Register now, make more friends, enjoy more functions, and let you play in the community easily.

You need Sign in Can be downloaded or viewed without an account?Register Now

x

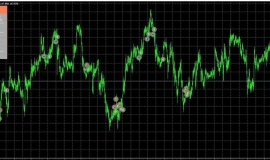

Returning from the National Day holiday,AThe stock market has been positive for four consecutive days, and market sentiment has significantly warmed up. In the afternoon of last Friday, with the substantial inflow of funds from the north, Shanghai Stock Exchange50The index continues to rise. In the subject matter50ETFIn the case of a strong upward trend,50ETFoptionThe market has ushered in a long-awaited surge. Multiple call option contracts have surged one after another. Among them, the one with the largest holdings10Monthly bullish3100At one point during the trading session, the contract surged by more than182%The closing increase is101.92%Successfully achieved a doubling of the market price.9Since the beginning of the month, with the continuous decline in implied volatility, the selling returns of options have been quite substantial, and some investors or institutions have even implemented "brainless" selling strategies. Recently, with the The new round of trade negotiations between the United States and the United States has made substantial progress, with the US stock marketA50The futures index and RMB exchange rate have surged one after another. This week is a huge test for sellers of call options and another risk lesson.

*Call options surged across the board*Under the stimulation of multiple positive news, global market risk appetite has significantly increased.

11In the morning session,50ETFThe index opened slightly higher and maintained a strong and volatile trend thereafter; In the afternoon, with the significant inflow of northbound funds, the market was bullish, and the Shanghai Composite Exchange50Continuously rising. As of closing,50ETFSoaring1.51%Report3.032, successfully stood up3.0Da Guan. In the subject matter50ETFUnder the strong upward trend, multiple call option contracts have surged one after another. Among them, the one with the largest holdings10Monthly bullish3100At one point during the trading session, the contract surged by more than182%, with a closing increase of101.92%Successfully doubled;10Monthly bullish3000The contract is also close to doubling, with an increase of99.18%. For investors who buy long options, they have finally ushered in a long-awaited surge.

The derivatives department of CITIC Securities stated that the doubling of the call options market last Thursday was caused by two factors: the emergence of a unilateral market in the underlying market and the recent low implied volatility, which rose with the rise of the underlying market last Friday. Both factors are indispensable. In other cases, simply buying a call option, even if the direction is correct, cannot yield similar substantial returns. This is also why we previously said that investors who buy a call should seize the opportunity for a significant upward movement of the target when the implied volatility is low and make a profit in one fell swoop.*Implied volatility continues to decline*

It is worth noting that after the National Day holiday, the index trend remained stable, and the uncertainty before the holiday dissipated,50ETFThe implied volatility of options is rapidly decreasing.10month8Today, the implied volatility of options has even experienced a flash market.10month11Day closing,50ETF20The daily historical volatility is determined by12.0%lower11.5%. Weighted implied volatility of flat value option contracts14.5%Ascend to15.0%The weighted implied volatility of all contracts is determined by15.0%Ascend to15.6%Overall, the implied volatility is still at a relatively low level. The National Day holiday is clearly beneficial for option sellers.

What is implied volatility? Option Planet Xie Jieliang introduced that implied volatility is a parameter derived from the pricing model of contract quotes in the options market. When investors are willing to quote a higher price, the implied volatility naturally increases, and vice versa. When the market faces significant uncertainty(Including major indicators, major event announcements, and long holidays, etc)At times, bullish investors will buy call options for speculation, while bearish investors will buy put options for hedging. They may be willing to pay higher costs, and the supply-demand relationship will drive up the contract's price, reflecting the high implied volatility of the contract.

Xie Jieliang believes that the recent sustained decline in implied volatility is mainly due to two factors. Firstly, after the long holiday, the trade war between China and the United States improved, and uncertainty factors were eliminated; Secondly, the decline in historical volatility has further driven down implied volatility. Although implied volatility is currently at its lowest level since the beginning of this year, it is still higher than historical volatility.9Since the beginning of the month, with the continuous decline in implied volatility, the selling returns of options have been quite substantial, and some investors have even implemented "brainless" selling strategies.

Huajue Asset Fund Manager Zhao Lin believes that the current market is in a very delicate state: the actual volatility of major indices is very low, although it has not yet reached2017The historical low point of the year, but in the past10In the middle of the year, it is already at a low level. and2017The major global markets were in a state of extremely low volatility, which is relatively rare in history. The uncertainty factors currently facing the market have increased compared to before, and the trend of volatility is clearly inconsistent with the current environment. Undoubtedly,2019year10month8Day is a day worth remembering for all option traders, and the changes in implied volatility on that day will be included as extreme values in our risk calculation module. If you are the buyer of an option, it does not mean that there is a mistake in judgment or a failure in strategy; If you are the seller, do not let your guard down due to excellent returns, always pay attention to risks Zhao Lin said.

In Zhao Lin's view, in fact, from a risk perspective, the recent large exposure to put options carries significant risks. "Basically, those who sell out their positions are those who sell options. Although the probability of winning by selling options is high, the profit and loss ratio is poor, and they need to be sold systematically. Selling options is like farming, where most of the time there is a harvest, but there will always be natural disasters and it will be over if encountered. Selling options is easy, but the key is position management and emergency response capabilities."

This article is written byDoo PrimeDepu Capital:dooprime.net, organize to the network |