Register now, make more friends, enjoy more functions, and let you play in the community easily.

You need Sign in Can be downloaded or viewed without an account?Register Now

x

To continue to thrive in this market for a long time, it is necessary to have a complete trading system, including position skills, risk control, and technical systems. This way, in a volatile market, it can provide you with clear guidance, even if the profit is small, it is easy and there is a sense of achievement;In a unilateral market, it can make you have a trend in your mind. If you see it right, strive for maximum profit. However, when you see it wrong, you can control the risk and objectively adjust your thinking to turn losses into profits, instead of blindly and subjectively sticking to your own thinking, blindly increasing positions in reverse orders, and placing positions on the edge of risk. I have posted these things countless times. I have been talking so much, but I just want to change everyone's traditional views, habits, and mentality. Remember that for order makers, technology is not important at all, and habits and principles are the most important!

Information analysis:

Super Week, unexpected heavyweight, Federal Reserve Chairman Powell and US President Trump stunned the global market - the Federal Reserve lowered interest rates for the first time in a decade and ended its balance sheet contraction early, and Powell issued a hawkish signal; US President Trump Threats China3000Billion dollar product surcharge10%Tariffs. In addition, there are major events in the market such as the US non-farm report... The hawkish interest rate cut by the Federal Reserve and Trump's threat to impose tariffs have ignited the trade situation, cooling global risk sentiment, causing sell-offs in US and European stocks, and a temporary collapse in oil prices8%;全球债市收益率再创低位;美元冲高回落,gold暴涨暴跌,最高逼近1450Gateway.

In the coming week, the market will usher in another week of intensive economic data release: major economies around the world will release their service industriesPMIThe UK and Japan will announce the second quarterGDPChina will announce7Monthly trade accounts and inflationforeign exchangeReserve heavyweight data. Central Bank Resolution: Both the Reserve Bank of Australia and the Reserve Bank of New Zealand will announce interest rate decisions. After the Federal Reserve cuts interest rates, the global wave of easing may continue. In terms of official speeches, Federal Reserve officials such as Brad and Evans will deliver speeches on economic issues; Australian Federal Reserve Chairman Lowe and New Zealand Federal Reserve Chairman Orr will also hold press conferences.

黄金开盘行情走势分析:

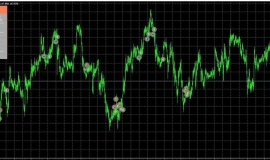

Gold: After experiencing the long and short market competition this week, the weekly chart recorded a physical bullish bar with up and down shadows, and the price remained above the Bollinger upper track. The moving averages of each cycle were arranged in multiple directions, and the upward momentum of the short-term indicators was depletedKThere is a slight deviation in the development of the line, and the weekly trend is cautiously bullish.

The inability to break through the upward trend demonstrates the effectiveness of resistance. On the daily chart, there were small bearish bars with up and down shadows in yesterday's trading, and the price remained above the short-term moving average. There was no increase in volume after the short-term indicator went down, and the daily chart still needs to be confirmed.

Weekly hardware prices stabilize1430Above the threshold, it may be a positive performance, but without the guidance of fundamental news, there is not much room for bullish positions to rise again, so it is normal for high pressure to fall back. The upward extension resistance is located at1448-1452Regional, downward support is in the1430-1425In my personal opinion, there is a demand for a pullback in gold in the short term, and we will look at it again at the beginning of the week1430Support and continue to see a rebound without breaking this level.

黄金开盘操作建议:

1Gold rebounded to1448-1446Short on the front line, stop loss4US dollars, look at the target1440-1435Nearby;

2Suggest withdrawing from the1430-1428Nearby, stop loss4US dollars, look at the target1438-1445Nearby;

什么是最佳入场点:

从总体上讲,黄金市场操作最好是以顺势操作为佳,就是在上升的趋势中逢低买进,在下跌的趋势中逢高抛出。如果想做反转势那就必须是原走势从形态、比例和周期这三方面同时到达一个关键的反转点上,并以设好止损为前提的情况下,方可入市操作。

最好入场点五个特点:

1.必须是趋势价格,确定了一段走势的延续性;

2.在入场之后会有非常好的防守位置,即止损位置;

3.这个止损位置的止损幅度不是很大,但却是十分有效的;

4.止损和盈利的空间能够形成有效的比例关系;

5.如果是短线操作,那么好的入场点位会满足投资者在尽可能少的持仓时间中,获得更多更大的盈利。

为什么总是做不好交易,是不是现在市场不好做了,难道是我运气不好,还是老师指导有问题?无数次的疑问,无数次的解答,终究还在于你自己是处于一个什么样的心态去看待这个充满金钱的市场。石老师本人来看:其实这并不是市场本身难做,而是始终过不了自己那关,所有的亏损几乎都来自于套单、重仓、满仓和逆势操作,其次就是存在(侥幸心理)总是想 着回调或反弹一点我就出,最后市场反向走,机会就这样流走;自己操作时往往会出现这样的情况;获利快速平仓,亏损就死扛;就是我们俗称的“拿不住”操作上建仓和平仓把握不准,仓位上单子着急的朋友可以关注万胜贤。

在我这里,我能做的是帮你合理的把控仓位,利用支撑和阻力位下单,让每一单有理可依,有迹可循。买卖点位不应该是随意进场,请对自己的资金负责。文章的结尾万胜贤想说,如果你对行情真的无法把握,可以前来找到胜贤,多一个分析师对你来说没有任何损失,永远记住一句话,专业的人做专业的事,一切实战只为盈利,合作只为双赢。

Sheng Xian's message: Trend is king, follow the trend, go against the trend is death, and being suitable for oneself is the best

Wen/Wan Shengxian (Guided by idealism)wsxls954) |

"Small gifts, come to Huiyi to support me"

No one has offered a reward yet. Give me some support

|