Register now, make more friends, enjoy more functions, and let you play in the community easily.

You need Sign in Can be downloaded or viewed without an account?Register Now

x

todayUltimaMarkets Bringing you 2024year 1month 31The daily exchange rate between the US dollar and Japanese yenIn depth analysis.

Fundamental points - The negative interest rate policy of the Bank of Japan:日本央行12月货币政策会议纪要显示,政策制定者正在为短期内退出负利率做准备。委员们积极讨论了逐步取消刺激措施的条件,并同意深入讨论未来适当的加息步伐。

- 日本经济复苏:日本工业生产在12Monthly growth1.8%,这是自去年6月以来的最大涨幅。这一定程度上证明日本经济已经恢复增长,这可能为正在考虑加息时机的日本央行扫除障碍。

technical analysis Daily chart analysis Daily chart of USD/JPY, sourceUltima Markets MT4)

- Random oscillation index:指标进入超买区域后发出空头信号,指标走势缓慢下行,暗示当前下跌趋势更大概率是调整结构,在指标没有彻底远离超买区间前不能轻易做多。

- 潜在支撑位:汇价在上涨突破65日均线后开始震荡调整,回调受65日均线支撑。红色33日均线仍处于65日均线下方,因此警惕汇价跌破65日均线后仍将继续向下调整,目标为38.2%斐波那契回撤位。

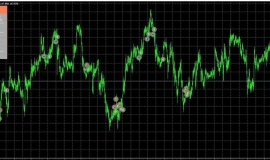

4Hour chart analysis (USD/JPY)4Hour chart, sourceUltima Markets MT4)

- Convergent Triangle:汇价目前在高位形成收敛三角形结构,暗示多空正处于博弈阶段,等待方向明确后关注交易机会。

- 平台震荡结构:若汇价跌破收敛三角形,则汇价大概率将走出艾略特波浪理论中的ABC平台震荡型调整结构。目前正处于下跌C浪中,下方看向A浪的等比高度,同时也是下行通道线的下沿146.186One area.

Trading CentralHub Line Indicators (USD/JPY)30Minute chart, sourceUltima Markets APP)

- according toUltimaMarkets APPInTradingCentralHub line indicators, central price range for the day147.90,

- 147.90Upward bullish, first goal148.10Second objective148.30

- 147.90Under bearish, first target147.15Second objective146.90

Disclaimers The comments, news, research, analysis, pricing, and other information contained in this article can only be considered as general market information and are provided solely to assist readers in understanding the market situation and do not constitute investment advice.UltimaMarketsReasonable measures have been taken to ensure the accuracy of the data, but the accuracy of the data cannot be guaranteed and can be changed at any time without notice.UltimaMarketsWe will not be responsible for any losses or losses (including but not limited to any loss of profits) that may arise from the direct or indirect use or reliance on such information.

|