Register now, make more friends, enjoy more functions, and let you play in the community easily.

You need Sign in Can be downloaded or viewed without an account?Register Now

x

Unexpectedly "chilling" for small non farm workers

United States2monthADPRecord an increase in employment11.7Ten thousand people, lower than expected17.7Ten thousand people, the previous value has increased from17.4Increase from 10000 to 1000019.5Ten thousand. It should be noted that the market's response to small non agricultural data is not obvious, as it was not clear before the data was released,10The yield of one-year US Treasury bonds rose, leading to a decline in gold prices. After the data was released, gold prices continued to decline, and the cold weather did not provide support for non agricultural sectors.

Biden acknowledges tightening eligibility for stimulus checks

A Democratic aide stated that Biden has agreed to the demands of moderate Democrats to tighten the bailout bill1400Eligibility for receiving USD stimulus checks. Now the income exceeds8Individuals with $10000 will not be eligible for this cash disbursement, as previously drafted legislation had a limit of10Ten thousand US dollars. In addition, there are reports that the US Senate amendment is expected to maintain unemployment insurance at400dollar/Week until8Month.

goldMarket trend analysis:

Spot Golden Week in Sanya1730-1740The narrow range fluctuation of the US dollar, the European market began to fluctuate and decline. Before the release of small non agricultural data, gold prices experienced a short-term pulldown and hit their lowest overnight1701.82The US dollar has fallen more than30USD, followed by another wave exceeding20The short-term upward trend of the US dollar ultimately ended in a decline1.56%Report1710.87dollar/ounce.

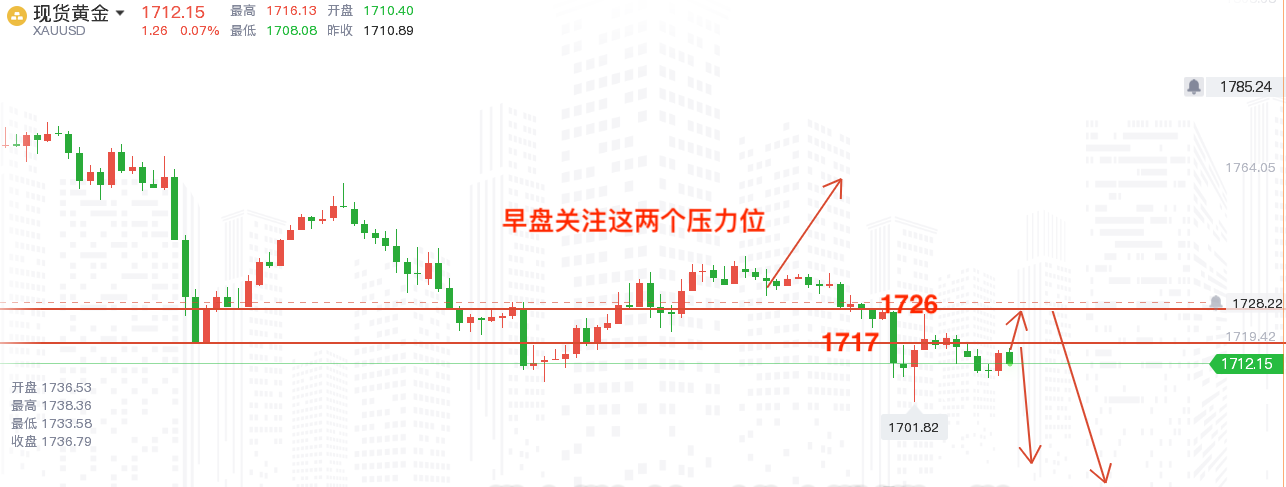

Early morning gold opened at a low level, with upward pressure1726, lower support1702Gold rebounded rapidly after falling yesterday1720The top did not effectively break through the pressure level, and yesterday's starting and falling points in the US market were at1726But we haven't been able to break through here, so today's market may still be a weak point, and we need to pay attention to it in the morning1717One line of resistance, break through here and take a look back1724-26First line, it's better not to participate in multiple orders today. You can wait and see in the morning, and if the European market has been in1710So many horizontal plates below, just go in and take a look1702-1680-1660Today, it's broken1700It will definitely accelerate the decline. If there is a pullback today1710The vast majority of people below will go long to see the market rise, and at this point, the market will not have as much momentum to rise;

Suggestions for Gold Operations:

Early Market Follow1717Can we effectively break through, break through1717Callback long, stop loss1708, Objective1724, given above1724-26Short selling with stagflation on the first line, stop loss1732, Objective1708-1703-1680;

(The investment is risky, so it is necessary to be cautious when entering the market. The operation suggestions are only for reference, and the operation should be carried out in sequence at your own risk)

Experience benefits: For retail friends who are interested in consulting and cooperating, it is convenient for mutual trust in future cooperation. Add the author:(Yb663665) Later, you can experience it with screenshots of the actual warehouse3Tianshou order, you can choose whether to cooperate based on the income in the future! I believe this welfare is a great turning point opportunity for friends who have suffered long-term losses in the market and investors who have lost confidence. Whether the opportunity is firmly established depends on your choice.

Price quantity spatiotemporal relationship:

Quantity is the first priority of price, there is a sky high quantity, there is a sky high price, and land quantity is the land price. Although trading volume is the leading factor in price, it usually needs to be combined with four factors to determine everything: price, quantity, time, and space. Price is the origin of the trend, and without analyzing the price, the other three factors are meaningless. Based on the current trend of the purchase price, combined with large trading volume, during active time periods, when analyzing it, there is also the top or bottom of the trend. Without the analysis of the four elements, trading volume becomes passive water, prone to errors, unable to move up or down.

The meaning analysis of the four major elements is as follows:

(1)Referring to the position of gold prices in historical trends and based on technical experience of historical trends, a prediction of the magnitude of fluctuations can be made. Generally speaking, the position of gold prices in the trend chart can be divided into low, medium, and high areas. The more room there is for prices to rise in the low range, with a focus on buying long; The mid range should be based on the trend, follow the trend, go long when the market rises, go long when the trend is sideways, and go short when the trend is bearish; The more room there is for the high level zone to fall, the main focus is on short selling. The primary focus of analyzing prices is that as long as the entry point is relatively low, no matter how the market fluctuates, there is ultimately a chance to make money; Similarly, the price of short selling is relatively high, and there is still a chance to make money after the market turns around. There is a corollary to eating: long at low prices will earn, short at high prices will earn.

(2)Analyzing transaction volume is second only to analyzing price. Simply put, price is cars, and transaction volume is oil. Without cars and oil, there is no use, and even with cars and oil, there is no movement. Therefore, it can be concluded that there is no fluctuation in the price and quantity market, while there is a large fluctuation in the price and quantity market. The omens of a trend start with a contraction, followed by quantity. There are five specific types of significant increase in trading volume:1When a trend bottoms out and undergoes a low reversal in the horizontal direction;2When a trend at the top shrinks horizontally and reverses;3When breaking through the critical support pressure neck line;4When the small Yang rises in a row and the long Yang rises in a reversal;5When the small yin falls in a row and the long yin plummets and reverses.

(3)Time is also one of the important factors in technical analysis. When the gold price is sideways in a range for a longer time, the price fluctuation becomes smaller, and the trading volume is correspondingly smaller, presenting a symbol of short-term inactivity. When breaking through upwards or downwards, one sentence can be used to summarize "how long is the horizontal and how high is the vertical". The height here refers to the force.

Author: Chen Yibo(Guidance hotline:Yb663665)

Market strategy analysis writing: Chen Yibo team from the Risk Control Technology Department. Please indicate the source for reprinting. The content of the article is for reference only. The article has lag and timeliness, and it is recommended to follow the guidance of the Chen Yibo team in terms of operation—— Perhaps my words can help you break through the long-standing technical bottleneck, or perhaps my trading perspective can help you avoid losses of hundreds, even thousands, or even tens of thousands of dollars. Perhaps your attempt this time will help you find the right direction for your efforts.

|

"Small gifts, come to Huiyi to support me"

No one has offered a reward yet. Give me some support

|