Register now, make more friends, enjoy more functions, and let you play in the community easily.

You need Sign in Can be downloaded or viewed without an account?Register Now

x

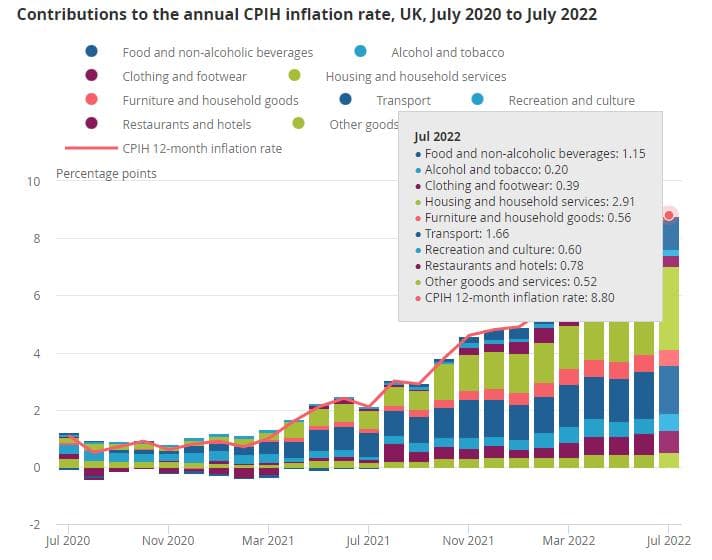

There are two consumer price indices in the UK, namelyCPIandCPIHThe former is a general indicator for investment analysis, while the latter includes the cost of owning a house (i.eOOH, approximatelyCPIHof17%)So it is highly valued by the UK Bureau of Statistics.7Month UKCPIHGrowth rate8.8%, higher than the previous value8.2%The biggest contributors to price increases are housing and household services (mainly from electricity and natural gas), followed by transportation costs (mainly fuel), and finally food and non-alcoholic beverages.7Month UKCPIGrowth rate10.1%, higher than the previous value9.4%, DriveCPIRising factors andCPIHBasically the same.

Comparatively speaking, the United StatesCPIAlready from a high position9.1%Fallback to8.5%; eurozone7monthCPIOnly for8.9%Japan, Canada, and AustraliaCPIAll are in7%following. The UK has become the country with the most severe problem of high inflation among major developed economies. Faced with such exaggerated inflation levels, the Bank of England is bound to adopt a more aggressive interest rate hike policy. single time50The basis point may no longer be able to reverse market expectations, and the next interest rate decision will raise interest rates75The probability of a base point increases significantly.

The UK treasury bond bond market is expected to increase interest rates due to overdraft. Yesterday, the yield of 10-year UK bonds rose from2.135%Soaring to2.317%, distance6Month high point2.745%One step closer. The latest benchmark interest rate of the Bank of England is only1.75%The yield of one-year British treasury bond bonds has reached2.57%, difference82One basis point. this year9month15Day11month3Day12month15On the same day, the Bank of England will also make three interest rate decisions. Judging from the yield of treasury bond, the cumulative rate increase of the three interest rate resolutions is at least82Base point.

The UK labor market continues to perform well. The unemployment rate in the second quarter was only3.8%(has remained at this level for three consecutive months), far below the full employment rate5%Although the British people have to face the problem of high prices, fortunately, most of them have stable incomes.

The election for the new UK Prime Minister is in full swing and is expected to take place9The final result will be available at the beginning of the month. According to the data of the polling agency, former Foreign Secretary Truss is most likely to win the election. The main reason why Johnson was forced to step down is the issue of high inflation. However, the root cause of the high inflation problem lies in the shortage of supply side. Before the end of the Russia-Ukraine conflict, even if a new prime minister takes office, it will not change the situation of soaring prices.

GBPUSDWe are currently in a significant bearish trend.8month10The significant increase failed to break through1.2293Resistance is a manifestation of insufficient bullish power. The US dollar index has continued to strengthen this week,GBPUSDThere is a high probability that it will further decline.

ATFXBrief viewpoint of the analyst team: High inflation in the UK continues, and the Bank of England is likely to aggressively raise interest rates, butGBPUSDThe probability of strengthening is not high.

*Risk Tips and Disclaimers*

There are risks in the market and investment should be cautious. The above contents only represent the views of analysts and do not constitute any operational recommendations.

2022-08-18

|

"Small gifts, come to Huiyi to support me"

No one has offered a reward yet. Give me some support

|