Register now, make more friends, enjoy more functions, and let you play in the community easily.

You need Sign in Can be downloaded or viewed without an account?Register Now

x

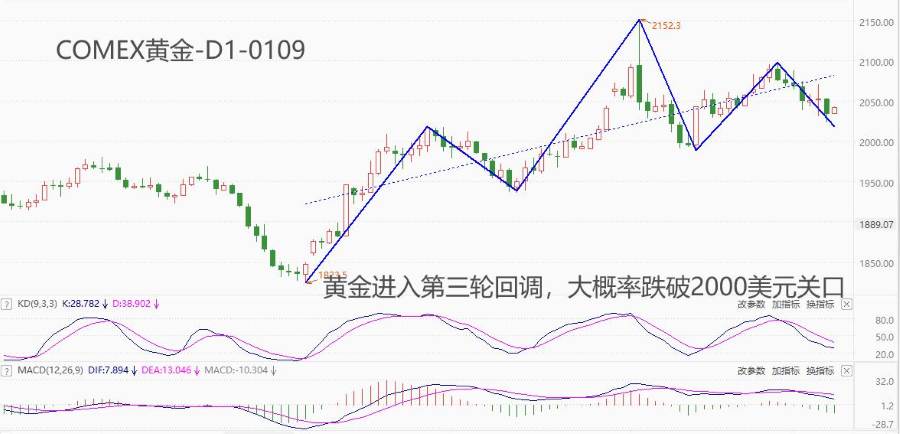

2023year12month28There have been eight trading days so far,goldfrom2089.4The US dollar fell to2040.1USD, decline2.36%During this period, the lowest touch was reached2022.7US dollars. There have been two significant pullbacks in the mid-term upward trend of gold in this round: the first one is10month30Solstice11month13Day, lowest touch1935.6US dollars; The second time is12month4Solstice12month12Day, lowest touch1991.2US dollars. The commonality of the two pullbacks is that they both fell below the integer level of $2000.12month28The pullback starting today is the third round and is expected to fall below2000The US dollar barrier. Considering that the low point of the second pullback is higher than the first one, the low point of the third pullback must also be higher than the second one. So, the third round of retracement may be touching2000The US dollar, but it won't fall too much. The reason for the third round of retracement is very clear, which is the strengthening of the US dollar index. Due to the expectation of interest rate cuts, the US dollar index cannot continue to remain strong. When the US dollar index bottoms out and falls back, gold will also rebound from the bottom.

From a technical perspective, gold is in the short-term correction phase of a medium-term bullish trend, when the last threeKWhen a linear bottomed fractal structure is formed, the callback continues to end and declares its end. The market price is below the regression line, and the upward traction of the regression will continue to play a role. Awesome Oscillator KDThe reading is in the lower middle range, but has not yet reached20The oversold line is expected to continue its short-term decline for some time.MACDThe bar line of the indicator is below the zero axis, and the absolute value shows signs of continuous amplification, indicating that the trend of short to medium term bias is still continuing. Overall, most indicators believe that the short-term decline of gold will continue for a short period of time, but ultimately will reach2000After reaching around the US dollar level, we found support and resumed our upward trend.

Risk aversion is the most important factor affecting gold besides the US dollar index.2022The ongoing Russia Ukraine issue2023The year saw the emergence of the Palestinian Israeli issue2024The Mandela Strait issue that emerged in recent years has been stimulating sensitive nerves in the market.1month8South Korean officials have stated that there will no longer be a buffer zone between North and South Korea, and North Korea will provide a strong response. This may once again stimulate the safe haven attribute of gold. In addition, the international market often mentions that the Federal Reserve is about to cut interest rates, which means that the macroeconomy has entered a recession. When a recession occurs, competition for resources among countries becomes fierce, and international relations become tense. In the long run, gold can travel through cows and bears, and it is beautifulstock market indexCounting the same, every drop may be a golden pit.

Risk reminder, disclaimer, special statement:

There are risks in the market, and investment needs to be cautious. The above content only represents the analyst's personal views and does not constitute any operational suggestions. Please do not consider this report as the sole reference. At different times, analysts' perspectives may change, and updates will not be notified separately.

2024-01-09

|

"Small gifts, come to Huiyi to support me"

No one has offered a reward yet. Give me some support

|