Register now, make more friends, enjoy more functions, and let you play in the community easily.

You need Sign in Can be downloaded or viewed without an account?Register Now

x

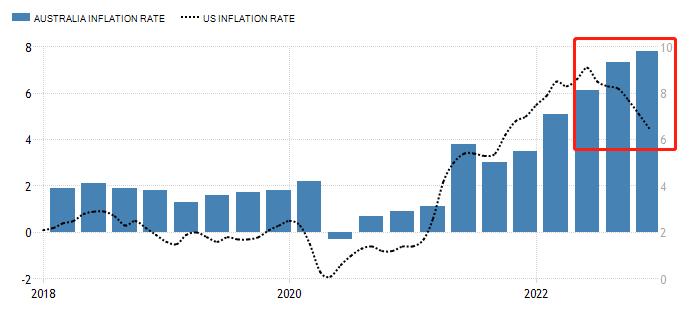

today11:30The Reserve Bank of Australia announces the results of its interest rate decision, based on the previous benchmark interest rate3.1%, expected3.35%, Latest Value3.35%, in line with the interest rate hike25This is the ninth interest rate hike by the Reserve Bank of Australia, based on the expectation of a basis point. It is already a trend for Western central banks to reduce the magnitude of a single interest rate hike, and the Federal Reserve is75Base point reduced to25Starting point, the European Central Bank and the Bank of England75Base point reduced to50Base point. The single rate hike by the Reserve Bank of Australia has also increased from50Base point reduced to25However, Australia's macroeconomy is not the same as that of the United States, the eurozone, and the United Kingdom, and there are hidden concerns about the Australian Federal Reserve's policy of slowing down interest rate hikes.

The blue bar represents the name of AustraliaCPIThe growth rate is obvious, and the problem of high inflation is still ongoing,2022Reached in the fourth quarter of the year7.8%Set a new high in nearly 20 years. The black dashed line represents the name of the United StatesCPIGrowth rate,2022year7Since the beginning of the month, the problem of high inflation in the United States has eased. The main purpose of the central bank's interest rate hike is to curb high inflation, and the Federal Reserve's goal has been achieved in stages. Gradually stopping the aggressive interest rate hike policy is logical. The Australian economy is still plagued by high inflation, and slowing down the pace of interest rate hikes at this time may lead to further inflation. Of course, in the name of AustraliaCPIThe growth rate is announced quarterly, and the deadline for the data in the chart is2022year12month. If in January of this year and2Name of monthCPIIf the growth rate slows down, then the decision of the Reserve Bank of Australia to withdraw from its aggressive interest rate hike policy is logical.

raise interest rates25After the announcement of the news of the base point,AUDUSDstay5Within minutes from0.6919Charge up to0.6952Rising33The standard point indicates that market funds believe that the sustainability of the Reserve Bank of Australia's interest rate hike is stronger than that of the Federal Reserve. From a technical perspective,AUDUSDThe daily chart is in a pullback state, and the medium-term uptrend line has been breached. The lowest point of this round of decline may be reached0.6585(Lower limit of central tendency in the previous round). The periodic appreciation trend of the US dollar index isAUDUSDThe main driving force behind the decline. The non farm payroll report shows that the US labor market is unusually active and can withstand more rate hikes, which has pushed the market back to the point when the Federal Reserve will stop raising interest rates, leading to a rise in the US dollar index103Gateway.

The Australian dollar is a commodity currency, and its value is influenced by the price of iron ore.2022year10month31Recently, driven by the improvement of supply and demand, iron orefuturesThe price is in an upward trend, with a cumulative increase34.59%This has boosted Australia's export industry and the value of the Australian dollar. It should be noted that the Australian dollar has a weak boost from iron ore futures,AUDUSDThe ultimate direction still depends on the movements of the Reserve Bank of Australia's monetary policy and the US dollar index.

2022year5Since January, the yield of Australia's 10-year treasury bond has been in a wide range of fluctuations, and the current market price is near the lower limit, which is likely to rise. Once the upward trend starts, the value of the Australian dollar will receive a significant boost. Meanwhile, the rise in bond yields indicates an increase in market demand for the Australian Federal Reserve to raise interest rates more frequently this year.

Risk reminder, disclaimer, special statement:

There are risks in the market, and investment needs to be cautious. The above content only represents the analyst's personal views and does not constitute any operational suggestions. Please do not consider this report as the sole reference. At different times, analysts' perspectives may change, and updates will not be notified separately.

2023-02-07

|

"Small gifts, come to Huiyi to support me"

No one has offered a reward yet. Give me some support

|