Register now, make more friends, enjoy more functions, and let you play in the community easily.

You need Sign in Can be downloaded or viewed without an account?Register Now

x

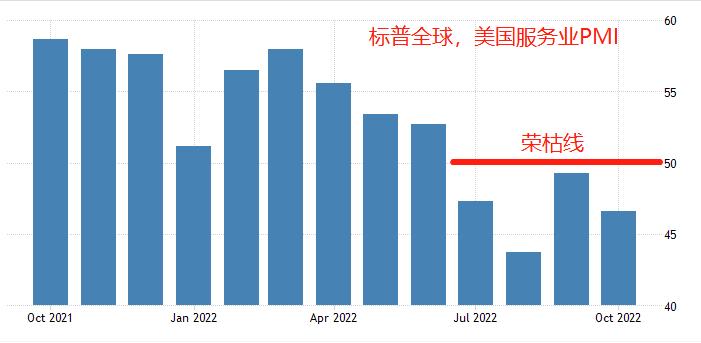

The United States' Soft/The hardware technology, healthcare, and finance industries have always been highly valued by the market and belong to traditional popular sectors, with their respective total market values being2Trillion to8Between trillions. Although there are manufacturing technology companies such as Apple and Tesla in the technology sector, the main business orientation of the three major sectors is still the service industry. According to S&P Global Data,10US service industryPMILatest value46.6, lower than the previous value49.3, also lower than50The boom bust line has been in an unfavorable situation for four months now.

The reasons for the contraction of the service industry are obvious: the demand side decreases under the expectation of recession, and the cost side significantly amplifies under the coexistence of high interest rates and high inflation. In fact, the worst situation has not yet occurred. the United States9The monthly unemployment rate is only3.5%Far below the standard of full employment5%This means that although the service industry is facing significant negative impacts, it has not experienced widespread layoffs or stopped hiring. For the Federal Reserve, inflation rate is the target and unemployment rate is the bottom line. As long as an unacceptable level of unemployment has not yet emerged, interest rate hikes can continue. Of course, although technology, healthcare, and finance all belong to the service industry, they also have their own unique attributes. In a comprehensive comparison, the financial industry benefited from the widening of interest margin after the interest rate increase, and the medical industry benefited from the awakening of health awareness after the epidemic. Only the science and technology sector did not have significant industry highlights, especially pure software services and China Internet.

The individual stock level is the most diversified part, and there are always some individual stocks that ignore policy, macro, and industry negative factors and go against the trend to strengthen. There are numerous individual stocks, and this time we will focus on Apple, a technology stock with dual attributes of manufacturing and technology. According to third-party data, the global smartphone shipment volume in the third quarter was3.02Billion units, year-on-year decline9.7%However, during the same period, Apple's mobile phone shipments increased year-on-year1.6%, to5190Ten thousand units, indicating a strong demand for Apple products in the market.

In the third quarter of this year, Apple achieved single quarter revenue901.5100 million US dollars, year-on-year growth8.14%Good growth potential. At the stock price level, Apple's cumulative decline since the beginning of this year has been13%Left and right, far below the Nasdaq index30%There is a significant resistance to the decline in both sides. Due to the strong expectation of interest rate hikes during this period, Apple's stock price only showed high volatility and did not significantly decline. Therefore, we believe that in the current situation where the expectation of aggressive interest rate hikes has weakened, Apple is expected to continue2021The strong state of the year.

ATFXAnalyst team's comprehensive view: Monetary policy and macroeconomics determine the three major factors in the United Statesstock market indexThe mid-term decline is likely to continue, but opportunities still exist at the industry and individual stock levels. Individual stocks that have shown resistance to decline or even strengthened against the trend in the past three quarters deserve continued attention.

*Risk Tips and Disclaimers*

There are risks in the market and investment should be cautious. The above contents only represent the views of analysts and do not constitute any operational recommendations.

2022-11-02

|

"Small gifts, come to Huiyi to support me"

No one has offered a reward yet. Give me some support

|