Register now, make more friends, enjoy more functions, and let you play in the community easily.

You need Sign in Can be downloaded or viewed without an account?Register Now

x

goldLatest market analysis:

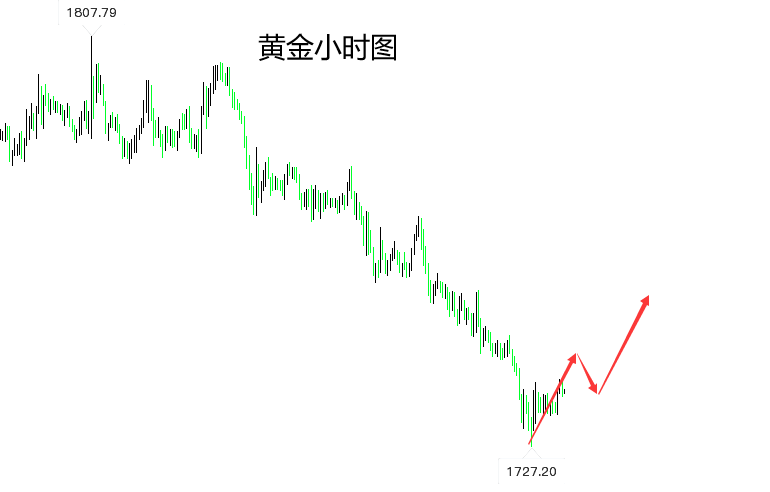

Gold briefly rebounded during the Asian session yesterday and then fell again, breaking through1740Support, low point drops to1728On the first line, it was precisely because of the early decline in the Asian session that the abnormal rise of the US dollar index in the evening did not have a significant impact on it. Gold remained low and volatile, but in the end, the daily line still closed at a negative level. In terms of daily structure, gold has closed negative for six consecutive trading days, mainly due to the influence of the extreme trend of the US dollar. However, the market has fallen to the lower edge of the daily level range, and theoretically, the bearish momentum has also been released. There may be a technical rebound at any time in the future. However, the current daily structure has changed, and even if gold rebounds, its space may still be limited. Stay tuned below within the day1730Nearby support competition, if the US Index continues to operate at extreme limits in the near future, then gold will be affected by it and fall back to1700It is also possible nearby. However, based on the rhythm of yesterday's gold decline, short-term bulls have already engaged in counterattacks, and a certain rebound in the near future is also possible. However, there are more pressure levels facing the upper part, so the upper part can pay attention to them5Daily line1748-50Pressure, focus or attention10、20Daily line1770Nearby, as for the direction of future market movements, it is likely to depend on the speech of Federal Reserve Chairman Powell on Friday.

Combining1、4Hour chart trend, gold was on a downward trend yesterday1728After the first line, there was a rebound movement, although the space was not significant, it was not affected by the extreme rise of the US Index again in the evening. Today's morning market also saw another rebound movement, indicating that the bull momentum has already acted. Pay attention to yesterday's break point first in the day above1740-45If the pressure does not break through this level in the regional competition, then short-term gold may still have a low volatility process. If standing firm to1740-45Above, combined with the pressure recovery of the US Index, the gold rebound in the short term1748-50, and even1760、1770There are also possibilities. In terms of intraday operations, the conservative choice of gold is still to wait and see for the time being, to avoid the risks brought by the extreme limit operation of the US Index, while the radical one continues to try to short and long, but the selection of points and the allocation of positions must be reduced to prevent the risk of market fluctuations again.

crude oilLatest market analysis:

Analysis of crude oil news: Tuesday(8month23day)Yashi morning trading, Meiyou current report90.8Near the US dollar; Oil prices rebounded from intraday lows on Monday, benefiting from market weighing Saudi concernsOPEC+Warning of potential production reduction, andCPCThe partial damage to the oil pipeline within Russia has led to a decrease in exports, and the market is also evaluating the possibility that the Iran nuclear agreement may bring sanctioned Iranian oil back to the market.

The current oil price is influenced by Saudi Arabia's concernsOPEC+Boost from potential production reduction warnings, coupled withCPCPartial damage to the oil pipeline within Russia has led to a decrease in exports, resulting in strong oil prices,CPCPartial damage to the oil pipeline in Russia has led to a decrease in exports, causing a new blow to European energy supply and a decrease in US crude oil reserves35The lowest level in recent years may further highlight supply concerns, and oil prices may fluctuate and rise in the short term. The inventory situation still needs to be monitored as announced on WednesdayAPIandEIAIf further data shows a decrease in inventory, oil prices may be further boosted.

Technical analysis of crude oil: Crude oil staged a fierce roller coaster yesterday, with short-term repeated tugs of war91.0Falling under pressure on the first line86.23On the first line, the market regained its lost ground after a strong recovery in the late trading session, returning to the downside and closing at a high level, which is equivalent to a day of losses and recovering all the lost ground. The fluctuation base is large, and the sawing range is also relatively large, which is in line with yesterday's range. It's just a short ride out of the roller coaster. The daily trend once again bottomed down and rebounded at the closing cross, and the second bottoming and rebound enabled the short-term structure to break out of the double needle bottoming trend of bottoming and rebounding. The competition between long and short shows intense intensity.

Crude oil4The hour chart is lowered to the lower track of Bollinger Road and stabilized before confirming the resistance of the downward channel through reverse pumping. The short line is in a sawing vibration and there is support underneath86.0-86.20.There is resistance on the trend line, and the short term is seeking breakthroughs. Yesterday's repeated tug of war also showed intense competition between the long and short sides. Currently, considering4During the closing of Houbulin Road, the overall price stabilized after a wide range of bearish and volatile trading yesterday86The checkpoint is facing strong fluctuations and rebounding. Today's short-term support is focused on yesterday's hourly neckline level89At the checkpoint, relying on this position to support the rebound and rebound, the upward pressure is focused on the early daily level opening of the downside92.5-93Regional, short-term stabilization89First, let's focus on the rebound and rebound. Overall, it is recommended that the short-term operation of crude oil today should focus on a pullback and long selling, supplemented by a rebound and short selling, with a focus on the short-term above93.5-94.0Frontline resistance, short-term focus below89.0-88.5Frontline support.

① If gold withdraws again within the day1735-33、1730Aggressive nearby can make further short and long attempts, with yesterday's low point1728Stop Loss Below, Target Look1740Change to break even and stop loss nearby, and measure the pressure to1742-45Reduce positions again, if you stand firm1745Above, leave it for further review1750、1760、1770expect.

|

"Small gifts, come to Huiyi to support me"

No one has offered a reward yet. Give me some support

|