Register now, make more friends, enjoy more functions, and let you play in the community easily.

You need Sign in Can be downloaded or viewed without an account?Register Now

x

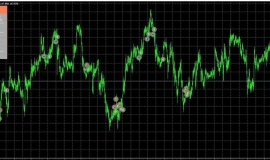

黄金兑美元周二收盘微幅上升0.5%后,今日开盘涨至2035.92附近,收复了周一的部分跌幅,因此前美元和美债收益率回落,给金价提供反弹机会,交易商等待本周几位美联储官员的讲话,以判断今年可能的降息步伐。

在利多数据方面,美元周二下跌0.3%, USA10年期公债收益率也回落1.75%,这给不孳息黄金带来支撑。道明证券大宗商品策略师Daniel Ghali表示,预计美联储官员将重申,虽然3月降息可能为时尚早,但他们只需看到通胀方面延续同样的表现,就可以启动降息周期。由于本周美国经济数据清淡,缺乏数据驱动因素,金价难以找到方向。由于本周至少有八位美联储发言人将发表讲话,纷纷发表利率前景,贵金属连续两天的抛售已经暂停了一段时间。

而在利空数据方面,克利夫兰联储主席梅斯特周二的讲话略显鹰派。梅斯特表示预计美联储将获得信心,今年晚些时候开始降息。梅斯特表示如果经济表现符合预期,美联储可以在今年晚些时候降低利率。通胀必须持续降低才能开启降息之门。如果通胀不下降,美联储可以维持当前政策。预计随着时间推移将回归2%的通胀水平。无法确定通向2%通胀的最后阶段是否会很快。过早降息将是一个错误。当美联储降息时,可能会采取渐进的步伐。梅斯特表示,仍倾向于明年进行三次降息;不愿提供降息的时间安排,认为没有降息的急迫性。在决定利率之前需要更多数据。

总而言之,黄金多头受到强于预期的美国经济数据的打击,随着市场继续降低对三月美联储降息的押注,它们被迫重新评估较低水平。随着第一次美联储降息的临近,贵金属应该会上涨。然而,如果美联储被迫推迟其政策转变的开始,这应该会促使这种贵金属在此期间解除最近的部分涨幅。

Press from above(Upper resistance) 2035.90,2037.20; From the downward direction, the lower support2033.60。

CPT MarketsRisk Tips and Disclaimers : The above article content is for reference only and is not intended as future investment advice.CPT Markets The articles published are mainly based on international financial data reports and international news as reference.

|