Register now, make more friends, enjoy more functions, and let you play in the community easily.

You need Sign in Can be downloaded or viewed without an account?Register Now

x

News: Yesterday, Russia and Ukraine held the fifth round of negotiations and made positive progress. The head of the Russian negotiating delegation, Medinsky, stated that the Russian side has confirmed Ukraine's desire for a neutral, non aligned, and nuclear-free status. The latter will not produce or deploy weapons of mass destruction on its territory and will abandon joining any military alliance. Ukrainian delegation member Arahamia said that Kiev hopes to establish an international mechanism to ensure Ukraine's security. In addition, Deputy Minister of Defense Fumin of Russia stated that the Russian side has decided to significantly reduce military activities in the direction of Kiev and Chernihiv, the capital of Ukraine. Kate Beddingfield, director of the White House Communications Office, said: "At present, I do not intend to set preconditions for the talks between President Biden and President Putin. Before the President carries out such a dialogue, Russia needs to effectively ease tensions and make a clear and sincere commitment to the diplomatic path." From the statements of all parties, the tension in the Russia-Ukraine conflict has been greatly eased, The peace agreement is no longer far away. Affected by this news, yesterdaygold、crude oilThe wheat, US dollar indices fell sharply, but in the latter half of the US session, except for the US dollar index, other varieties rebounded beyond expectations, leaving only a longer downward shadow on the daily level.

Technical aspects of the US dollar index: Facts have proven that the US dollar index has experienced a third shock100The integer level once again failed. After significant progress has been made in the Russia Ukraine negotiations, the US dollar index has reached a high point99.3Plummeted to its lowest point98.03, decline1.27%The mid-term upward trend line has also been broken. Follow Today97.7Position, this is the lower limit of the high volatility range. Once the lower limit is broken (judged by the closing price below this level), the US dollar index will break out of the volatility range and is expected to experience a significant decline in the future. In the selection of currency pairs, it is recommended toGBPUSDandNZDUSDBecause the Bank of England and the Federal Reserve of New Zealand have both raised interest rates three times, the degree of monetary tightening is stronger than that of the Federal Reserve, resulting in a higher likelihood of currency appreciation.

Technical aspects of gold and crude oil: Yesterday, the opening price of gold1922, lowest touch1888Closing price1918The lower shadow line is prominent. It can be seen that the will of funds to short gold is not firm, or in other words, while the risk aversion has subsided, the decline of the US dollar index has supported gold prices, causing short funds to be unable to withstand the counterattack of long funds. Crude oil performance is similar, with yesterday's opening price103Lowest price98Closing price105, closing with a long shadow line. The macroscopic aspect of crude oil is relatively complex, with bothOPEC+The increase in production is also expected to follow the supply growth after the Russia-Ukraine conflict has eased. So, at present, the attitude towards crude oil is to "wait and see", waiting for supply and demand to become clearer.

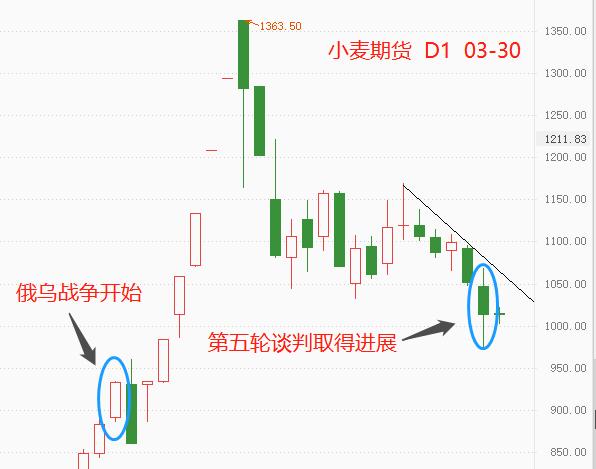

wheatfuturesWe rarely talk about agricultural futures, but this time it's different. Russia and Ukraine have become "European granaries", with their wheat exports accounting for26%(2021Annual data), with Russia accounting for16%Ukraine occupies10% . Since the Russia-Ukraine conflict, Ukraine has at least160Ton of wheat8A container is trapped in Ukraine and cannot be shipped out. It should be noted that Ukraine is the second largest food producing country in the world, with wheat cultivation covering nearly half of its land area. The supply side's obstruction has led to a significant increase in wheat futures prices. Prior to the Russo Ukrainian War, wheat futures prices were quoted873During the war, the price of the US dollar surged to1353USD. Today's latest price1011The US dollar remains above the normalized level. Therefore, the tension in the Russia-Ukraine conflict has eased. In addition to gold, crude oil and the US index, wheat in agricultural futures also deserves continuous tracking.

WTITrend chart:

Summary

ATFXThe analyst team believes that the positive progress of the fifth round of negotiations between Russia and Ukraine may only be a prelude to the end of the war in the future. With the gradual fading of risk aversion, most of the safe haven products will return to normal prices, including agricultural futures, precious metals, and the US dollar index.

*Risk Tips and Disclaimers*

There are risks in the market and investment should be cautious. The above contents only represent the views of analysts and do not constitute any operational recommendations.

|

"Small gifts, come to Huiyi to support me"

No one has offered a reward yet. Give me some support

|