Register now, make more friends, enjoy more functions, and let you play in the community easily.

You need Sign in Can be downloaded or viewed without an account?Register Now

x

today21:30The United States Department of Labor will announce1The monthly non farm employment report requires special attention to two data points: firstly, the non farm employment population after quarterly adjustment, with the previous value indicating an increase21.610000 people, expected increase18Ten thousand people, expected to emerge4A decrease of around ten thousand people; Secondly, the pre value of unemployment rate3.7%, expected3.8%Expected to occur0.1A percentage point increase. Both the decrease in new employment and the increase in unemployment rate indicate a weakening of demand in the US labor market. The small non farm payroll announced this WednesdayADPData display, latest value10.7Ten thousand people, far below the previous value15.810000 people, lower than expected14.5Ten thousand people. The initial unemployment benefit data released this Thursday shows the latest value22.4Ten thousand people, higher than the previous value21.510000 people, higher than expected21.2Ten thousand people. On the one hand, there has been a decrease in employment, and on the other hand, there has been an increase in unemployment. Coupled with negative factors, today's non farm employment report data is likely to be explosive, and the possibility of a negative impact on the US dollar index is high.

The Federal Reserve's interest rate decision on Thursday was hit hard by President Powell's statement that "it is unlikely to cut interest rates in March.". However, the US dollar index did not rise sharply as a result, but instead closed with a long upward shadow on the same day, indicating that market participants have reached a consensus: interest rate cuts will only be postponed, but will definitely come, and overall expectations are still bearish for the US dollar index. Yesterday, the US dollar index closed with a long bearish candlestick at market price(103.01)Approaching the range of medium and short-term oscillations(102.77~103.83)Lower limit. If the major non farm sector experiences an expected cold drop tonight, the probability of the US dollar index falling below the volatile range will increase significantly.

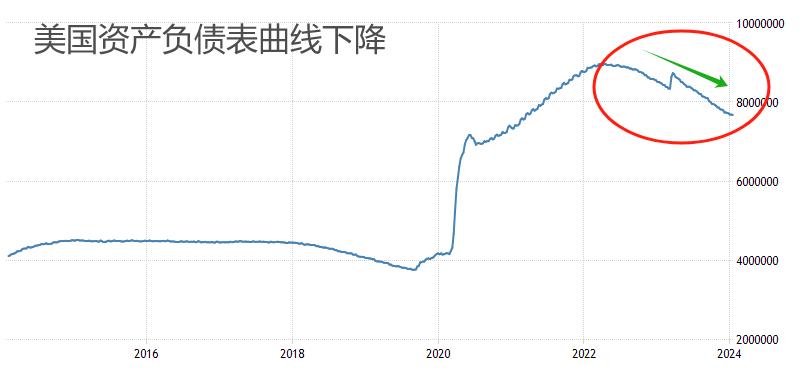

We have observed that the total balance sheet of the Federal Reserve has significantly decreased, with the latest value of approximately7.67Trillion US dollars.2022year4The peak level of the month is approximately8.96Trillion US dollars, with a cumulative decline of nearly15%. Shrinking the balance sheet means that the Federal Reserve is reducing the supply of dollars, and without considering the effect of currency multipliers, the total amount of dollars in circulation in the market is decreasing. From this perspective, there is still a long-term upward momentum for the US dollar. Of course, the trend of the US dollar index in the medium to short term still depends on the strength of the expected interest rate cuts.

From a technical perspective, the monthly trend of the US dollar index still shows a steady upward trend,KThe line runs inside the rising channel line. Month in the first half of this yearKThe line is crucial, and if there is a long bearish line, the market price is highly likely to fall below the lower track of the channel line; If there is a Changyang line, the market price will return to the middle area of the upward channel. Awesome Oscillator KDThe reading is in the middle region, with the fast and slow lines running horizontally, indicating that the short-term trend at the monthly level tends to fluctuate.MACDThe bar line of the indicator is below the zero axis, but the absolute value is relatively short, and the downward force is not strong. Overall, most indicators believe that the long-term trend of the US dollar index is in a critical state of long short transition.

Risk reminder, disclaimer, special statement:

There are risks in the market, and investment needs to be cautious. The above content only represents the analyst's personal views and does not constitute any operational suggestions. Please do not consider this report as the sole reference. At different times, analysts' perspectives may change, and updates will not be notified separately.

2024-02-02

|

"Small gifts, come to Huiyi to support me"

No one has offered a reward yet. Give me some support

|