Register now, make more friends, enjoy more functions, and let you play in the community easily.

You need Sign in Can be downloaded or viewed without an account?Register Now

x

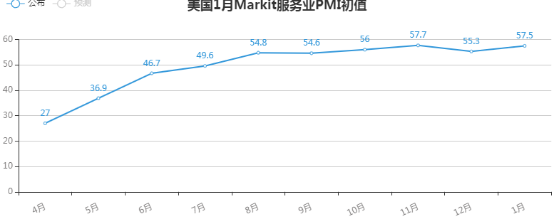

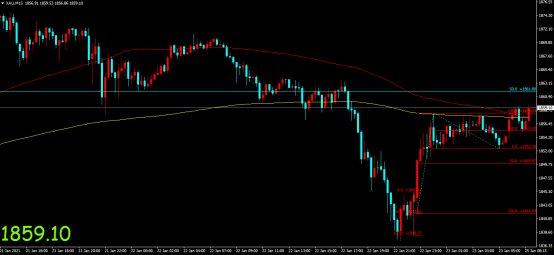

Market Review: internationalgoldFriday(1month22Japan's volatility maintained a slight decline, with the opening price1863.85dollar/Ounces, highest price1871.29dollar/Ounces, lowest price1837.20dollar/Ounces, closing price1855.84dollar/ounce. Message surface: The United States announced on Friday1monthMarkitmanufacturingPMIThe initial value is59.1Higher than market expectations56.5,The previous value is57.1; U.S.A1monthMarkitService industryPMIThe initial value is57.5Higher than market expectations53.6, previous value is54.8.(Manufacturer recorded from2008year7The largest increase in sales prices since the beginning of the month

The comment states that,Data shows that the United States2021The year has had a strong start, driven by the hope that vaccine development will mean the worst of the epidemic has passed, and the new government will provide a sustainable and supportive environment for stronger economic growth.1In the month, output growth accelerated to nearly6The second fastest in the year, with a significant increase in business optimism for the coming year. In the past three months, corporate confidence has been consistently at2015The highest level since the beginning of the year. But there are disappointing news in the labor market, with recent concerns about the impact of the epidemic, especially concerns about consumer facing service demand and rising costs, leading to the emergence of employment data7The weakest level since the beginning of the month. British Prime Minister Johnson stated that he does not want to change the current restrictions.Still on2month15Evaluate the blockade measures on a daily basis. The infection rate of COVID-19 is frighteningly high. The possibility of taking further measures on the border cannot be ruled out. There is no consensus on when the blockade can be relaxed. It is expected that the number of deaths from COVID-19 will continue to be high. Wallace, the chief scientific adviser of the British government, said that the vaccine was very effective in preventing serious symptoms, but it was not sure whether the vaccine could prevent people from contracting COVID-19 or prevent the spread of the virus. Continuous attention must be paid to the effectiveness of vaccines. We are more concerned that the vaccine may not have as high efficacy against South African and Brazilian variant strains. There is a lot of uncertainty regarding the number of cases of infection with mutated strains. The evidence regarding the mortality rate of mutated strains is not yet sufficient. Patients infected with the UK variant are at increased risk. The death rate of COVID-19 may rise next week. The decrease in the number of confirmed cases will take several weeks to translate into a decrease in hospital admissions. UK Health Secretary Hancock announced that experts say the variant of the virus in the UK may be more deadly. According to DBS Bank analysis,The gold price may reach2300USD. The basic forecast is for quantitative easing to expand, leading to more stimulus measures, a depreciation of the US dollar, and a flat yield, which will continue to provide good support for gold. The world's largest goldETF--SPDR Gold TrustThe position is flat compared to the previous day, and the current position is1173.25Tons. according toCMEFederal Reserve Observation: The Federal Reserve This Year1Monthly interest rate maintained at0%-0.25%The probability of the interval is100%Interest rate hike25Bps to0.25%-0.50%The probability of the interval is0%; this year3Monthly interest rate maintained at0%-0.25%The probability of the interval is100%Interest rate hike25The probability of a basis point is0%。 This week's focus is on: Monday:17:00 Germany1monthIFOBusiness Prosperity Index;23:30 U.S.A1Dallas Federal Reserve Business Activity Index for the month;

Tuesday:15:00 britain11Three months in a monthILOUnemployment rate, UK12Monthly unemployment rate, UK12Number of applicants for monthly unemployment benefits;19:00 britain1monthCBIRetail sales margin;22:00 U.S.A11monthFHFAMonthly rate of housing price index, United States11monthS&P/CS20Annual rate of housing price index in major cities;23:00 U.S.A1Monthly Consultation Chamber of Commerce Consumer Confidence Index, United States1Monthly Richmond Fed Manufacturing Index;

Wednesday:05:30 From the United States to1month18Day and WeekAPIcrude oilInventory;08:30 Australia Q4CPIAnnual rate;15:00 Germany2monthGfkConsumer confidence index;17:00 Switzerland1monthZEWInvestor confidence index;21:30 U.S.A12Monthly rate of durable goods orders;23:30 From the United States to1month22Day and WeekEIACrude oil inventory;

Thursday:03:00 From the United States to1month27Japanese Federal Reserve Rate Decision;15:00 Switzerland12Monthly trade account;18:00 eurozone1Monthly Industrial Prosperity Index, Eurozone1Monthly Consumer Confidence Index Final Value, Eurozone1Monthly economic prosperity index;21:00 Germany1monthCPIInitial monthly rate;21:30 From the United States to1month23Number of initial claims for unemployment benefits in the current weekActual situation in the fourth quarter of the United StatesGDPInitial value of annualized quarterly rate, initial value of actual personal consumption expenditure quarterly rate in the fourth quarter of the United States, core value in the fourth quarter of the United StatesPCEInitial annual rate of price index;23:00 U.S.A12Annualized total monthly new home sales, US12Monthly consultation chamber leading indicator monthly rate;23:30 From the United States to1month22Day and WeekEIANatural gas inventory;

Friday:07:30 Japan12Monthly unemployment rate;14:30 France Q4GDPInitial annual rate;15:00 Germany Q4 not seasonally adjustedGDPInitial annual rate, UK1monthNationwideMonthly rate of housing price index;16:00 Switzerland1monthKOFEconomic leading indicators;16:55 Germany1Unemployment after quarterly adjustment, Germany1Unemployment rate after monthly adjustment;21:30 U.S.A12Monthly CorePCEAnnual rate of price index, USA12Monthly personal expenditure rate, US12Monthly CorePCEMonthly rate of price index, Canada11monthGDPMonthly rate;22:45 U.S.A1Month ChicagoPMI;23:00 U.S.A1Final Value of the University of Michigan Consumer Confidence Index for the Month, USA12Monthly rate of contracted sales index for completed houses; Technical aspect:

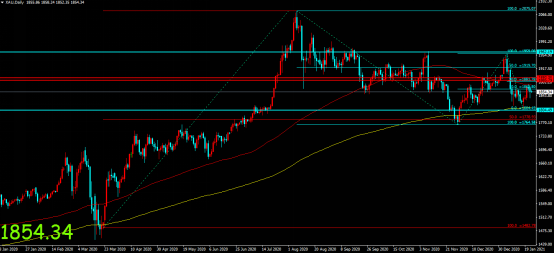

International gold hit a bottom and reversed again on Friday, with the highest gold price hitting early Friday1871After the first line, the short-term trend remained volatile and fell, and gold prices hit their lowest point in the afternoon session1857First line, once maintained1857-1863Interval organization. Gold prices fell again during European trading hours, hitting their lowest point before and after the opening of the US market1837After the first line of trading, the volatility rose, and gold prices accelerated to decline during US trading hours1838First line performance once againVType reversal, formed from1838The first line is relatively strong and continues to rise. The Chen gold price has gradually stabilized in the short term since Saturday1852-858High level consolidation interval, maintaining short-term long consolidation performance. On Monday morning, gold prices expanded their short-term gains, reaching their highest point1860Maintain a high level of consolidation in the short term. Maintaining the main trend of volatility, the short-term upward trend of gold prices continues to be good, and it is still difficult to see a significant unilateral downward trend within the day. The daily line recorded a longer shadow line, and the short-term gold price once again tested the daily line200The daily moving average still shows a relatively strong support level price impact, and the current gold price is in the pressure level price range supported by the technical indicators of the daily moving average. The daily moving average shows a narrowing and bonding form, and the short-term consolidation range shows a gradually narrowing performance, without showing significant volatility and getting rid of price trends. The four hour line shows that short-term gold prices have once again bottomed out and reversed, and the current gold price remains stable above the four hour technical indicator support level, The four hour technical indicators are in a cohesive form, and the current gold price is related to the four hour technical indicators20Exploring performance on the daily moving average, the short-term technical indicator pressure level breakdown will once again stabilize above the technical indicator support level, In the short term, the gold price has been continuously rising and maintained unilaterally, with the main trend being volatile. The cautious operation approach for the day is to maintain a more bullish range. Daily operating range: Multiple orders: radical1851Frontline participation, stop loss3-05Point, profit target1856upper steady1845Frontline participation, stop loss3-5Point, profit target1850upper Empty order: radical1882Frontline participation, stop loss3-5Point, profit target1876Below steady1892Frontline participation, stop loss3-5Point, profit target1887Below The mutation of COVID-19 caused concern, the gold price hit the bottom and reversed and rose again, and the operation idea of more ranges was cautiously maintained in the day

|