Register now, make more friends, enjoy more functions, and let you play in the community easily.

You need Sign in Can be downloaded or viewed without an account?Register Now

x

Fundamentals:

Tuesday(4month28day)goldPrice maintenance1716-1691区间震荡,日线收带下影线阴线。

Today's data

Technical aspect:

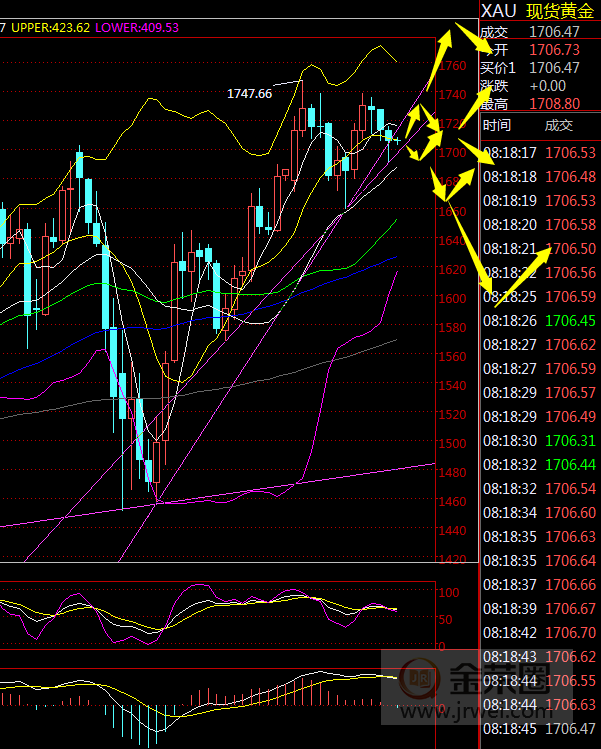

日线上,黄金日线收带下影线阴线,目前处于短期线附近运行,5Japan and Japan10日均线走平,中期线仍向上运行,MACD死叉向下运行,KDJ死叉向下运行,指标看跌。黄金前一波上涨从1450到近期高点1748Nearby, the increase is close to300The US dollar is approaching the limit of its previous year's increase, as seen in this way1748附近及上方很可能成为今年顶部了,也就是说即使上方还有空间,比如涨到1800,也还是顶部区域,而且很难再有多少空间,相比向下可能调整100-200美金空间来说空间已经很小了,再往上随时见今年顶部,一旦调整就是100-200美金空间。今年由于疫情影响,想要真正趋势转空还是需要等待疫情拐点,只有拐点出现后无限QE才可能停止,宽松流动性才会减弱,这样黄金才能走出持续性回调,否则拐点出现前即使回调100美金后仍然可能企稳继续拉升冲高,不过已经说了1748附近及上方就是顶部区域,所以预计未来1-2Maintain for a month1600-1748区间波动概率大,然后等待疫情逐步控制到达拐点,之后黄金才会开始真正回调下跌,目前看时间上可能是6From the beginning of the year to the beginning of the month, in terms of time cycle3Gold is showing a clear upward trend in the month, entering into3A wave appeared after the month1700-1450Great plunge, but due to insufficient liquidity, unlimited in the Federal ReserveQEAfter providing sufficient liquidity, gold began to soar and even broke through1700Pass, this indicates3After the month, it is not a downward trend, but currently it cannot be completely said to be an upward trend. From a spatial perspective, it is a large-scale fluctuation, which means3月份到现在整体其实是一个超大区间波动,只不过是波动空间太大,在更短的周期上看是趋势行情,但你退一步出来看是更偏向区间波动,那么12Month to3month3The period of one month is on an upward trend,3month-6The month should be a volatile market, but there is a lot of room for it. Wait until6A new trend market will only appear after the month, and it is likely that the epidemic has reached a turning point. As mentioned before, once the epidemic reaches a turning point, gold will fall6月份后黄金很可能走下跌趋势了,到时候将走出持续回调的走势,不再是来回震荡颠簸没有真正方向,不过也这一切的推断预测都是建立在6月出现拐点的前提下,这是未来中期需要注意的节奏,唯一改变这种预期的可能就是疫情影响时间大大超出预期,同时值得注意的是欧美国家预计5月份重新开放复工复产,这将有利于经济复苏,将会对黄金形成利空。

日线昨天先跌破1700关口,但是跌至趋势线支撑1690附近出现不小的反弹,虽然没有反转向上,但是再次陷入震荡中,目前看不好说是不是能继续下跌,还是说重新上涨,需要等待日线收线确认,日线收出不错的阳线应该就要上涨,再次收出阴线,并能跌破1690那就是进一步下跌,再下跌就要冲击1670-1660支撑,若往上将重新考验1735-1740压力,更大的格局上还是关注1748-1660突破,不能突破将在未来一段时间内维持此区间内震荡。(Band Midline Trading Opportunity Reminder:1735-1740Layout empty orders, target1700-1600-1500-1400)

4小时回调后企稳震荡,目前处于短期线附近运行,短期线走平粘合,中期线金叉但方向混乱,MACDRun down,KDJRunning upwards, there is no obvious direction for the indicator.4小时回调下跌冲击趋势线附近支撑1690企稳开始震荡,昨天就是在1690-1715内震荡,目前看4小时有逐步企稳要反弹迹象,4小时虽然回调一波但仍在三角区间内波动,除非向下跌破1690,否则还有可能重新反弹考验下降趋势线压力和近期高点1730-1740压力,未来想要走出更大的方向,不要突破三角区间,耐心等待,若今明两天跌破了1690,预计将冲击1660-1670支撑,不跌破1660仍有可能企稳大幅拉升,再跌破1660就将冲击1600附近及下方,当然如果最近突破1740-1748,那就要冲击1800,如果突破不了,有可能形成高位震荡筑顶,在不断冲高但不突破1740-1748的情况下可以尝试冲高受阻布局高空,但最好实用短线中做的方式,控制好风险。

pressure1710-1715-1720-1740-1748-1800

brace1700-1690-1680-1670-1660-1600-1570-1500-1450

Spot gold:

1. 1710Short nearby, stop loss1716, Objective1700-1690-1680-1670-1660-1600

2. 1695Long nearby, stop loss1690, Objective1700-1715-1730-1740-1748

3. 1670Long nearby, stop loss1659, Objective1680-1700-1720-1740-1800 |

"Small gifts, come to Huiyi to support me"

No one has offered a reward yet. Give me some support

|