Register now, make more friends, enjoy more functions, and let you play in the community easily.

You need Sign in Can be downloaded or viewed without an account?Register Now

x

Yesterday we mentioned that before the Federal Reserve's interest rate decision, the US dollar would strengthen and the US stock market would weaken, and this basic view remains unchanged. Early Thursday morning3:00The Federal Reserve announced the decision results, and half an hour later there was Powell's press conference, which was the last wave of performance for the US dollar and US stocks. Starting from the Asian session on Thursday, the view that the US dollar is strengthening and the US stock market is weakening is about to reverse, becoming a weakening of the US dollar and a strengthening of the US stock market. The principle behind it is that negative news is always positive. Of course, this assertion is that the Federal Reserve will raise interest rates within the year3If the frequency is higher than this, the power of monetary tightening will also drive the US dollar up and the US stock market down.

Another core issue is the United States'CPIHow long will it be strong? The latest value is7%Future breakthroughs8%What is the likelihood? In fact, we have analyzed this issue many times in the previous article. The culprits of high inflation are oil prices and chips. As long as the prices of these two commodities fall, the inflation rates of Western countries led by the United States will naturally decrease.OPEC+Member countries control oil prices, TSMCskCompanies such as Hynix and Intel control chip production capacity, with the former on the road to increasing production (although the increase in production has been criticized) and the latter also building new factories to increase production. Combined with the Federal Reserve's tightening monetary policy,CPIThe situation of high growth rate will soon be suppressed. Of course, 'soon' here is not a goal that can be achieved in a few days, but in a few months. As long as it formsCPIThe unanimous expectation of a decline does not require such a long time, and the US dollar will weaken while the US stock market will regain its upward trend.

The US dollar index and US Treasury bonds

The current upward trend of the US dollar index has continued9On a trading day, from the perspective of technical trends, hitting the previous high point96.95The probability is extremely high. However, reaching the previous high point may not necessarily continue the upward trend, as the US dollar index has been fluctuating at a high level for over two months. As mentioned earlier, it is important to be cautious of any significant changes in the trend of the US dollar index after the interest rate decision, as this has occurred many times in history.

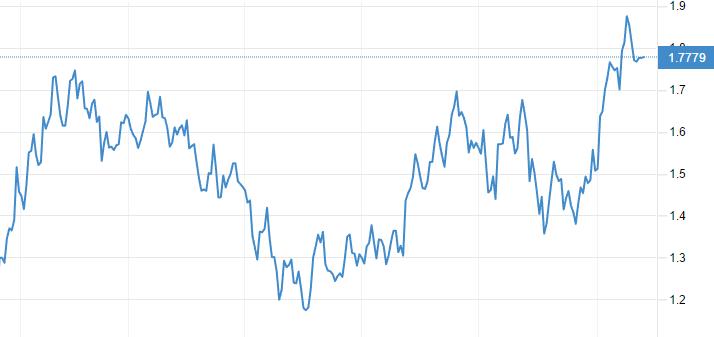

The treasury bond bond market is the most sensitive to interest rate decisions, and the trend of long-term treasury bond yield is the "anchor" of the dollar index. From the above chart, it can be seen that the trend of the 10-year US Treasury yield is bullish. Although the yield has declined in the past two trading days, the upward structure has not been disrupted. As mentioned earlier, 'all negative outcomes are positive'. A major prerequisite for the weakening of the US dollar and the strengthening of the US stock market is the downward trend of the 10-year US Treasury yield after reaching its peak. Do not act rashly until the top structure of US Treasury bonds is fully formed.

Summary

ATFXThe analyst team believes that the more consistent the market expectations are, the more the development of the market will move in the opposite direction, and we have already explained the principle behind it.2022The first interest rate resolution of the year, everyone is expecting a sharp rise in the US dollar and a sharp drop in the US stock market. 'I am afraid when I am greedy,' and it is recommended that participants be alert to possible reverse market trends.

*Risk Tips and Disclaimers*

There are risks in the market and investment should be cautious. The above contents only represent the views of analysts and do not constitute any operational recommendations.

|

"Small gifts, come to Huiyi to support me"

No one has offered a reward yet. Give me some support

|