Register now, make more friends, enjoy more functions, and let you play in the community easily.

You need Sign in Can be downloaded or viewed without an account?Register Now

x

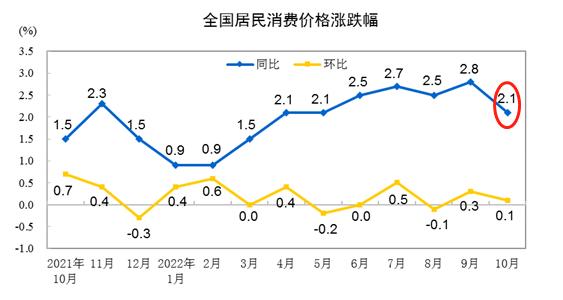

According to the latest data from the National Bureau of Statistics,2022year10In September, the national consumer price rose year on year2.1%Among them, food prices have risen7.0%, non-food prices rise1.1%In the food industry, the price of pork has risen9.4%It is the variety with the largest increase. The internationally recognized moderate inflation standard is2%, China1-10monthCPIThe year-on-year growth rate is exactly2%This indicates that the domestic price performance is very stable and healthy.

Due to the absence of malignant inflation like in European and American countries, the People's Bank of China will not aggressively raise interest rates like the Federal Reserve and the European Central Bank. Similarly, China's inflation rate does not frequently fall into negative territory like Japan, so there is no need to implement a large-scale loose monetary policy. As stated by the Governor of the People's Bank of China, Yi Gang, we must adhere to the implementation of a prudent monetary policy.

In fact, macroeconomic pressure comes fromGDPGrowth rate, rather thanCPIOr the unemployment rate. Q3GDPYear-on-year growth3.9%Much larger than the second quarter0.4%But less than the annual target5.5%A month has passed since the third quarter, and under the impact of the epidemic, some provincial capitals have implemented stricter prevention and control policies, which may harm the local areaGDPThe growth. As an important means of regulating the economy, monetary policy is bound to take measures to maintain stability.

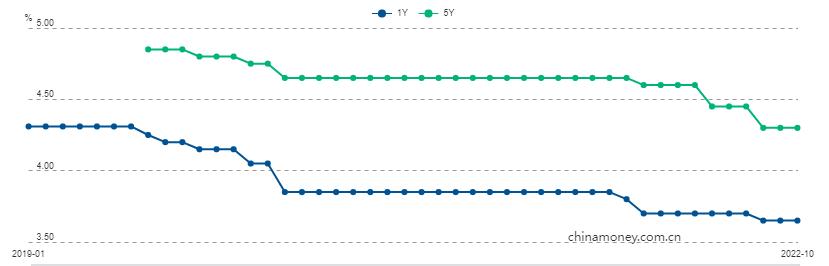

Since the beginning of this year, the one-year periodLPRInterest rates have been lowered twice, with a five-year termLPRInterest rates have been lowered three times, and it is highly likely that the fourth quarter will have another impact on both cyclesLPRInterest rates will be lowered, and the reduction in long-term interest rates will be greater than that of short-term interest rates. The reason is that,5Years and aboveLPRBenchmarking the interest rate on residents' housing loans and moderately reducing their housing pressure can alleviate the current situation of year-on-year decline in real estate transaction volume. Especially for cities with less prosperous commercial development, fiscal revenue relies more on land transfer fees, and the recovery of real estate transaction volume is of great significance for such cities.

Based on the expectation of interest rate cuts in the fourth quarter,USDCNHOr it may be boosted. Since this year9Monthly exchange rate breaking7since,USDCNHHighest touch7.3482Over the past month, it has been maintained at7.2The area is shaking up and down nearby. The Federal Reserve announced a rate hike earlier this month75This is a significant deviation from the loose monetary policy of the People's Bank of China. Without considering direct intervention from the People's Bank of China,USDCNHIt is possible to touch in the fourth quarter7.5Resistance level.

ATFXAccording to the comprehensive view of the analyst team, the largest pillar of the Chinese economy is manufacturing, not real estate development. Although the target of monetary policy support in the fourth quarter includes the real estate industry, the focus is still on manufacturing. Considering that China is a major exporter, the monthly import and export data released regularly will also have an impact onUSDCNHThe impact needs to be closely monitored.

*Risk Tips and Disclaimers*

There are risks in the market and investment should be cautious. The above contents only represent the views of analysts and do not constitute any operational recommendations.

2022-11-09

|

"Small gifts, come to Huiyi to support me"

No one has offered a reward yet. Give me some support

|