Register now, make more friends, enjoy more functions, and let you play in the community easily.

You need Sign in Can be downloaded or viewed without an account?Register Now

x

Geographically, the most convenient countries for supplying EU oil and gas are Russia and the Middle East. However, due to geopolitical issues, NATO's relations with Russia and the Middle East have always been tense.2022year2After the beginning of the Russia-Ukraine conflict in January, this tension began to materialize. In order to reduce their dependence on Russia's oil, European countries have introduced several rounds of sanctions. The main target of sanctions is Russia's oil exports, the most typical of which is to set a Price ceiling for oil exports.2022year9In January, after the North Stream natural gas pipeline was destroyed, European countries almost stopped importing natural gas from Russia. Who will supplement the missing share of oil and natural gas? The answer is the United States.

According to Eurostat data, up to2022At the end of the year, the largest EUcrude oilThe supplier countries are the United States, followed by Norway and Kazakhstan.2022year12Month, EU18%The imported crude oil comes from the United States.2022year1At the end of the month, Russia remained the largest crude oil supplier to the European Union, providing31%Imported crude oil. The United States is the second largest crude oil supplier to the European Union, accounting for half of the total crude oil imports from the EU13%。 Over the course of a year, the structure of European oil imports underwent a drastic change. The EU's efforts to reduce its dependence on Russian oil have achieved significant results, but the negative impact is that European people have to use higher priced American oil.

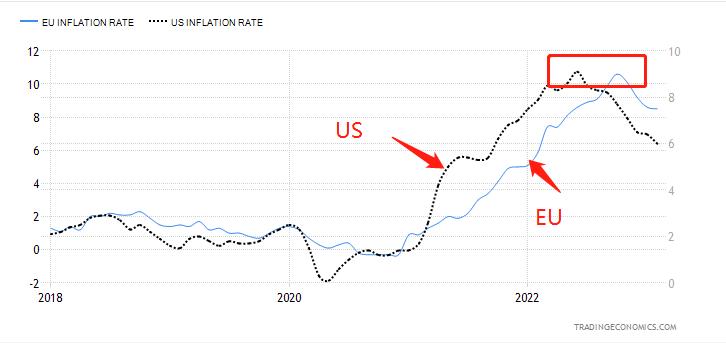

From the Eurozone and the United StatesCPIFrom the growth rate overlay curve, it can be seen that the inflection point of inflation in the United States appeared earlier than in the eurozone, and the latest inflation rate is much lower than in the eurozone. The reason is that the European Union chose the high priced energy of the United States for the sake of distance and proximity. The relatively high inflation rate determines that the duration of the European Central Bank's interest rate hike is longer than that of the Federal Reserve, and the probability of the euro's appreciation is higher. For the crude oil market, Europe has reduced its dependence on Russian oil, but the total amount of Russian oil exports has not experienced a cliff like decline. Therefore, the supply and demand of the international crude oil market remain relatively stable.

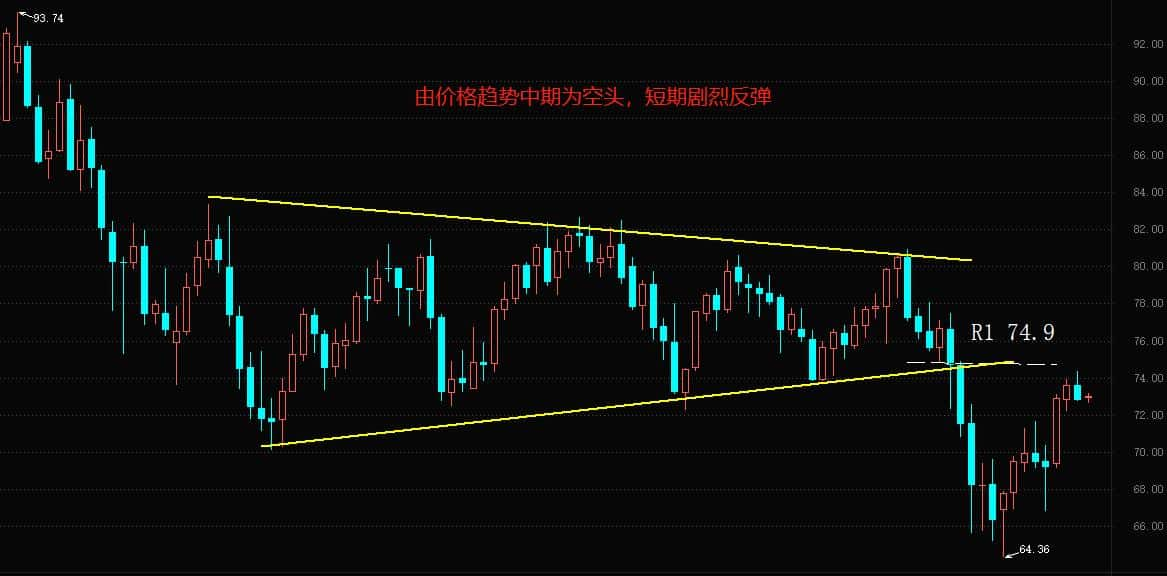

From a technical perspective,WTIThe short-term rebound has not yet been touchedR1 74.9Resistance level. The bearish trend structure still exists. If in the futureWTIIf the price rises to the central region of the convergence triangle range (yellow line), the duration of the rebound will be greatly prolonged. Yesterday's announcement from the United States3month24Day and WeekEIAThe latest value of crude oil inventory has decreased748.9Ten thousand barrels, with an expected increase of9.2Ten thousand barrels. althoughEIAThe crude oil inventory curve is generally on the rise, but the short-term decline is more intense than expected. With the weakening of market concerns about liquidity issues in the European and American banking systems, the demand for crude oil will rebound to some extent. Overall,WTIThe probability of rebounding to the yellow area is high, and short traders need to do a good job in risk management.

Risk reminder, disclaimer, special statement:

There are risks in the market, and investment needs to be cautious. The above content only represents the analyst's personal views and does not constitute any operational suggestions. Please do not consider this report as the sole reference. At different times, analysts' perspectives may change, and updates will not be notified separately.

2023-03-30

|

"Small gifts, come to Huiyi to support me"

No one has offered a reward yet. Give me some support

|