US dollar index will be boosted, with non US currencies represented by the eurogoldBoth the US and US stocks will fall. The logic behind it is that high inflation rates may lead to the Federal Reserve continuing to raise interest rates.

In the past ten months, in the name of the United StatesCPIThe growth rate continues to decline, with the maximum monthly decrease reaching1.4Percentage points. April nominalCPIThe expected growth rate remains unchanged, and the market attitude tends to be conservative. From the overall trend, the nominalCPIThere is a high probability of growth entering4The beginning of the era. Impact nominalCPIThe core factor of growth rate fluctuations is international oil prices, and4monthWTIThe cumulative increase is only1.27%Basically maintaining a broad fluctuation trend, so the market expects nominalCPIIt is logical that the growth rate will remain unchanged. Why do we still think that nominalCPIDoes the growth rate continue to decline? Because there is a risk of recession in the US macro economy.

The US non farm employment report released last Friday showed that the unemployment rate has increased from3.5%Lower to3.4%The newly added non agricultural employment population has increased from16Increase in 10000 people to25Ten thousand people. If viewed from the performance of the labor market, there is no possibility of a macroeconomic recession in the United States. because3.4%The unemployment rate is far below international standards5%This indicates that the demand in the US labor market is very strong. The core standard of economic recession is the high unemployment rate, which is clearly not in line with the reality. However, one of the fundamental characteristics of macroeconomics is its circularity. The macroeconomic situation in the United States has undergone2021End of year and2022After the annual Qualcomm account, we will inevitably enter the era of low inflation, which is the evolutionary law of the economic cycle. Although the current labor market in the United States is still performing well, it is expected that this positive state will gradually change over time.

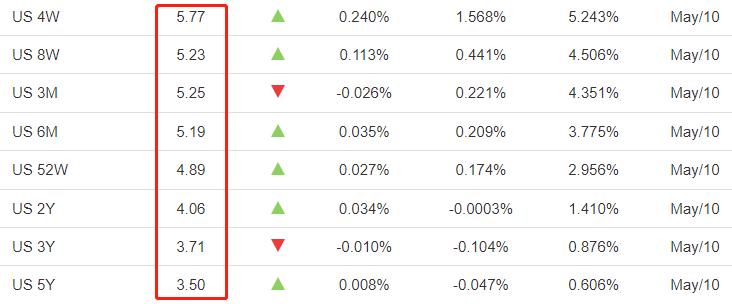

The US bond market shows a typical inverted phenomenon that the yield of long-term bonds is lower than that of short-term bonds. As shown in the above figure,1The yield of monthly treasury bond bonds is5.77%The yield of the two month treasury bond bond is unexpectedly5.23%The yield of treasury bond with longer cycle will be lower instead. The yield of five-year treasury bond bonds is even as low as3.5%You should know that the current benchmark interest rate range set by the Federal Reserve is5%~5.25%. It means that after a period of time, the Federal Reserve will inevitably initiate interest rate cuts, and the reason for the rate cuts is clearly a macroeconomic recession.

From a technical perspective, the US dollar index is falling to101After the checkpoint, it seems to have encountered sustained support and experienced a sideways trend. International gold prices have skyrocketed to2050dollar/After an ounce, we can't set new highs for a long time.EURUSDIt was already on board as early as early as April1.1000The checkpoint, but now it's back1.0900Nearby. Based on various price trends, the international market's attitude towards bearish US dollar indices is not firm enough, and gold and the euro are facing periodic upward resistance. This stalemate is expected to continue until there are clear signs of recession in the US economy.

Risk reminder, disclaimer, special statement:

There are risks in the market, and investment needs to be cautious. The above content only represents the analyst's personal views and does not constitute any operational suggestions. Please do not consider this report as the sole reference. At different times, analysts' perspectives may change, and updates will not be notified separately.

2023-05-10

|

"Small gifts, come to Huiyi to support me"

No one has offered a reward yet. Give me some support

|