Register now, make more friends, enjoy more functions, and let you play in the community easily.

You need Sign in Can be downloaded or viewed without an account?Register Now

x

Summary:

Throughout history, large-scale spending bills by US presidents have been unable to be voted through in both houses of Congress at once, with countless twists and turns in between, often resulting in a stillbirth. Current US President Biden's1.75The same goes for the trillions of dollars spending package bill, which was passed in the United States House of Representatives with220Ticket support213After narrowly winning the vote against it, moderate member of the Senate and fellow Democratic Party member Joe Manchin publicly expressed opposition. This angered the White House, accusing it of "sudden and inexplicable changes and leaving", while also making the passage of the spending bill in the Senate a mirage.

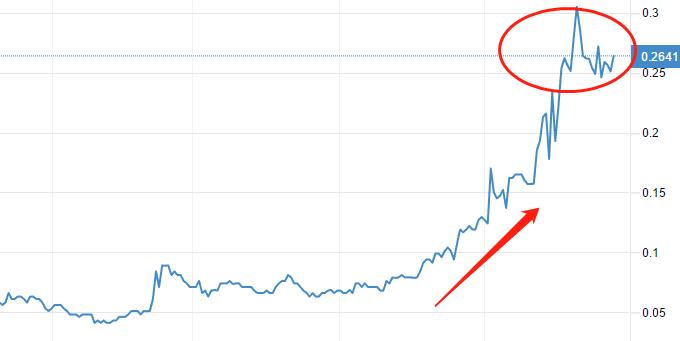

▋ US one-year treasury bond bond yield

Analyzing any news in the United States requires considering the curve of the bond market.1The yield on one-year US Treasury bonds is significantly high,1.72The trillion dollar expenditure plan faced public opposition and did not trigger a rapid decline in bond market interest rates, so its impact on the US dollar index was relatively weak. In fact, the most severely impacted sector is the electric vehicle sector in the US stock market, as a portion of the expenditure bill includes consumer subsidies for electric vehicles and financial support for charging infrastructure.

▋EURUSD Daily line

since11month24Daily hit a new low for the year,EURUSDHas been in a narrow range of oscillations, with a range of(1.11~1.13). It is difficult to provide a clear view on whether the future volatility will rise or fall after it ends. What can be certain is that,EURUSDStill a significant bear, the bond market interest rates behind the US dollar index are also in an upward trend, and from a technical perspective, the probability of future decline is higher.

▋GBPUSD Daily line

The Bank of England has taken the lead in raising interest rates, and the strengthening of the pound is supported by monetary support. As shown in the figure, the latest four trading daysGBPUSDThe price has been running above the downward trend line, indicating that the breakthrough is effective. If the multi head band can last longer, then the bottom structure is confirmed,GBPUSDA major turning point in the trend has arrived. At this stage, we need to be patient and not enter the venue too early to participate, after allGBPUSDThe medium-term trend remains significantly bearish.

▋USDJPY Daily line

USDJPYStill in a volatile state, except11month26The decline in the daily US dollar index is quite prominent on this variety. The Bank of Japan has been maintaining its quantitative easing policy, even during major monetary policy shifts in various countries2022In the year, it is highly likely that the Bank of Japan will also remain silent. From the perspective of trend structure,USDJPYThere is a small pullback hook shape feature, which will break down in the future112The probability of support is relatively high.

Summary

Biden 1.75The trillion dollar spending bill is just a small twist in the trend of the US dollar index, and its impact is relatively limited. Returning to the monetary level, the Federal Reserve acceleratesTaperThe US dollar index should continue to rise, while non US currencies should continue to decline, which is very clear. However, the trend of prices is often opposite to the macroeconomic situation. We can firmly believe that the Federal Reserve will tighten monetary policy, but we cannot be overly confident in the rise of the US dollar index.

*Risk Tips and Disclaimers*

There are risks in the market and investment should be cautious. The above contents only represent the views of analysts and do not constitute any operational recommendations.

|

"Small gifts, come to Huiyi to support me"

No one has offered a reward yet. Give me some support

|